What's Affecting Markets Today

Gina joins forces with lithium giant SQM in $1.7b Azure bid

Gina Rinehart’s Hancock Prospecting and Chile’s Sociedad Quimica y Minera (SQM) have partnered in a $1.7 billion bid for Azure Minerals (AZS). Securing over 60% of the stock, their $3.70 per share offer gained support from key shareholders Mark Creasy and Delphi Group. Mineral Resources, holding a 13.5% stake, may choose to sell into the Rinehart-SQM takeover. In November, Chris Ellison expressed interest in Azure’s Andover project.

RBA considered rate increase in December

In its December policy meeting, the Reserve Bank contemplated a potential increase in the cash rate from 4.35 percent but ultimately favored maintaining the current rate, as disclosed in meeting minutes. The board affirmed the appropriateness of retaining government bonds until maturity but acknowledged ongoing consideration of the option to sell the bonds prematurely.

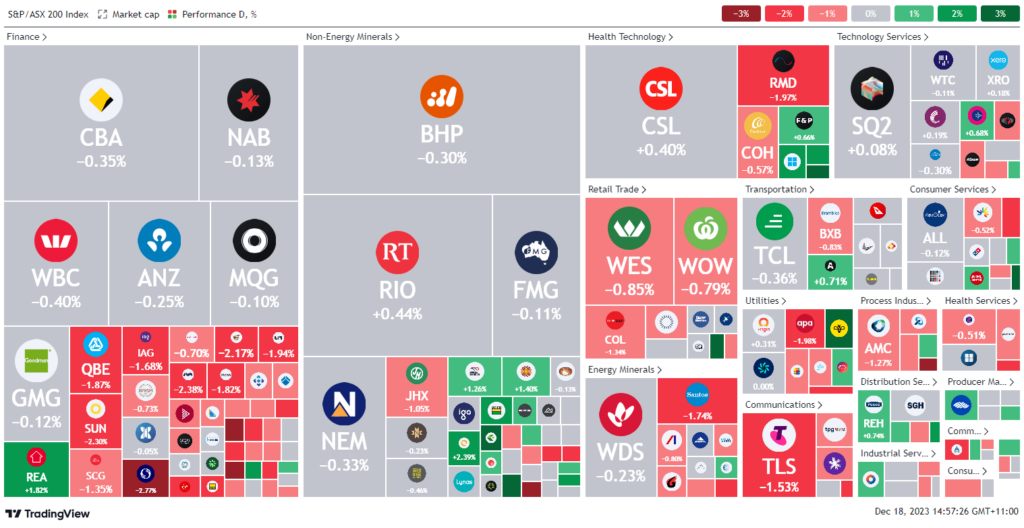

ASX Stocks

ASX 200 - 7,485 (+58.7 or +0.806%)

Key Highlights:

Australian shares surged in tandem with a Wall Street upswing, driven by a rally in commodity stocks amid heightened oil prices. The S&P/ASX 200 gained 0.8%, reaching 7485, with all 11 sectors showing positive momentum. Oil prices rose by 2% following increased attacks by Iranian-backed Houthi militants in the Red Sea, prompting concerns of supply disruptions. This surge benefited the resources sector, including iron ore, gold, and lithium explorers, with companies like Fortescue Metals, Liontown Resources, and Ramelius Resources experiencing notable gains. Meanwhile, the Australian dollar hovered around US67¢, maintaining a five-month high.

Leaders

GEM G8 Education Ltd 12.56%

LTR Liontown Resources Ltd 8.87%

NEU Neuren Pharmaceuticals Ltd 7.75%

RIC Ridley Corporation Ltd 6.56%

KAR Karoon Energy Ltd 4.63%

Laggards

WBT Weebit Nano Ltd -5.63%

TAH Tabcorp Holdings Ltd -5.53%

AWC Alumina Ltd -3.53%

SDR Siteminder Ltd -3.18%

SKC Skycity Entertainment Group Ltd -2.89%