Closing Bell

3 Things Affecting Markets

- US CPI – Came in in with analyst expectations overnight, will the Fed Pause?

- Oil Price Take Pause – Oil halts seven-week rally amid technical barriers

- ASX Corporate Earnings & Announcements – Newcrest, Nick Scali and REA Group reports

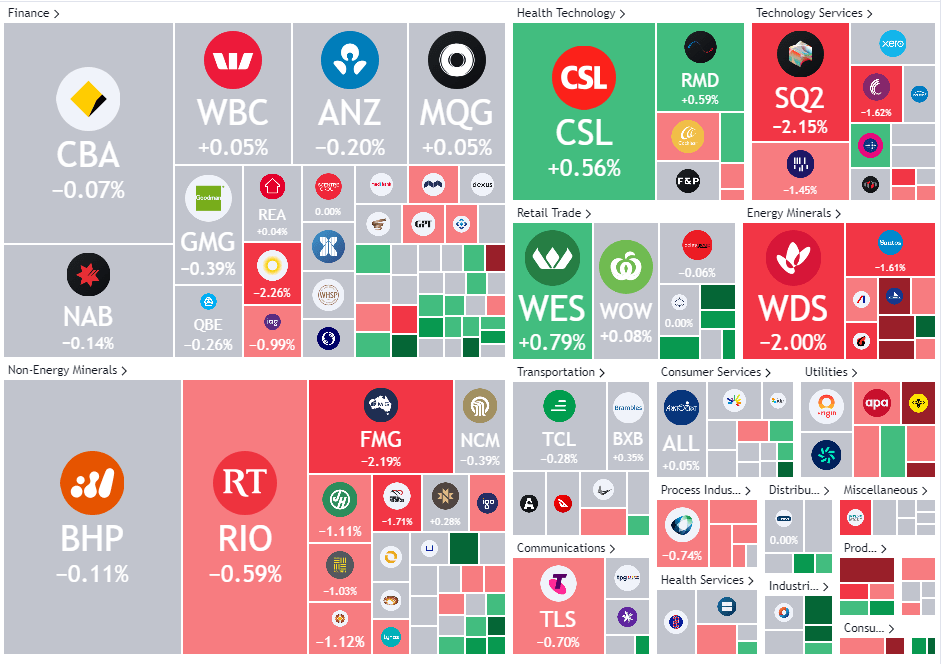

ASX Today

ASX 200 - 7,339.5 -17.9 (0.24%)

Housing Crisis Warning

Outgoing RBA governor Philip Lowe has sounded the alarm on the housing crisis. He cautions policymakers against the allure of quick solutions like rent controls, emphasizing that such measures could further aggravate the housing shortage. This warning is timely, coming ahead of a national cabinet meeting where Prime Minister Anthony Albanese will discuss housing supply and rental rights with state and territory leaders.

Australian Dollar’s Struggle

The Australian dollar is facing challenges. Currently, it’s hovering just above a two-month low at US65.23¢, indicating its potential fourth consecutive weekly loss. This downturn is attributed to the RBA’s recent dovish stance on interest rate policy. Despite some fluctuations, the currency remains under pressure. Bond futures suggest a 54% chance of the RBA raising the cash rate this year. Su-lin Ong from RBC Capital Markets hints at a potential rate hike in Q4, emphasizing the influence of global policy dynamics.

Global LNG Supply Threat

A potential month-long strike at plants operated by Woodside and Chevron could lead to a significant 10.5% cut in global LNG supply. ANZ’s Daniel Hynes, while considering the risk low, warns that a prolonged strike, especially during a cold winter, could strain Europe’s energy resources.

What is moving the ASX today?

Nick Scali’s Performance: Nick Scali, a renowned furniture retailer, has posted impressive figures with a record profit for the year ending June 30. Sales surged by 15.1% to $507.7 million. However, the company has raised concerns about a potential decline in orders, attributing this downturn in consumer sentiment to rising interest rates.

The Star’s Rise: Shares in gaming group The Star Entertainment are shining bright. Currently, they’ve soared by 18.4% to $1.155, marking a significant uptick. This surge is attributed to the government’s decision to drastically reduce a proposed tax on poker machine profits.

Newcrest’s Dividend: In the mining sector, Newcrest Mining has announced a record-tying annual dividend of US55¢, following a robust profit report of $US778 million.

Allkem’s Lithium Boost: Allkem has ramped up its James Bay lithium project output in Canada by a staggering 173% to 110.2 million tonnes. CEO Martin Perez de Solay is optimistic about the project’s future growth potential and its central role in Allkem’s upcoming lithium production endeavors in Quebec.

Leader

This surge is attributed to the government’s decision to drastically reduce a proposed tax on poker machine profits.

Posted impressive figures with a record profit for the year ending June 30. Sales surged by 15.1% to $507.7 million.

No Significant News.

No Significant News.

No Significant News.

Laggards

No Significant News.

No Significant News.

No Significant News.

No Significant News.

No Significant News.