Closing Bell

What's Affecting Markets Today

Infrastructure Spending Cuts Proposed to Combat Inflation

Australian Treasurer Jim Chalmers has acknowledged the necessity to reduce infrastructure spending to alleviate economic overheating and tackle inflation. This comes as the Reserve Bank of Australia (RBA) is expected to raise interest rates. A federal review showed a $33 billion overrun in infrastructure projects, with plans to cut some spending to be announced by year’s end. The IMF has indicated that excessive spending is pushing the economy past its full capacity, necessitating further rate hikes by the RBA. Chalmers emphasized the need for tough decisions to address these overruns and inflation challenges. A deputy to RBA governor Michele Bullock is also to be appointed soon, with the next rate rise anticipated to be under her leadership.

Albanese Urges China for Fair Trade Practices

Prime Minister Anthony Albanese has called on China to engage in fair trade, suggesting that this would benefit the region and China itself. Despite China’s sanctions on Australian exports, Australia’s trade has hit a record high. Speaking at the China International Import Expo, Albanese stressed the importance of a rules-based trade system and the role of the World Trade Organisation in ensuring fair play and addressing trade issues. He expressed optimism that Beijing’s sanctions would eventually be lifted, enhancing trade relations.

Saudi Arabia and Russia Maintain Oil Supply Cuts Amidst Middle East Tensions

Saudi Arabia and Russia have confirmed their commitment to oil supply cuts until year-end, despite Middle East tensions affecting global markets. OPEC+ has reduced supply by over 1 million barrels per day, with Saudi Arabia cutting 1 million barrels of its daily production and Russia reducing exports by 300,000 barrels. The decision aims to stabilize markets, though it may be reassessed based on the evolving geopolitical landscape. High oil prices continue to be a concern for global inflation and economic stability, with the Saudis needing higher prices for ambitious projects and Russia requiring funds for its military actions in Ukraine.

ASX Stocks

ASX 200 -6,997.4 (+0.28%)

Key Highlights:

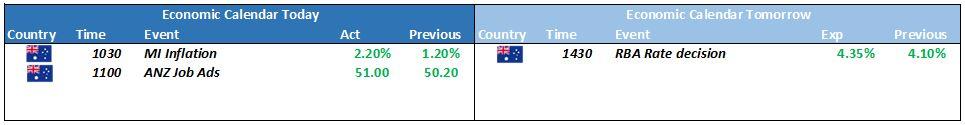

The S&P/ASX 200 nudged above the 7000-point mark for the first time in over two weeks, closing up 0.3% at 6999, as markets anticipate the Reserve Bank’s rate decision. Healthcare led the gains, with CSL’s 1.8% rise, while energy stocks lagged. Gold miners like Northern Star, Evolution Mining, and De Grey Mining saw significant rallies. The Australian dollar remained strong against a weakening US dollar.

In the US, optimism grew as job data suggested the Federal Reserve might stop rate hikes, impacting bond yields and the US dollar. Conversely, Australian bond markets expect an RBA rate hike, while US traders see only a 16% chance of a Fed rate increase in January, with a cut expected by June.

Westpac’s shares climbed 3.4% after a profit surge and buyback announcement. Goodman Group’s shares dipped despite a positive earnings forecast. Weebit Nano initially jumped on its first revenue report but then fell back. Block Inc dropped after a recent surge, while Whispir skyrocketed 60% due to a takeover bid. Talga Group shares fell after announcing a share offer to fund its anode project, and IRESS surged 7.5% following an upgrade by JPMorgan.