Closing Bell

What's Affecting Markets Today

US PMI Data Give Hope That Fed Will Pause

Today’s economic activity was subdued. US PMI data hinted at a potential Federal Reserve rate pause with Flash Manufacturing PMI at 47.0 (expected 48.9) and Flash Services PMI at 51.0 (expected 52.1). The US 10-year note yield dipped 12 basis points, falling below 5%, reflecting tepid American business growth. Concurrently, the 10-year German rate decreased by 13 basis points due to intensified private-sector contraction in the euro area.

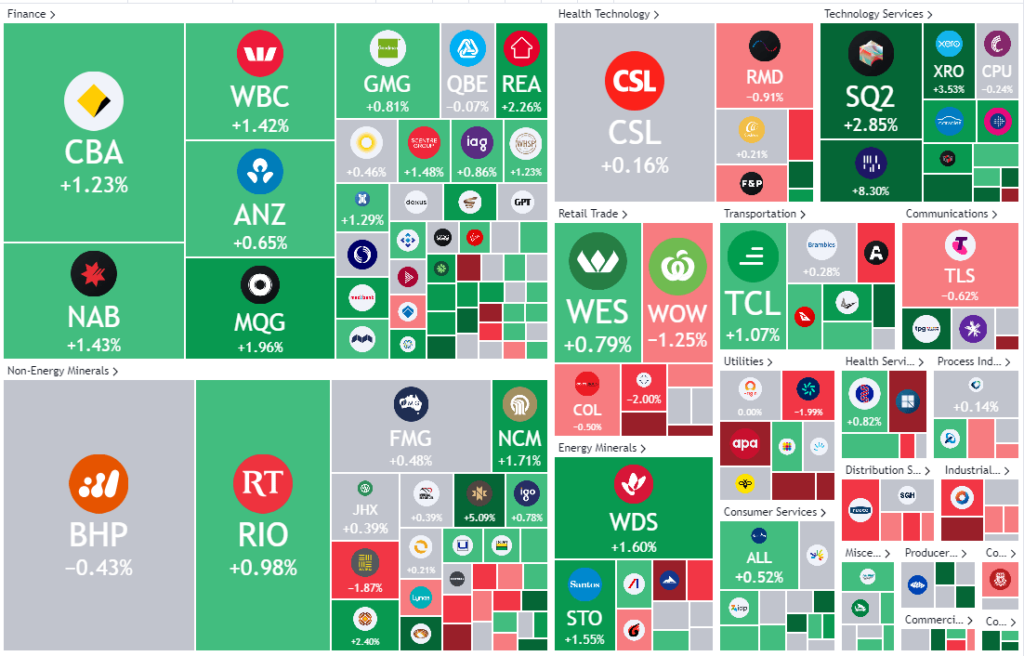

ASX Stocks

ASX 200 -7182.1 +33.7 (0.47%)

Nvidia beats expectations

Nvidia’s stock surged 10% after outperforming sales expectations due to strong AI demand, positively impacting other chipmakers like Advanced Micro Devices and Broadcom. This uplift comes as a relief to the Nasdaq 100, which faced a challenging month. Nvidia’s optimistic outlook on the AI trend, with projected sales of around $US16 billion in the next quarter and an additional $US25 billion stock buyback, underscores the company’s dominance in the AI-driven tech market. CEO Jensen Huang emphasized the growing shift towards Nvidia’s chips and the rise of AI-generated content across industries.

Key Highlights:

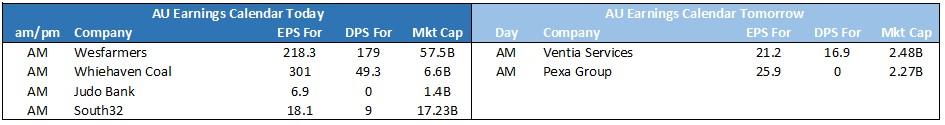

Earnings Releases:

For more detailed summary click the earnings calendar here.

- S32: $US173M loss; earnings down 65%.

- RHC: 3.6% net profit drop to $365.5M.

- NST: 30% profit increase; 15.5¢ dividend.

- AIA: Profit drops to $NZ43.2M.

- QAN: Record $2.5B underlying profit.

- TPG: 71% profit decline to $48M.

- SGP: $440M profit; $256M property loss.

- MPL: $46.4M cyber hit; 30% profit rise.

- WHC: Record $2.66B profit; 42¢ dividend.

- CWY: 71% profit slide; 13.9% revenue rise.

- QUB: 32% profit rise to $167.9M.

- NEC: 21% dividend cut; $2.69B revenue.

- TAH: $66.5M profit post-demerger.

- LOV: 30% sales rise to $596.4M.

- IFL: 15% profit drop to $191M.

- JDO: $73.4M net profit.

- RPL: $13.1M interim profit.