Closing Bell

What's Affecting Markets Today

RBA lifts cash rate 0.25pc to 4.35pc; $A drops

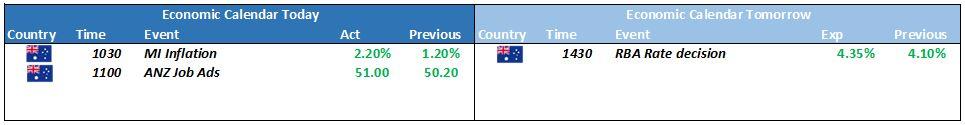

The Reserve Bank of Australia (RBA) has increased the cash rate by 0.25 percentage points to 4.35%, leading to a drop in the Australian dollar to US64.62¢. This move reflects the RBA’s cautious stance on future rate hikes amid persistent inflation. Despite inflation peaking, it remains stubbornly high, particularly in the services sector. The RBA aims for inflation to hit around 3.5% by the end of 2024, with a gradual rise in unemployment expected. This rate hike, the first since July, comes after significant price increases and robust retail sales. The RBA will reassess its position at the next policy meeting in December and will release comprehensive economic projections soon.

Cost-of-living relief Labor’s top priority: Chalmers

Treasurer Jim Chalmers emphasizes the government’s commitment to combating inflation and providing cost-of-living relief. Despite a slight moderation in inflation and economic slowdown, the persistence of inflationary pressures remains a concern. The government’s focus is on delivering immediate relief to households, improving the fiscal situation, and addressing housing and skills shortages. Chalmers acknowledges the public’s desire for a quicker reduction in inflation and assures that the government’s strategies are aligned with easing the inflation burden.

Australian dollar slips after cautious RBA

Following the RBA’s expected rate hike to 4.35%, the Australian dollar fell, reflecting the central bank’s cautious approach to further monetary tightening. The RBA’s statement introduced uncertainty with the inclusion of “whether,” suggesting that future rate increases will be data-dependent. This subtle shift in language indicates a softer tightening bias than in previous communications. The bond market responded, with Australian three-year bond futures rising as traders scaled back expectations for additional rate hikes.

ASX Stocks

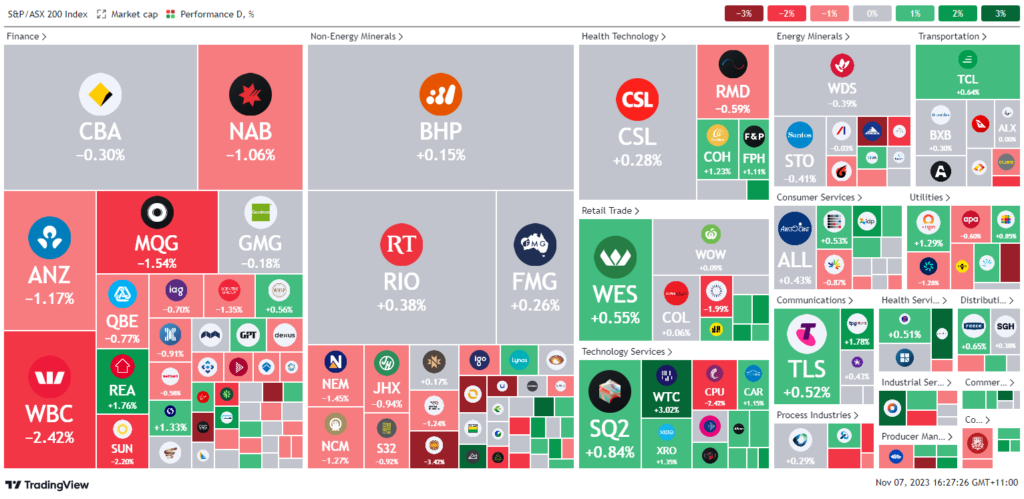

ASX 200 - 6,977.1 (-0.29%)

Key Highlights:

Ahead of the Reserve Bank of Australia’s (RBA) meeting, the Australian stock market saw a decline, with the S&P/ASX 200 index dropping 0.4% to 6969.7, influenced by losses in the financial and real estate sectors. Major banks contributed to the downturn, with Westpac leading the fall at 2.8%. The RBA’s anticipated decision to raise the cash rate target by a quarter point to 4.35% is the center of attention.

In contrast, Wall Street ended on a mixed note, with slight gains across its major indices, as investors ponder the sustainability of the recent rally initiated by the US Federal Reserve’s decision to pause interest rate hikes. Morgan Stanley’s Mike Wilson expressed skepticism, suggesting the current market upturn could be a temporary bear market rally, given the backdrop of declining earnings and economic indicators.

In corporate news, Origin Energy saw a 1.5% increase after a recommendation for shareholders to approve a $US10.5 billion acquisition offer by a Brookfield-led consortium. Meanwhile, GQG Partners experienced a 2.8% drop after reporting a $US1.9 billion decrease in funds under management for October, signaling a slight downturn from the previous month.

Leader

HLS-Healius Ltd (+6.76%)

RSG-Resolute Mining Ltd (+5.26%)

APM-APM Human Services Ltd (+4.70%)

SDR-Siteminder Ltd (+4.60%)

WBT-Weebit Nano Ltd (+4.27%)

Laggards

CHN-Chalice Mining Ltd (-4.71%)

VSL-Vulcan Steel Ltd (-4.47%)

A4N-Alpha Hpa Ltd (-4.32%)

AKE-Allkem Ltd (-3.89%)

LTR-Liontown Resources Ltd (-3.80%)