Closing Bell

What's Affecting Markets Today

Central Bankers’ Meeting at Jackson Hole

Central bankers, academics, and finance journalists gather annually at Jackson Hole. The main topic this year is inflation. Jerome Powell, the chair of the US Federal Reserve, is a key figure at the event. The inflation trajectory post-COVID has been unpredictable. Some viewed it as a temporary supply shock, while others believed only a significant rise in unemployment would control it. However, inflation has been decreasing without a rise in unemployment, challenging both views. The effectiveness of the Fed’s tools, like short-term interest rates, is being questioned. The rise in policy rates hasn’t curbed inflation as expected.

Oil Prices

Oil is set for a second weekly loss due to increased supply and economic challenges in China, the largest importer. Despite efforts by OPEC+ to boost prices, crude remains below its starting price for the year. Investors are reducing their oil exposure in the US. However, some experts believe there’s potential for price growth.

Australian Dollar

The Australian dollar fluctuated, affected by risk aversion and anticipation of Jerome Powell’s address at Jackson Hole. The market is keen on insights about the US interest rate outlook. The Australian dollar has seen a modest rise this week, potentially its first weekly gain in six weeks, despite a 4.5% decline this month.

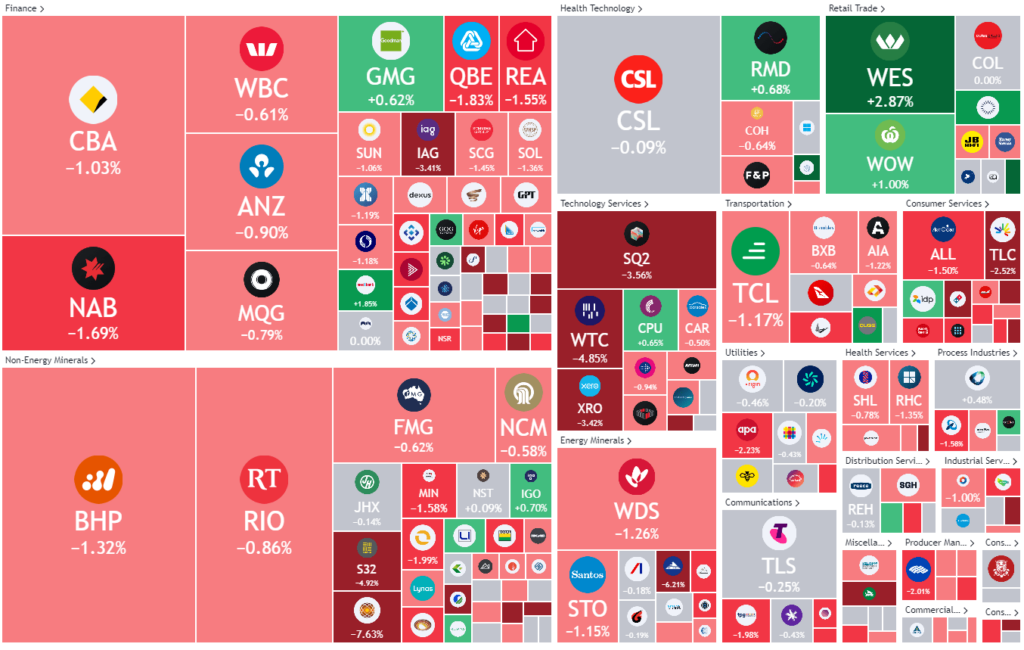

ASX Stocks

ASX 200 -7115.2 +66.9 (-0.93%)

Key Highlights:

Earnings Releases:

For more detailed summary click the earnings calendar here.

Wesfarmers Limited (WES: ASX) – 4.8% NPAT rise to $2.465 million; $1.91 per share dividend; 18.2% sales growth.

Ventia Services Group Limited (VNT: ASX) – 16% interim net profit drop to $88.3 million; 11% revenue increase; 8.3¢ dividend.

Pexa Group Limited (PXA: ASX) – UK market estimate cut to $500 million; $21.8 million net loss.

Jumbo Interactive Limited (JIN: ASX) – 13.9% revenue boost to $118.7 million; 20¢ final dividend.

Pilbara Minerals (PLS: ASX) – $2.4 billion NPAT; 35% ore reserve increase; $4.1 billion revenue.