Closing Bell

What's Affecting Markets Today

China’s Woes Continue

China’s deflationary phase is causing market concerns, but it might be a blessing in disguise. Lower costs globally are anticipated due to China’s manufacturing dominance. This could halt further interest-rate hikes, possibly leading to economic easing. EdenTree Investment suggests this might “reduce inflation pressures and may allow Western economies to run ‘hotter.’”

European LNG Futures Prices Soars again

Woodside Energy Group’s ongoing negotiations with workers could lead to strikes, affecting global LNG exports. Talks regarding pay and job conditions remained inconclusive. Woodside shares dipped by 1%.

RBNZ May Not Be Done Yet

The Reserve Bank of New Zealand (RBNZ) maintained its cash rate at 5.5%. Despite this, the RBNZ hinted at a potential rate rise in the future, emphasizing the need to keep the rate at restrictive levels. The bank has increased rates by 525 basis points since October 2021, leading to a technical recession in the country.

Crude Oil Continues to Slide

Crude oil prices are on a downward trend, with West Texas Intermediate dropping 0.2% to $US80.85 a barrel. US crude stockpiles decreased by 6.2 million barrels last week, marking the lowest inventory levels at Oklahoma storage since April.

ASX Stocks

ASX 200 - 7,195 +28 (0.38%)

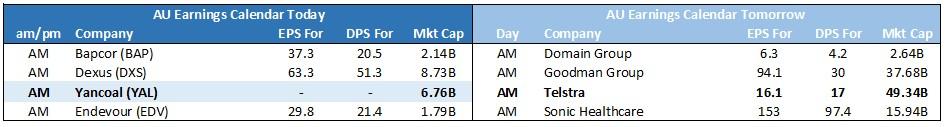

What’s happening in reporting season?

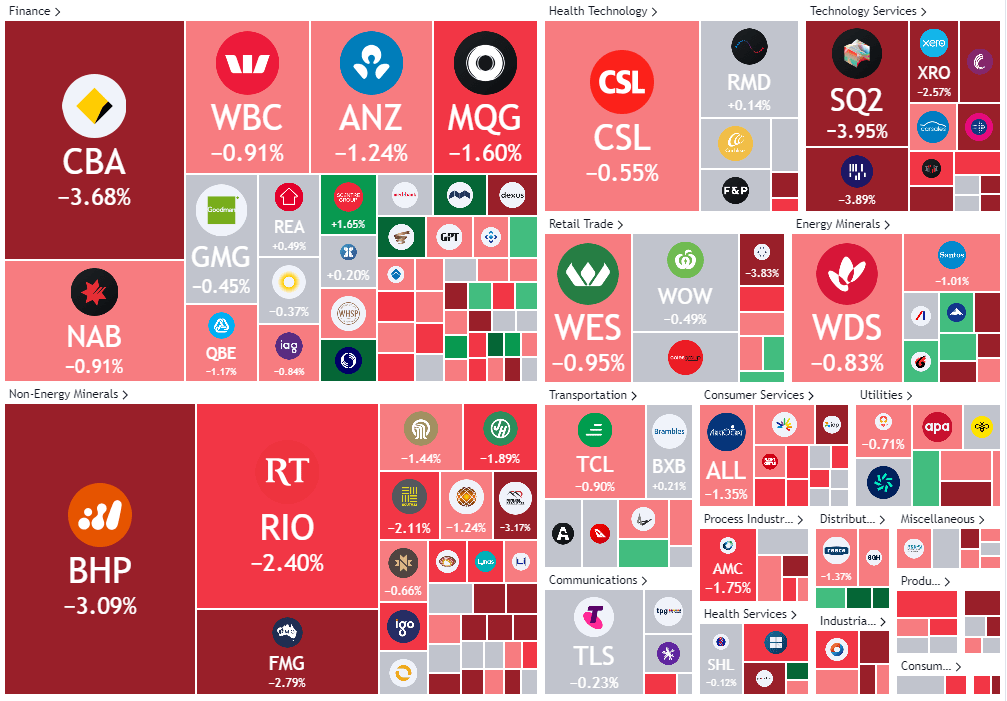

The Australian sharemarket experienced a significant downturn, reflecting a broader global sell-off. This downward trend across the Asia Pacific region mirrored Wall Street’s performance, where strong US retail sales data raised concerns about the Federal Reserve maintaining higher interest rates for an extended period. The Australian tech sector, sensitive to interest rate changes, was the hardest hit.

- Commonwealth Bank (CBA: ASX) – One of Australia’s largest banks, CBA saw its shares drop by 3.59%. The bank began trading ex-dividend today, which often leads to a temporary decrease in share price.

- Fletcher Building (FBU: ASX) – The building products group cut its final dividend to NZ16¢ from NZ22¢ a year earlier due to a 46% decline in net profit to $NZ235 million. This resulted in a significant 7.6% drop in its share price.

- Dexus (DXS: ASX) – The real estate group reported a swing to a full-year statutory net loss of $752.7 million, primarily due to write-downs on its portfolio. This news led to a 3.5% decline in its share price.

- Vicinity Centres Group (VCX: ASX) – Despite reporting a lower net profit of $271.5 million for its 2023 financial year (down from $1.21 billion), the company’s shares managed to climb by 1.7%.

- Bapcor (BAP: ASX) – The automotive parts company’s shares surged by 7.5% after releasing its full-year report. UBS analyst highlighted the company’s greater cash conversion and reduced net debt as standout points in an otherwise expected result.

- Mirvac (MGR: ASX) – The property developer’s shares increased by 4.4%. However, the company did warn that its earnings would likely decline in the upcoming year.

- Endeavour (EDV: ASX) – The owner of Dan Murphy’s saw its shares slide by 2.7%. The company refrained from providing earnings guidance for 2024 and reported earnings and profits for the 2023 fiscal year that fell short of consensus.

- Transurban (TCL: ASX) – The toll road operator’s shares retreated by 1.7% after its full-year earnings came in below analysts’ expectations. Additionally, CFO Michelle Jablko is set to succeed Scott Charlton as the CEO of the company.

Leader

No Significant News.

No Significant News.

No Significant News.

No Significant News.

Earnings release see above.

Laggards

$40 Million Institutional capital raising.

Terrible earnings see above.

No Significant News.

No Significant News.

Poor Earnings release for Seven Media Group.