What's Affecting Markets Today

Reserve Bank is Done Raising Rates

ANZ forecasts that the Reserve Bank of Australia (RBA) will maintain the current cash rate, anticipating a shift towards easing by late next year. Adam Boyton, ANZ’s head of Australian economics, points to declining job advertisements and a new labor market tightness measure indicating that the RBA’s efforts have sufficiently addressed domestic inflation pressures. Consequently, the peak cash rate is predicted to be 4.35%. Boyton projects a decrease to 4.1% in a year and further to 3.85% by March 2025.

Woodside Energy and Santos in Preliminary Merger Talks

Woodside Energy and Santos have initiated serious discussions regarding a potential merger, estimated at about $80 billion. The talks, which are roughly 5% underway, involve high-level meetings between CEOs Meg O’Neill of Woodside and Kevin Gallagher of Santos. While no formal proposal exists, both parties have agreed in principle to explore the merger. Santos is receiving advisory services from Goldman Sachs, Macquarie Capital, JBNorth & Co, and Citi, while Woodside is working with Morgan Stanley. The companies aim for scale amidst global consolidation trends, as evidenced by significant mergers in the energy sector. The urgency is partly driven by potential leadership changes at Santos.

US Rates on a Prolonged Hold, Fed Officials Likely to Hesitate

The Federal Reserve is expected to maintain interest rates at their upcoming meeting, with growing speculation that a rate cut may not occur until after the first half of 2024. Oxford Economics’ Michael Pearce believes the Fed will continue its hold, citing resilient economic conditions and ongoing high wage growth. Despite a slowdown in economic growth and quicker cooling of inflation, Pearce anticipates the Fed will emphasize the persistence of inflation and upside risks. Consequently, rate cuts may be delayed until September, followed by a more gradual reduction pace compared to past cycles.

ASX Stocks

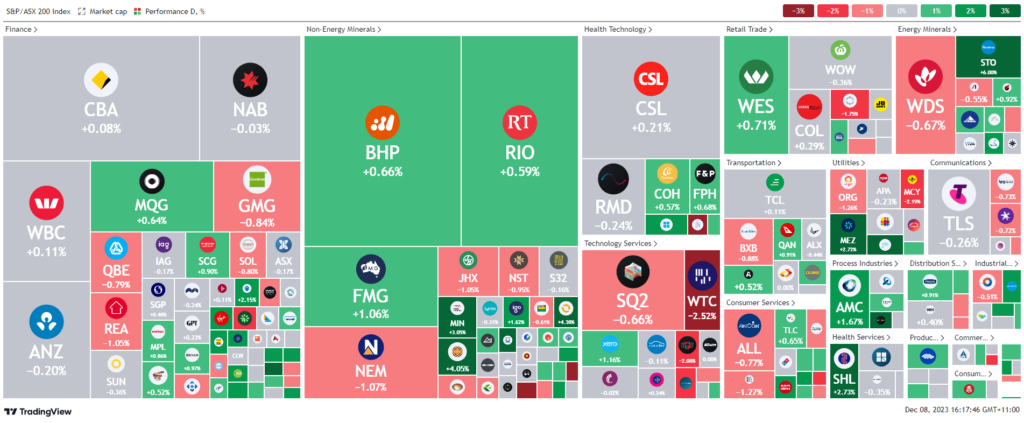

ASX 200 - 7,184.0 (0.15%)

Key Highlights:

The ASX experienced a slight decline on Friday, primarily due to a downturn in utilities and real estate stocks. However, a significant surge in Santos shares, following news of a potential merger with Woodside Energy, helped mitigate overall market losses. The S&P/ASX 200 index fell by 0.2%, marking a potential end to its recent streak of weekly gains. This market activity comes as traders globally anticipate US job data, which could confirm the Federal Reserve’s halt in interest rate hikes and signal a shift to an easing cycle in 2024.

In the domestic market, only the mining and energy sectors showed positive movement among the benchmark’s 11 categories. The potential Santos-Woodside merger dominated market activity, resulting in increased investment in Santos and a sell-off in Woodside shares. In the commodities sector, lithium explorers like Sayona and Core Lithium saw a rise of at least 3%, while gold miners experienced a decline despite high bullion prices.

Internationally, the Australian dollar stood strong against a weakening US dollar, fueled by speculation about the Bank of Japan’s interest rate policies. On Wall Street, tech stocks saw significant gains, with Alphabet and AMD performing notably well. The upcoming US jobs report is expected to influence market sentiment, particularly regarding wage data.

Key stocks saw varied movements: Woodside Energy declined by 1.4%, while Santos jumped 6.7% amidst merger talks. Energy player Genex Power increased by 1.2% after securing a power sales agreement. Ramsay Health Care and Sky City Entertainment Group both experienced declines, and Washington H Soul Pattinson retreated slightly despite its takeover bid for Perpetual, which saw a modest increase. Sigma Healthcare extended its trading halt amid significant transaction talks, particularly relating to Chemist Warehouse’s potential takeover.

Leader

SYA – Sayona Mining Ltd (+12.96%)

WC8 – Wildcat Resources Ltd (+11.19%)

STO – Santos Ltd (+6.00%)

HGH – Heartland Group Holdings Ltd (+5.66%)

AKE – Allkem Ltd (+4.39%)

Laggards

EMR – Emerald Resources NL (-5.72%)

CTT – Cettire Ltd (-4.46%)

AD8 – Audinate Group Ltd (-4.12%)

APM – APM Human Services (-4.06%)

DYL – Deep Yellow Ltd (-3.81%)