Closing Bell

What's Affecting Markets Today

Iron Ore Surges on China Real Estate Support Hopes

Iron ore prices reached a seven-month high, spurred by reports of potential support for China’s real estate sector, particularly the troubled developer Country Garden. Despite Ping An Insurance’s denial of plans to buy Country Garden, iron ore futures in Singapore rose to $US124.40 a tonne. The Chinese government’s involvement to prevent a property sector contagion and Goldman Sachs’ revised iron ore price forecasts contribute to the optimistic market sentiment.

Oil Demand Concerns Drive Prices Down

Oil prices fell over 2% due to shifting focus from supply shortages to weakening demand. Factors such as reduced refining margins in China, high fuel stockpiles, and stagnant air travel are contributing to the demand concerns. Central banks’ insistence on high-interest rates could worsen the demand outlook. In the US, petrol demand is projected to hit a 20-year per-capita low, while Russian oil shipments remain high and US crude inventories surge, signaling a potential oversupply.

NAB Reports Profit Growth and Dividend Increase

National Australia Bank (NAB) reported an 8.8% increase in cash profit to $7.7 billion for FY2023, with a raised final dividend of 84¢ per share. Despite this, NAB’s net interest margin fell, reflecting the mortgage competition’s impact on the banking sector, even as higher interest rates provide some financial benefits.

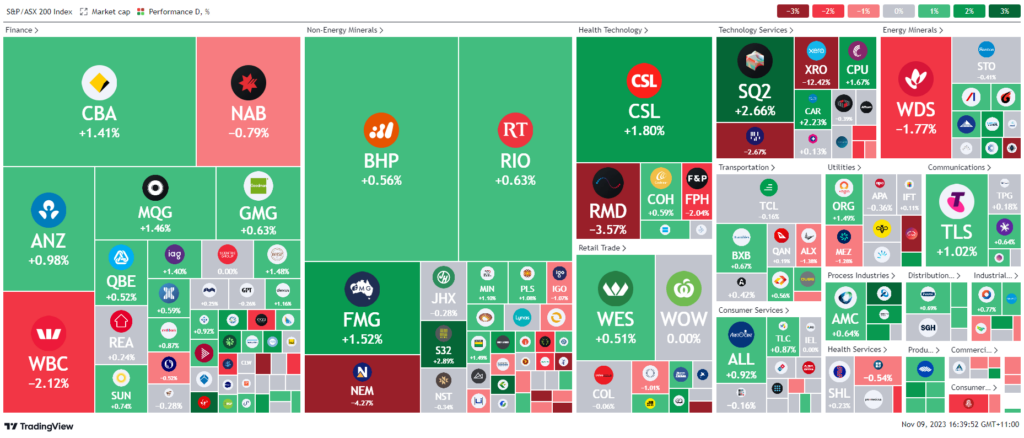

ASX Stocks

ASX 200 - 7,014.9 (0.28%)

Key Highlights:

Australian shares reached a three-week peak, with the S&P/ASX 200 up 0.3% despite a subdued Wall Street influence. Healthcare stocks surged, led by CSL’s 1.8% jump, while energy and tech sectors saw declines. Xero’s shares plummeted 12.4% after disappointing half-year results, particularly in the UK and North America. Mining stocks like Rio Tinto, BHP, and Fortescue made modest gains, even as iron ore prices slightly dipped from recent highs.

Banks showed mixed results; Westpac fell as it traded ex-dividend, while CBA and ANZ saw gains. NAB’s shares dropped after announcing a $7.7 billion cash profit and increased dividends but also signaled a challenging environment ahead. Challenger’s shares rose after expanding its partnership with Apollo Global Management, and Orica’s shares leaped following a significant profit increase and higher dividends.

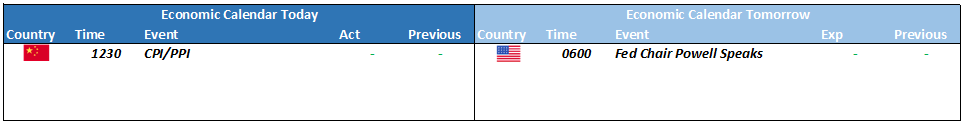

The Australian dollar remained subdued following the RBA’s latest rate hike, with bond yields dropping on speculation of an end to rate increases. Money markets are uncertain, with mixed predictions for future rate movements. Chinese inflation data indicated a slight decline, stirring expectations for potential rate cuts.