Closing Bell

What's Affecting Markets Today

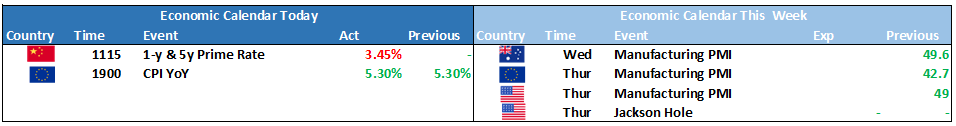

- China’s Lending Rate Cuts – Chinese banks made a smaller-than-anticipated cut to their one-year loan prime rate, reducing it by 10 basis points to 3.45%, despite the central bank’s urging for larger reductions. Contrary to economists’ predictions, the five-year rate, crucial for mortgages, remained unchanged at 4.2%. This unexpected decision, as noted by Zhaopeng Xing of ANZ, suggests banks may have been unprepared but further cuts might occur in the coming months.

- Bank of Japan’s Bond Buying – The Bank of Japan (BoJ) continues its aggressive government bond purchases, raising concerns about its control over longer-term interest rates. Even after policy adjustments to manage yield movements, the BoJ’s bond buying remains high. Bloomberg’s analysis indicates potential buying could reach a significant ¥124.6 trillion ($1.3 trillion), reflecting a growing trend and underscoring the challenges the BoJ faces in its interventions.

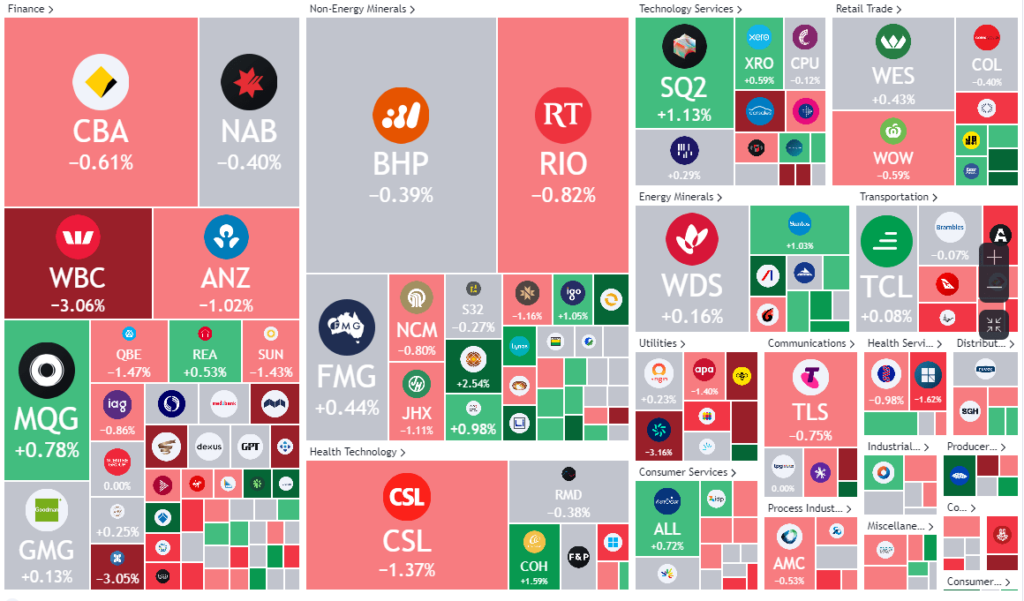

ASX Stocks

ASX 200 - 7115.5 -32.6 (-0.46%)

What’s happening in reporting season?

Today’s ASX market saw mixed responses across stocks. The ASX dropped slightly by 0.46% to 7115 by the end of day, as consumer staples and healthcare stocks pulled it down. Companies like AMP settled significant lawsuits, and oOh!media showcased resilience with a revenue jump. While some stocks like a2 Milk and Elders faced significant losses, others like Premier Investments and Breville Group flourished.

Key Highlights:

- Iress (IRE: ASX): Dropped by 35.54% post-suspending its interim dividend and announcing the sale of its managed funds administration business.

- AMP (AMP: ASX): Settled a notable $110m investor class action related to the 2018 disclosures. They admitted no liability.

- oOh!media (OML: ASX): Demonstrated resilience with a reported 7% jump in revenue.

- Westpac (WBC: ASX): Announced a Q3 net profit of $1.8 billion, but noted a squeeze in its core net interest margin.

- Premier Investments (PMV: ASX): Experienced a 10.3% surge post the CEO’s abrupt resignation announcement.

Earnings Releases:

For more detailed summary click the earnings calendar here.

- Ampol (ALD: ASX): First-half core profit plummeted by 26%; dividend reduced.

- The a2 Milk Company (A2M: ASX): Full-year sales saw a growth of 10.1%.

- Chorus (CNU: ASX): Encountered a 61% dip in its net profit.

- Insurance Australia Group (IAG: ASX): Enjoyed a sharp rise in profits, amounting to $832m.

- Reliance Worldwide (RWC: ASX): Announced a 2% uptick in net profit.

- BlueScope Steel (BSL: ASX): Reported a decline in net profit.

- Breville Group (BRG: ASX): Noted an increase in net profit for the year.

- Adairs (ADH: ASX): Group sales ascended by 10.1%.

- NIB Holdings (NIB: ASX): Presented an 11% growth in underlying operating profit.

- Charter Hall Group (CHC: ASX): Recorded operating earnings of $441.2m for 2023.