What's Affecting Markets Today

Argentina Announces Drastic Peso Devaluation

Argentina’s President Javier Milei has implemented a substantial devaluation of the peso by 50%, setting it at 800 to the US dollar, as part of urgent economic reforms. This decision comes amidst severe economic challenges including extreme inflation, widespread poverty, and substantial debts to the IMF and other creditors. The government’s strategy involves reducing public expenditures and subsidies, aiming to shrink the fiscal deficit and stabilize the economy. The IMF has expressed support for these initial steps, highlighting their importance in Argentina’s financial stability and growth.

US Inflation Data: A Closer Look

The latest US inflation data aligns with expectations, showing a 3.1% year-over-year increase and a 4% rise in core inflation. Monthly inflation rose marginally by 0.1%. The data reveals mixed trends across various sectors, with a decrease in food and energy prices, but a persistent rise in shelter costs. The ‘supercore’ inflation metric, excluding housing costs, indicates sustained inflationary pressures. This report underscores the Federal Reserve’s challenging path in controlling inflation, reinforcing its stance on maintaining high interest rates. Market reactions to this data were mixed, reflecting ongoing economic uncertainties.

Fortescue Reaches Record Valuation Amid Iron Ore Surge

Fortescue Metals’ shares have soared to an all-time high, propelled by strong iron ore prices, now surpassing $82 billion in market value. This record-setting performance is mirrored by Rio Tinto, which also reached a two-year high. These increases coincide with the government’s announcement of a budget surplus, largely attributed to robust commodity prices. Investors are optimistic about Fortescue’s financial prospects in 2024, contradicting analysts’ predictions, such as Goldman Sachs, which maintains a lower target price for the mining giant.

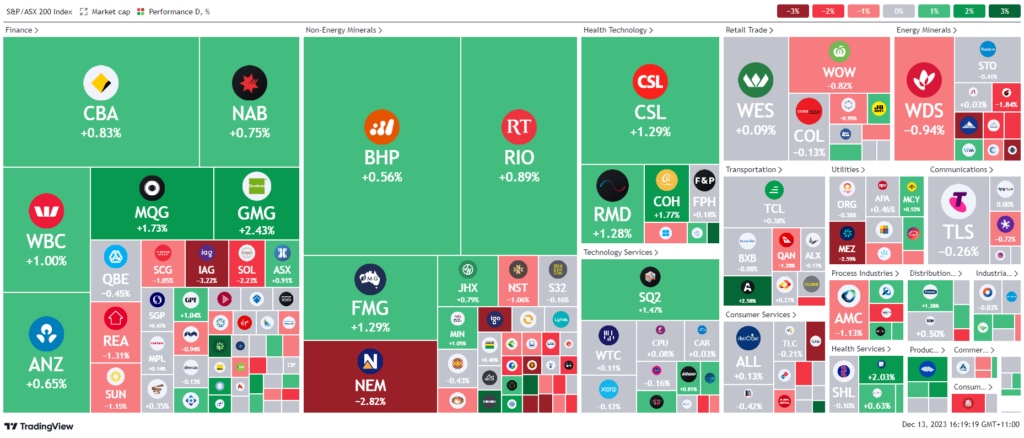

ASX Stocks

ASX 200 - 7,255.9 (0.29%)

Key Highlights:

Australian shares witnessed a modest rise of 0.2% around midday, driven by gains in the banking, supermarket, and iron ore sectors. However, these gains were partially offset by a decline in energy stocks, following a 3.5% drop in benchmark oil prices. Sigma Healthcare, targeted by Chemist Warehouse, stood out with a significant surge of over 70% in early trading, reaching $1.35 before settling around $1.05.

Fortescue Metals achieved a record high of $26.78, buoyed by iron ore prices surpassing $US135 a tonne. Rio Tinto also reached a two-year peak of $130.84, marking its highest since July 2021. These record share prices coincide with the government’s announcement of another budget surplus, largely supported by strong commodity prices.

Wall Street closed at 52-week highs, encouraged by data showing a reduction in core US inflation to 4% year-on-year in November, excluding food and energy prices. This led to a decrease in bond yields and a rise in mega-cap stocks, as traders anticipate potential rate cuts next year. However, ANZ notes that the US inflation data was robust enough to challenge early rate cut expectations by the Federal Reserve.

In individual stock movements, HMC Capital saw a notable rise, while Air New Zealand and Newmont experienced drops, the latter due to a decline in gold prices. Woodside also saw a decrease, influenced by the falling oil prices.

Leader

SIG – Sigma Healthcare Ltd (+44.12%)

NEU – Neuren Pharmaceuticals Ltd (+6.93%)

SLX – SILEX Systems Ltd (+6.05%)

AD8 – Audinate Group Ltd (+5.14%)

PNV – Polynovo Ltd (+5.12%)

Laggards

ERA – Energy Resources (-9.52%)

ADT – Adriatic Metals Plc (-9.09%)

WC8 – Wildcat Resources Ltd (-4.97%)

PTM – Platinum Asset (-4.94%)

SYA – Sayona Mining Ltd (-4.39%)