What's Affecting Markets Today

RBA Leaves Rates on Hold: Statement

The Reserve Bank of Australia (RBA) decided to maintain the cash rate at 4.35% and the interest rate on Exchange Settlement balances at 4.25%. This follows a 25 basis point increase last month, responding to slower-than-anticipated progress in reducing inflation to the 2-3% target range. The economy exhibited stronger-than-expected growth in the first half of the year, with higher underlying inflation, especially in services, and a still tight but easing labor market. Housing prices and mortgage numbers continue to rise. The RBA acknowledges the risk of prolonged high inflation, justifying interest rate increases to ensure inflation returns to target reasonably. Recent data indicates inflation moderation, primarily in goods, with consistent inflation expectations. Wage growth, influenced by the Fair Work Commission’s decision, aligns with the inflation target, assuming productivity increases. The RBA is assessing the effects of recent rate hikes on demand, inflation, and the job market, prioritizing returning inflation to target due to its widespread economic impact. Global uncertainties, persistent service inflation, the Chinese economy, international conflicts, and domestic consumption and labor market conditions contribute to a complex outlook. Future monetary policy tightening will be data-driven, focusing on global trends, domestic demand, and inflation and labor market forecasts.

The Bitcoin Hype Machine Ramps Up

Bitcoin’s price has experienced a significant surge, rising above $US42,000 and marking a 55% increase since mid-October, with a year-to-date gain of 152%. This price increase is accompanied by heightened enthusiasm from Bitcoin supporters. Brian Armstrong, co-CEO of Coinbase, suggested that Bitcoin could be pivotal in sustaining Western civilization by offering an alternative to traditional fiat currencies prone to inflation. Armstrong hypothesizes that as countries with reserve currencies tend to inflate their money supply, leading to deficit spending, people may increasingly turn to cryptocurrencies as a hedge against inflation. This perspective highlights the growing belief in Bitcoin’s transformative potential in global finance and its ability to challenge traditional economic structures.

Oil Losing Streak Grinds On

Oil prices have declined for the third consecutive session amidst skepticism about the effectiveness of OPEC+ supply cuts, despite several factors that could have bolstered prices. West Texas Intermediate (WTI) fell by 1.4% to settle near $US73 a barrel, extending a six-week loss streak. The market briefly reacted positively to Saudi Arabia’s Energy Minister’s statement on continuing production cuts past March, but this uptick was short-lived, reflecting prevailing market doubts. Oil has seen consecutive monthly declines due to increased supplies from non-OPEC sources and a weakening demand growth outlook. The market signals short-term oversupply, and recent OPEC+ meetings, marred by delays and internal disagreements, have led to doubts about the group’s commitment to supply restrictions. This environment has positioned oil as a market awaiting more definitive indicators of direction.

ASX Stocks

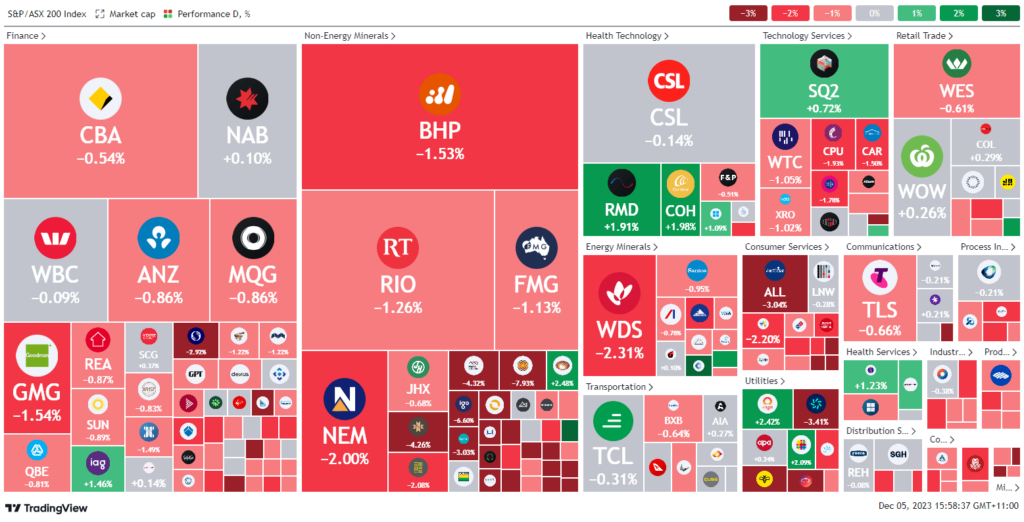

ASX 200 - 7,056.9 (-0.95%)

Key Highlights:

Australian shares recovered partially following the Reserve Bank of Australia’s decision to maintain interest rates at 4.35%. The S&P/ASX 200 index dropped by 0.8% to 7067.4, mitigating earlier losses of up to 1.2%, influenced by a weak performance from Wall Street. The All Ordinaries index also saw a 0.8% decline. Concurrently, the Australian dollar decreased by 0.6% to US65.81¢, and Australian government bonds showed a slight easing.

The materials sector suffered the most on the ASX, dropping 1.8%, as investors cashed in on recent gains. Major iron ore companies like BHP, Rio Tinto, and Fortescue Metals Group experienced dips exceeding 1%. Additionally, gold and lithium stocks declined, reflecting a broader downturn in commodity prices.

The technology sector fell 1.4%, mirroring the Nasdaq’s overnight losses. Energy stocks also dropped, with Woodside Energy declining by 1.5% to $28.88. In contrast, utilities stocks, led by Origin Energy’s 2.5% increase to $8.05, boosted the sector by 0.9%. This rise came after shareholders rejected a takeover bid for Origin Energy by Brookfield and EIG.

In the U.S., stock market performance weakened, and the yield on the 10-year Treasury neared 4.3%. Notably, Nvidia’s shares dropped following the U.S. Commerce Secretary’s commitment to restrict advanced semiconductor chip exports to China. Meanwhile, gold prices fluctuated, and Bitcoin traded above $US42,000, marking an overnight increase of over 5%.

In company-specific news, Capricorn Metals’ stock fell by 6.8% after significant share sales by its chairman and a director. Evolution Mining paused trading ahead of a share placement to acquire a stake in the Northparkes mine. Life360’s shares dropped by 3.7% following a share sale by its CEO. Whispir’s stock increased by 7.1% amidst takeover interest, and Mesoblast’s shares plunged over 22% following a capital raise.

Leader

ERA – Energy Resources Ltd (+3.03%)

ZIM – Zimplats Holdings Ltd (+2.48%)

ORG – Origin Energy Ltd (+2.42%)

SMR – Stanmore Resources Ltd (+2.27%)

NAN – Nanosonics Ltd (+2.16%)

Laggards

CEN – Contact Energy Ltd (-10.25%)

CXO – Core Lithium Ltd (-9.80%)

LTR – Liontown Resources Ltd (-9.19%)

CTT – Cettire Ltd (-8.96%)

PLS – Pilbara Minerals Ltd (-8.22%)