Closing Bell

What's Affecting Markets Today

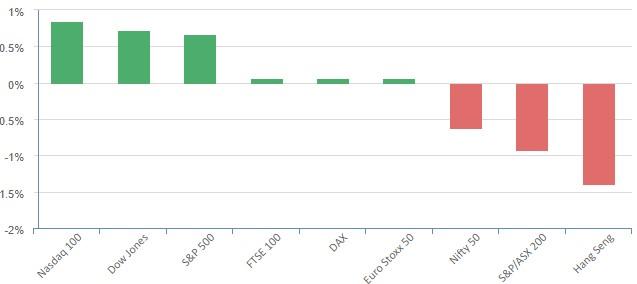

Boost in Chinese Stock Market Following New Regulatory Measures

Chinese stocks experienced a significant surge following the introduction of several measures aimed at attracting investors. Among these measures is a reduction in the stamp duty on stock trades and a deceleration in the rate of initial public offerings. The CSI 300 Index witnessed an impressive rally, marking its most significant rise in three years. Additionally, the Ministry of Finance announced a drop in the levy charged on stock trades, marking the first such reduction since 2008. The China Securities Regulatory Commission also indicated its intention to slow down IPOs in light of recent market conditions. In a surprising move, regulators imposed restrictions on share sales by major stakeholders in companies whose stock prices have plummeted below IPO or net asset levels.

Dramatic Decline for Property Developer China Evergrande

China Evergrande Group, a prominent property developer, saw its stock value plummet by 87% as trading resumed in Hong Kong. This comes after a 17-month trading halt. The company, known as the world’s most indebted, reported a staggering loss of $4.5 billion in the first half of the year, following an extensive debt restructuring process.

Positive Turn for Australian Retail Sales in July

Australian retail sales witnessed a 0.5% increase in July, surpassing the anticipated 0.3% gain. This positive trend comes after an unexpected decline in the previous month. Despite the rise in July, Ben Dorber, ABS head of retail statistics, noted that the underlying growth in retail turnover remains modest. When compared to July 2022, the growth rate stands at a mere 1.9%, even with significant price growth over the year.

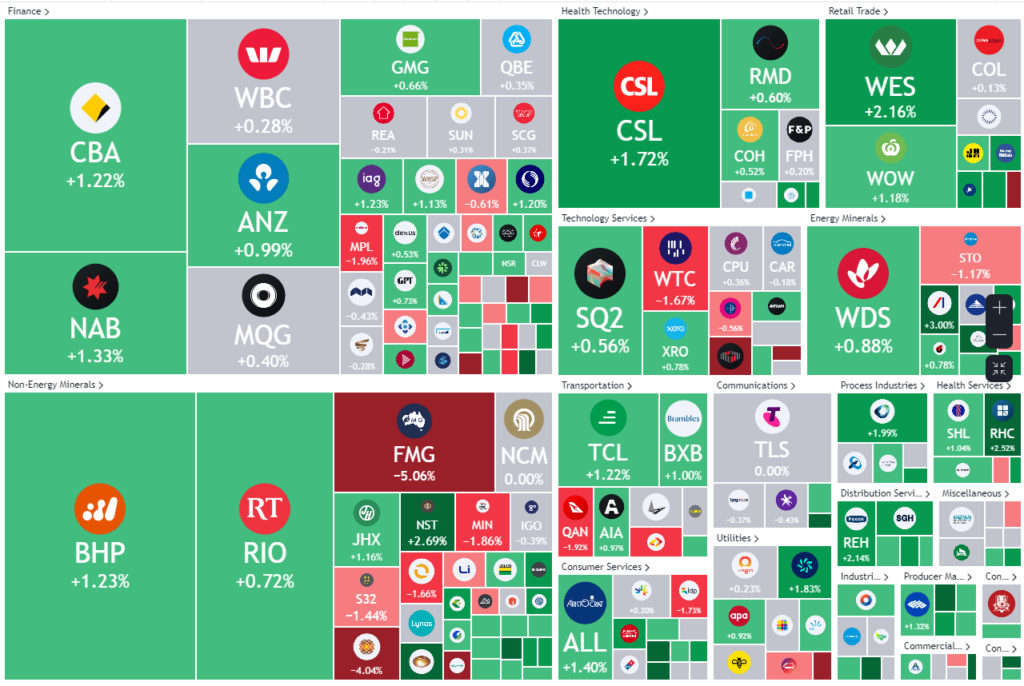

ASX Stocks

ASX 200 -7159.8 +44.6 (0.63%)

Key Highlights:

Earnings Releases:

For more detailed summary click the earnings calendar here.

Today, several prominent companies announced their financial results. Fortescue Metals Group Limited (FMG: ASX) reported a 3% decline in revenue and a significant 23% drop in net profit, despite declaring a $1 dividend. Nextdc Limited (NXT: ASX) saw a 25% surge in revenue but grappled with a substantial loss due to skyrocketing energy costs. Evt Limited (EVT: ASX) and Neuren Pharmaceuticals Limited (NEU: ASX) both celebrated significant revenue and profit boosts. In contrast, Invocare Limited (IVC: ASX) and Appen Limited (APX: ASX) faced declining revenues and reported losses. Waypoint Reit Limited (WPR: ASX) highlighted its robust property portfolio, while Liberty Financial Group Limited (LFG: ASX) and Imdex Limited (IMD: ASX) both reported profit declines. Lastly, Link Administration Holdings Limited (LNK: ASX) faced a challenging year, reporting a substantial loss despite a slight uptick in revenues.