What's Affecting Markets Today

GDP Expands 0.2pc in Q3, Below Forecasts

Australia’s GDP grew by 0.2% in the third quarter, falling short of the expected 0.4% and marking a slowdown from 0.4% in Q2. Annually, the economy expanded by 2.1%, aligning with previous quarters and slightly above the 1.8% forecast. Despite this underperformance, the Australian dollar remained stable, trading just under US65.7¢, and the ASX saw a slight increase. This GDP data is significant for the central bank, which seeks signs of economic deceleration to achieve inflation targets. With recent trends indicating softer employment and inflation, the RBA, pausing its meetings until February, will closely watch the fourth-quarter CPI report due on January 31 for further direction.

Bitcoin’s ‘Jet Fueled’ 16pc Six-Day Jump Takes Token Past $US44,000

Bitcoin experienced its longest winning streak since May, surpassing $US44,000 with a 16% increase over six days. This surge, part of a 165% rebound from last year’s slump, is driven partly by the anticipation of the US approving its first spot Bitcoin ETFs. Firms like BlackRock and Fidelity Investments await decisions on their ETF applications, with analysts expecting approvals as early as January. While ETF prospects have been influencing Bitcoin since June, the recent spike also reflects speculation about potential US Federal Reserve rate cuts next year, indicating a shift in investor focus towards looser monetary policy expectations.

Evolution Raises $525m to Fund Northparkes Deal

Evolution Mining successfully raised $525 million through the placement of 138.2 million new shares priced at $3.80 each to institutional investors. This capital raise is part of the funding strategy for acquiring an 80% stake in the Northparkes Copper-Gold Mine from CMOC Group for $US475 million. The completion of this acquisition, a strategic move for Evolution Mining, is expected by the end of the year, representing a significant expansion in the company’s mining portfolio and capabilities.

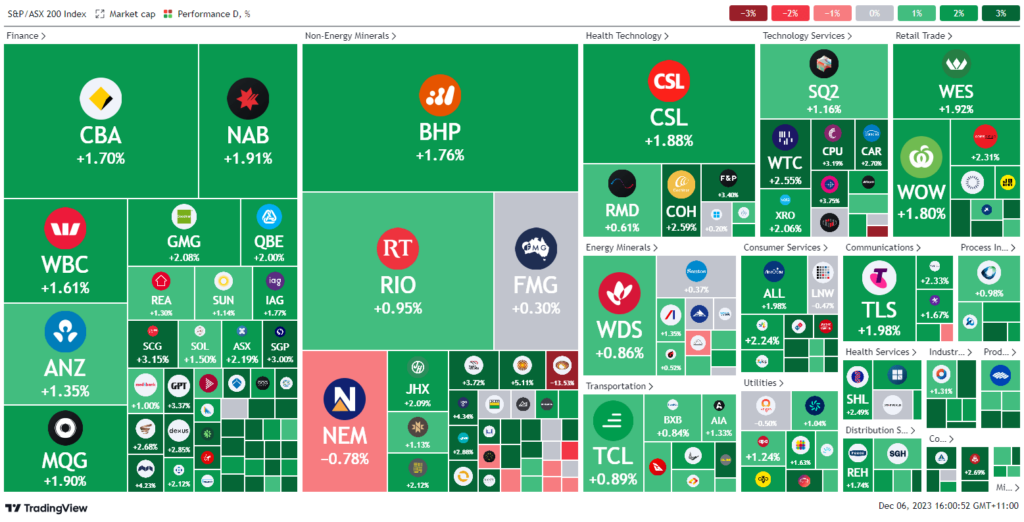

ASX Stocks

ASX 200 - 7,185.8 (1.76%)

Key Highlights:

The Australian stock market experienced a notable rally, with the S&P/ASX 200 index climbing 1.5% to 7165.7, driven by increased expectations of an interest rate cut by the Reserve Bank of Australia (RBA). This surge in the market, which saw all industry sectors in the green, coincides with the market fully pricing in a rate cut in December. The Australian dollar also strengthened, rising 0.7% to just under US66¢. This comes amidst news that Australia’s GDP grew by 0.2% in the third quarter, less than the 0.4% of the previous quarter and below consensus forecasts.

Interest rate-sensitive sectors like real estate, banking, and technology led the market gains. Mirvac, Dexus, and Goodman Group notably advanced in the real estate sector. The materials sector also saw an uptick, buoyed by rising iron ore prices, benefiting major players like BHP and Rio Tinto.

Wall Street had a mixed day, with significant movements in US tech giants like Apple, which rallied after positive forecasts from Foxconn. The US bond market reacted to data showing a decline in job openings, potentially signaling a cooling labor market to the Federal Reserve.

Among individual stocks, Endeavour Group and Perpetual saw significant gains, the latter following an announcement of a strategic review of its businesses. Woodside Energy also rose after securing a long-term LNG deal. However, Evolution Mining’s stock plummeted after a major capital raising, and Magellan Financial Group’s shares increased due to a rise in funds under management.

Leader

CXO – Core Lithium Ltd (+17.39%)

HMC – HMC Capital Ltd (+14.92%)

PNV – Polynovo Ltd (+11.52%)

ZIM – Zimplats Holdings Ltd (+9.33%)

SYA – Sayona Mining Ltd (+7.55%)

Laggards

EVN – Evolution Mining Ltd (-13.53%)

360 – LIFE360 Inc (-6.33%)

A4N – Alpha Hpa Ltd (-2.72%)

RMS – Ramelius Resources Ltd (-2.26%)

WGB – Wam Global Ltd (-1.99%)