What's Affecting Markets Today

Fed holds rates steady, indicates three cuts coming in 2024

The Federal Reserve maintained its key interest rate for the third consecutive time, signalling a shift toward a more accommodative stance in 2024. Despite a steady economy and moderating inflation, the Federal Open Market Committee unanimously voted to keep the benchmark rate within a targeted range of 5.25%-5.5%. Notably, the committee hinted at a forthcoming series of at least three rate cuts in 2024, each in quarter percentage point increments, a more aggressive approach than previously suggested. This decision, widely anticipated by markets, followed a cycle of 11 hikes that elevated the fed funds rate to its highest level in over 22 years. Post-announcement, the Dow Jones Industrial Average surged over 400 points, surpassing 37,000 for the first time.

Aussie economy adds 61500 jobs in November

In November, Australia’s unemployment rate reached an 18-month high, rising to 3.9% despite a stronger-than-expected employment increase of 61,500 people, exceeding economists’ projections of a 10,500 growth. The surge in new entrants to the labor force, amid a cooling jobs market, contributed to the uptick. The participation rate hit a record 67.2%, signaling increased workforce engagement. The data marked the end of a 1.5-year period with unemployment hovering between 3.4% and 3.7%. As the economy cools and interest rates tighten, the labor market is adjusting. The Reserve Bank of Australia anticipates a gradual rise in the jobless rate to 4.3% by mid-2025. Underemployment increased to 6.5%, reflecting evolving market dynamics.

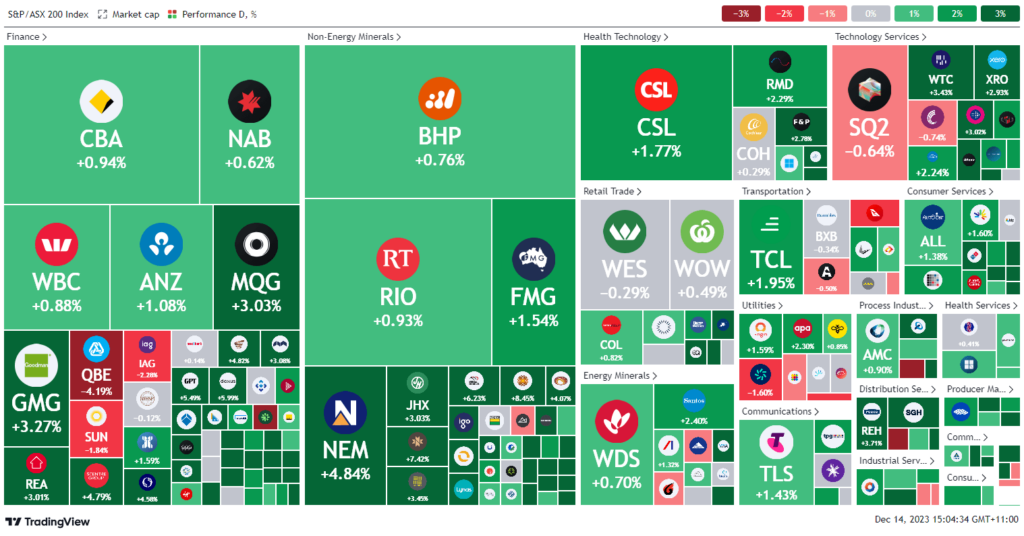

ASX Stocks

ASX 200 - 7,375 (1.6%)

Key Highlights:

Australian shares experienced a notable surge, poised for their most substantial single-day gain since mid-July, propelled by the US Federal Reserve’s decision to maintain key interest rates and signal potential rate cuts in the coming year. Around midday, the S&P/ASX 200 advanced by 115 points, a 1.6% increase, reaching 7373, with the All Ordinaries following suit with a similar gain. The real estate sector, particularly sensitive to interest rates, led the charge with an impressive 4.1% surge, outperforming other industry groups.

Material stocks, buoyed by a resurgence in gold prices surpassing $2000 per ounce, also contributed to the market rally. Furthermore, lithium mining companies such as Pilbara Minerals, Core Lithium, and Liontown Resources experienced substantial gains, exceeding 10%, following pledges at COP28 to transition away from fossil fuels.

In response to the US Federal Reserve’s dovish stance, the Australian dollar reached a five-month high, nearing US66.9¢. The Fed’s commitment to potential rate cuts next year, coupled with Australia’s jobless rate ticking up to 3.9%, reinforced the perception that the Reserve Bank of Australia’s efforts to combat inflation are making headway.

In the global context, the S&P 500 extended its gains by over 1%, and two-year yields dropped significantly by 28 basis points to 4.45%. Fed officials conveyed their expectation of lowering rates by 0.75 percentage points in the coming year, a more rapid pace of cuts than previously indicated in September’s projections. Analysts, such as Andrew Brenner, Head of International Fixed Income at Natalliance Securities, noted that the Fed’s stance is decidedly more accommodative than earlier projections, with an increase in the projected number of rate cuts to three in 2024.

Among the notable stock movements, Genesis Minerals rose by 11.3% after securing a deal to acquire gold projects from Kin Mining. Viva Energy witnessed a 4% increase to $3.26 following the ACCC’s non-opposition to its acquisition plans. Volpara Health Technologies experienced a significant 42.6% surge to $1.10 after the board endorsed a buyout offer from AI cancer detection developer Lunit.

Conversely, Orora faced a 2.6% decline to $2.61 due to earnings headwinds impacting the outlook for its Saverglass business. Meanwhile, Sydney start-up Pendula proposed a takeover of Whispir for 57¢ per share, a 19% premium compared to the offer from private equity-backed Soprano Design. Whispir responded positively with a 2.9% increase to 53¢.