Closing Bell

3 Things Affecting Markets

- US CPI – Came in in with analyst expectations overnight, will the Fed Pause?

- Oil Price Take Pause –Country Garden Holdings, once China’s largest private-sector developer by sales, is in the spotlight

- AUD Slumps – Weak Chinese data this week can be another reminder of the soft outlook and weigh on AUD/USD

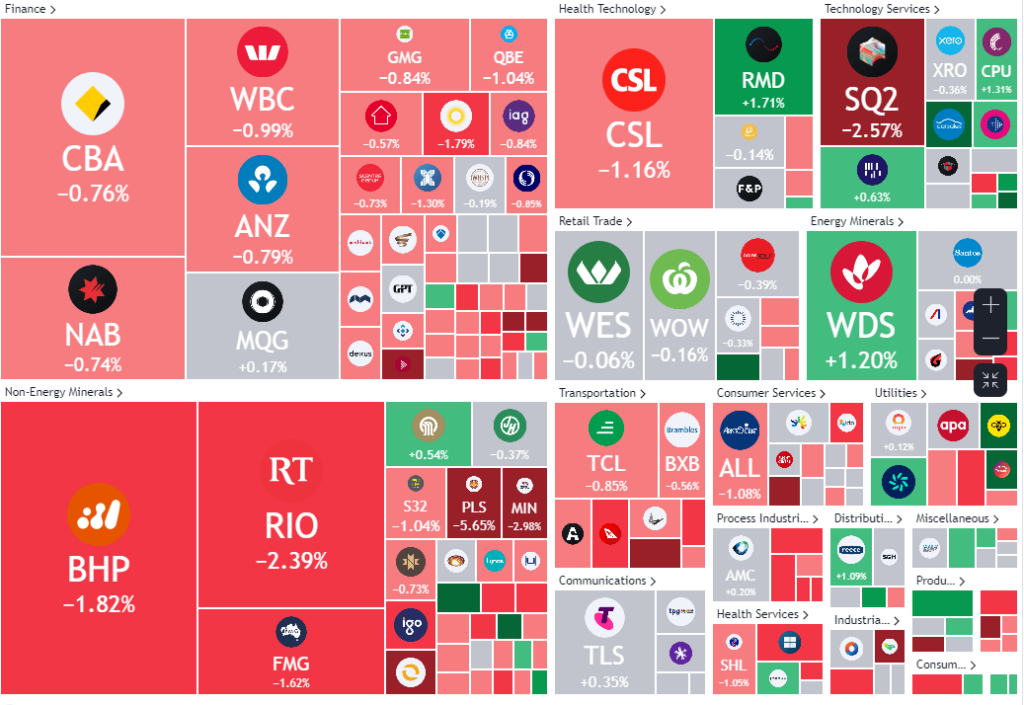

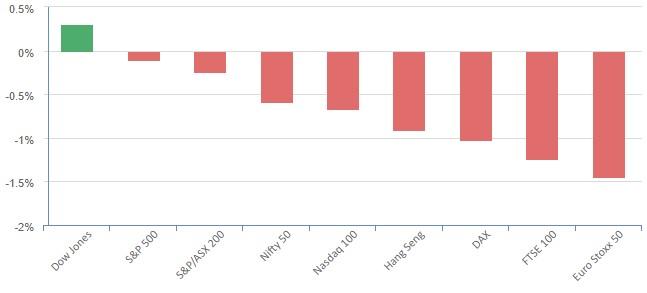

ASX Today

ASX 200 - 7,277 -63.1 (0.86%)

China’s Property Market Crisis

Chinese equities are undergoing a pronounced sell-off, a consequence of the deepening property market slump. This downturn is accentuated by the recent spate of underwhelming economic data. The CSI 300 Index, a key indicator for onshore Chinese shares, is on the brink of negating all its post-Politburo meeting gains from last month. Adding to the market’s woes is the precarious position of Country Garden Holdings. Once hailed as China’s premier private developer, the company now teeters on the edge of default. If it fails to honor the coupon payments on two of its dollar bonds within the stipulated grace period, it could face severe repercussions. This looming threat has already cast a shadow on its stock value, with shares taking a nosedive in Hong Kong’s market. Meanwhile, the offshore yuan is grappling with its own set of challenges. Currently, it’s oscillating around its weakest point this year, earning the dubious distinction of being among the poorest performers in the Asian currency spectrum.

Australian Dollar’s Decline

The Australian dollar’s trajectory has been anything but promising, plummeting to a nine-month nadir. This descent has been catalyzed by two Chinese listed companies defaulting on their payment obligations and the overarching anxieties surrounding China’s real estate sector. Given the intricate economic ties between China and Australia, the financial market is particularly attuned to developments in the former, reflecting its reactions to any significant news.

US Treasury Yields

The US Treasury yields are inching closer to their peak for the year. This upward trend is fueled by persistent inflationary apprehensions and the escalating Treasury issuance, a direct outcome of the US grappling with burgeoning deficits. Bill Gross, a luminary in the bond realm, has voiced his concerns regarding the current valuation of US debt. He opines that it’s inflated and pegs the fair value for 10-year Treasuries at a more modest 4.5%.

What is moving the ASX today?

Earnings Reports

- Beach Energy: Reported a 24% drop in its full-year profit, attributed to decreased domestic gas production and sales. The company’s revenue also declined, though gas prices saw a slight increase.

- Bendigo and Adelaide Bank: Despite a 15.3% increase in cash profits, the bank’s full-year profit fell short of some analyst expectations. The bank’s net-interest margins saw a positive uptick.

- Carsales: The company’s after-tax profit surged by 301%, driven by acquisitions of US-based Trader Interactive and Brazil’s Webmotors. Over half of its revenue now originates from outside Australia.

- JB Hi-Fi: The company reported a 4.3% increase in revenue, surpassing some estimates.

- Lendlease: The company reported a statutory loss, primarily due to a provision related to the UK government’s actions concerning residential buildings.

- Argo Investments: The company’s full-year profit declined by 13.2%, though it increased its final dividend.

Leader

No Significant News.

No Significant News.

No Significant News.

Full-year results, which showed its profit quadrupled to $646 million.

No Significant News.

Laggards

No Significant News.

Citi analyst downgrade.

No Significant News.

No Significant News.

No Significant News.