What's Affecting Markets Today

Chemist Warehouse to list on ASX

Sigma Healthcare has made a surprising entry into the M&A landscape with a potential deal that could redefine the year on the ASX. The pharmacy wholesaler, a quiet player for two decades often overlooked by small-cap managers, is set to undergo a remarkable transformation into a major player in the large-cap universe. The proposed acquisition of Chemist Warehouse owner CWG Group is poised to elevate Sigma into a globally attractive retailer, catching the attention of US giants such as Capital Group and Fidelity. This move signifies Sigma’s departure from its status as a small fish, with ambitions to become a significant entity in the retail pharmacy sector.

The scale of the deal, known as Project Orbit, is indeed astonishing. Sigma, currently valued at $810 million, is expected to leap to an $8.8 billion valuation, entering a new dimension in terms of market capitalization. To fund this strategic move, Sigma plans to borrow $1 billion from ANZ and National Australia Bank, allocating $700 million to CWG shareholders and issuing them scrip equivalent to 85.75% of the combined group.

Upon completion, the merged entity will emerge as Australia’s largest pharmacy group, serving 1000 pharmacies across Chemist Warehouse, MyChemist, Amcal, and Discount Drug Stores chains. Additionally, it will operate a substantial distribution network with 16 data centers and feature a significant private label business. The amalgamated business will function as a comprehensive wholesaler, distributor, and retail pharmacy franchisor.

The financials of the two merging companies are robust, generating a combined $495 million in earnings before interest and tax annually. Further synergies of up to $60 million are anticipated, according to the investor presentation. Sigma’s camp is expected to convince investors that the true EBIT forecast for FY25 or FY26 should be significantly higher.

In context, the synergies alone surpass double Sigma’s EBIT from the previous financial year, highlighting the magnitude of the deal. CWG’s EBIT appears to be approximately 20 times Sigma’s efforts in the same period. This substantial transaction, challenging Sigma’s past status as a relative minnow overshadowed by retail giants like Woolworths and Wesfarmers, reflects Sigma’s determination to play a more prominent role in the market.

ASX Stocks

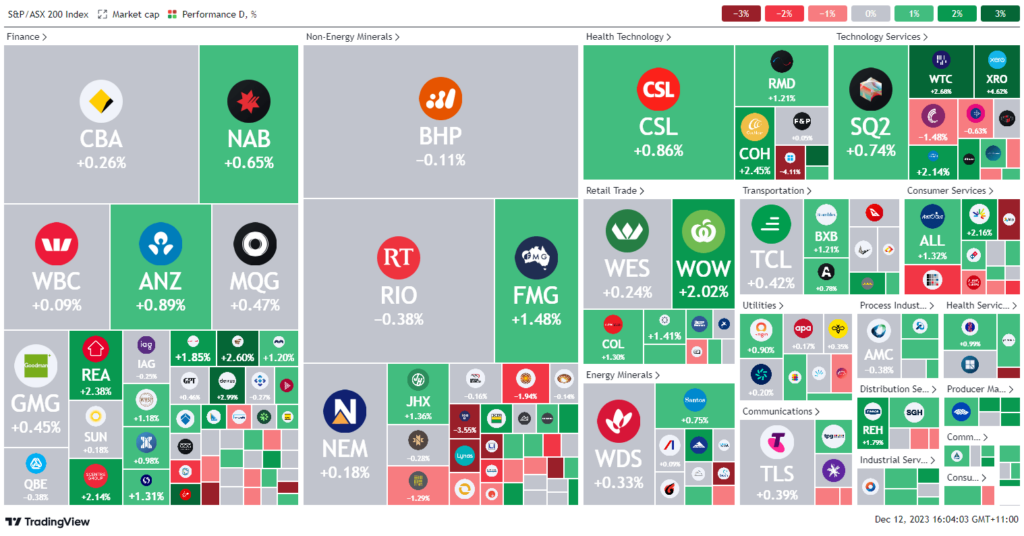

ASX 200 - 7,253.3 (0.50%)

Key Highlights:

The Australian sharemarket experienced late-session gains driven by a 0.5% increase in the benchmark S&P/ASX 200 index, reaching 7233.4 points around 2:30 pm AEDT. Notably, interest rate-sensitive stocks played a significant role in this upswing, with the information technology and consumer staples sectors leading the way. Technology stocks, in particular, saw substantial gains, surging 2.3%, with notable performers such as WiseTech rising 2.8% and Xero climbing 4.2%.

On Wall Street, the previous night saw a lacklustre session as investors adopted a cautious stance ahead of key US inflation data that could impact future interest rate decisions. Craig Erlam of Oanda highlighted the significance of upcoming events, including the Federal Reserve decision, which, while expected to be non-controversial, could be influenced by accompanying forecasts, the dot plot, and the subsequent press conference.

In the cryptocurrency realm, Bitcoin experienced a notable 7.5% decline, dropping below $41,000, following a remarkable 150% rally earlier in the year. In commodities, oil prices stabilized just above a five-month low amid concerns of oversupply despite OPEC+ commitments to extend and deepen output cuts. Global benchmark Brent traded around $76 per barrel.

Energy stocks mirrored the crude price movement, with Santos declining 0.4% and Woodside Energy slipping 0.1%. Reserve Bank governor Michele Bullock, addressing the Australian Payments Network Summit, expressed confidence that Australia is actively addressing inflation and is not lagging behind in implementing necessary measures to achieve target levels.

Leader

SLX SILEX Systems Ltd (+6.25%)

TPW Temple & Webster Group Ltd (+5.01%)

XRO Xero Ltd (+4.50%)

TLX TELIX Pharmaceuticals Ltd (+3.87%)

AD8 Audinate Group Ltd (+3.68%)

Laggards

GMD Genesis Minerals Ltd -6.06%

CTT Cettire Ltd -4.88%

DYL Deep Yellow Ltd -4.75%

ASK Abacus Storage King -4.60%

WC8 Wildcat Resources Ltd -4.17%