What's Affecting Markets Today

China reports fastest industrial output growth in 20 months

China’s industrial output surged 6.6% YoY in November, marking the largest expansion since February 2022 and surpassing the 5.6% forecast in a Reuters poll. However, retail sales growth at 10.1% fell short of the anticipated 12.5%, revealing a varied recovery in the second-largest global economy. The urban unemployment rate remained steady at 5% in November. Persistent weak consumer demand, evident in recent data, underscores economic challenges. China’s leaders emphasized economic priorities for 2024, acknowledging the need for robust measures. The nation’s post-COVID recovery faces hurdles such as a real estate crisis, debt risks, and youth unemployment, prompting calls for increased stimulus.

Dow Jones at record highs. Nasdaq and S&P chasing

Wall Street extended its record-breaking streak as the Dow reached a fresh high, closing above 37,000 for the first time. The 30-stock benchmark climbed 0.43% to 37,248.35, with the S&P 500 rising 0.26% to 4,719.55 and the Nasdaq Composite up 0.19% at 14,761.56. The S&P 500 is poised to achieve its own historic peak, currently less than 1.6% from the January 2022 record. The Nasdaq remains about 8% away from its highest-ever close and 9% from its peak intraday level. This surge follows the Federal Reserve’s acknowledgment of effective inflation control and the prospect of three 2024 interest rate cuts. The positive November retail sales data and cooler inflation readings further fueled optimism about the Federal Reserve steering a smooth economic course.

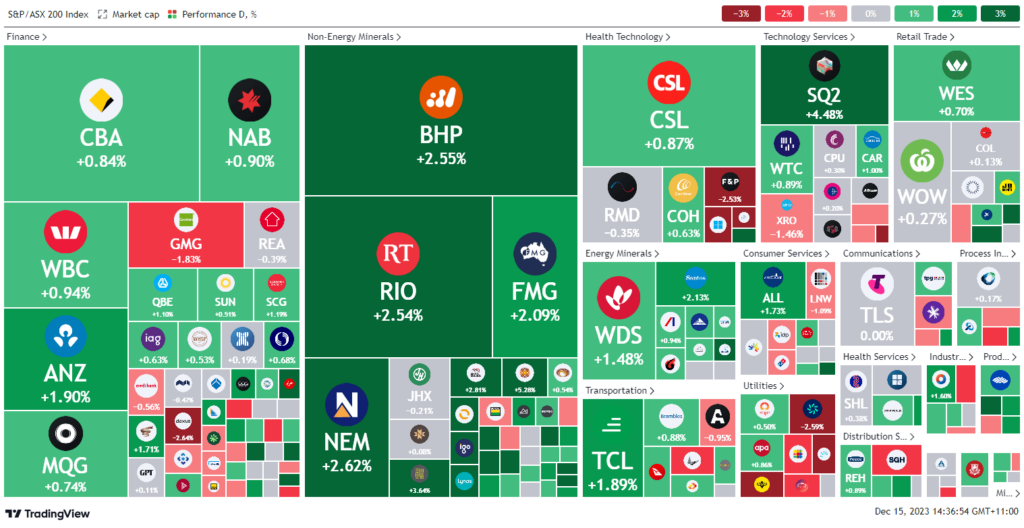

ASX Stocks

ASX 200 - 7,442 (+64.8 or 0.9%)

Key Highlights:

The S&P/ASX 200 surged 64 points, or 0.9%, reaching 7442, propelled by a rally in metal and energy prices. The weakening US dollar elevated copper, gold, oil, iron ore, and natural gas prices. The materials sector witnessed a 2.1% boost, with Fortescue Metals achieving a record high of $28.15. Both Rio Tinto and BHP experienced gains, and gold miners benefited as gold reached $2052 per ounce.

West Australian lithium producer Pilbara Minerals saw a 5% increase in its shares to $3.98, driven by rising battery metal prices in China. Pilbara had 20.8% of its stock shorted by traders anticipating a price decline. Other lithium and rare earths players rallied on Friday amid expectations that a lower US dollar would lift commodity prices.

Property management group Dexus adjusted its office and industrial property portfolio values downward by 5.2%, approximately $762.4 million, attributing the decline to higher discount and capitalization rates offset by rental market growth. Dexus shares fell 1% to $7.86.

The uranium price hit a 15-year high at $82.30 per pound, sparking speculation about its potential in 2024 as governments consider nuclear power for the energy transition. Uranium plays like Boss Energy, valued at $1.6 billion, rose 95% in 12 months, while Paladin Energy increased by 3.8% to $1.02 per share.

Australian Clinical Labs announced the withdrawal of its takeover bid for pathology peer Healius after the ACCC moved to block the deal on Friday.

Leaders

CXO – Core Lithium Ltd: 13.21%

SYA – Sayona Mining Ltd: 11.67%

ABC – Adbri Ltd: 9.33%

JDO – Judo Capital Holdings Ltd: 6.81%

LTR – Liontown Resources Ltd: 6.73%

Laggards

APM – APM Human Services Int: -9.64%

TLX – TELIX Pharmaceuticals Ltd: -6.83%

SIG – Sigma Healthcare Ltd: -4.79%

MCY – Mercury NZ Ltd: -4.52%

EBO – Ebos Group Ltd: -3.77%