What's Affecting Markets Today

US Economy Headed for Soft Landing: RBC

RBC Capital Markets forecasts a soft landing for the US economy in 2024, expecting a gradual slowdown without tipping into recession. They predict the first interest rate cut by mid-2024, aiming to prevent a hard landing. The outlook is contingent on the Federal Reserve’s response to economic signs, with risks skewed towards slower GDP growth and potential inflation spikes due to geopolitical conflicts and energy prices.

ECB Inflation Success Undermines Tough Rate Talk

The European Central Bank’s (ECB) tough stance on high interest rates is challenged by a significant slowdown in inflation, now closer to the 2% target. Despite hawkish policymakers’ claims, market participants anticipate a rate reduction as early as April. The ECB faces increasing pressure to adjust its forecast and potentially lower rates, especially if economic activity remains weak.

Oil Sinks as Traders Disappointed with OPEC+ Cuts

Oil prices dropped sharply following the OPEC+ meeting, which concluded with smaller-than-expected output cuts and unclear quota enforcement. West Texas Intermediate fell by 2.4%, with Angola rejecting its new target and other members’ commitment to cuts uncertain. Saudi Arabia extended its unilateral cut, and Russia increased its export reduction, but overall market disappointment led to a significant price decline.

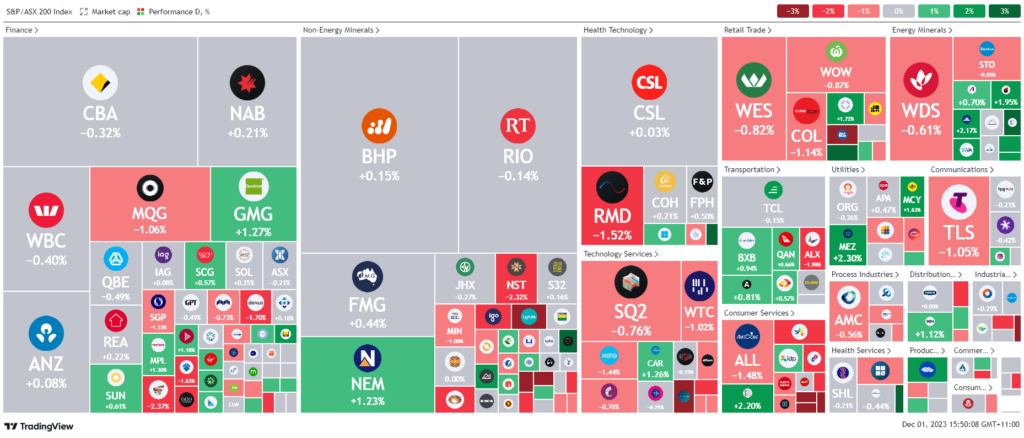

ASX Stocks

ASX 200 - 7,073.2 (-0.20%)

Key Highlights:

In the final trading hour of the week, Australian shares are trending lower, with the S&P/ASX 200 and the All Ordinaries both down by 0.3%, at 7063 and a similar level, respectively. Despite this decline, the market is set to finish the week 0.4% higher than the previous week. The downturn affects all 11 sectors, particularly technology stocks, which have fallen by 1.5%. Nonetheless, tech remains the top performer of the week, having risen by 2.3% over five days.

Energy stocks are stagnant after a decrease in oil prices, even though OPEC+ agreed to cut production. This drop occurs amid a lack of detailed plans from OPEC+ and Angola’s announcement to exceed its new output quota, indicating potential conflicts within the cartel.

Materials stocks also see a 0.3% decline, influenced by the latest China Caixin manufacturing PMI, which didn’t improve market sentiment in November. Additionally, manufacturing PMIs from the UK and the US are due later in the day.

Internationally, despite softer European and US inflation data and an OPEC+ meeting, the New York stock market rallied, with significant gains in the final half hour of trading. However, US bond yields increased, with the US 10-year note yield rising to 4.33%. According to ANZ, this suggests that the markets might be overly optimistic, expecting rates to remain high.

In company news, Premier Investments’ shares increased by 3.6% after projecting higher than expected first-half earnings. SRR Mining’s stock rose by 0.6% following its deal to sell a gold and silver project in Peru. Coles shares dropped by 1.2% after the ACCC approved its plan to buy milk facilities from Saputo. Pilbara Minerals, heavily shorted, saw its shares decrease by 0.4% after AusSuper acquired a 5% stake. Finally, Core Lithium’s stock fell by 3.6% after a downgrade by Citi analysts.