Closing Bell

What's Affecting Markets Today

Oil falls as OPEC+ meeting delay dims hopes for more output cuts

Oil prices fell as the delayed OPEC+ meeting caused uncertainty about tightening supplies. US crude stockpiles increased significantly, adding pressure on prices. Despite concerns, the market is hopeful that the delay, mainly due to disagreements with African members, will not lead to a drastic deviation from expected outcomes. Overall, oil markets remain volatile, with supply concerns and the upcoming US holiday influencing trading.

AI stocks proving their resilience, even Nvidia

Capital Economics’ Thomas Mathews suggests AI-linked equities could rise further, despite high tech stock price/earnings ratios. He believes that compared to the dotcom bubble, tech valuations are not excessively high. Wedbush Securities’ Dan Ives also sees AI as a key tech sector driver, citing robust results from companies like Nvidia and Microsoft. Investor enthusiasm for AI’s potential impact on productivity and technological advancement could continue to boost AI stocks.

China’s troubled shadow bank warns of insolvency

Zhongzhi Enterprise Group, a major Chinese shadow bank, has warned of severe insolvency, with debts more than double its assets. This development signals deepening troubles in China’s $3 trillion trust sector. The company’s assets significantly fall short of covering its debts in the short term, highlighting the risks in China’s financial system amidst a housing crisis and slow economic growth. Zhongzhi’s financial distress reflects broader challenges in managing high-yield investment products in the country’s volatile economic landscape.

ASX Stocks

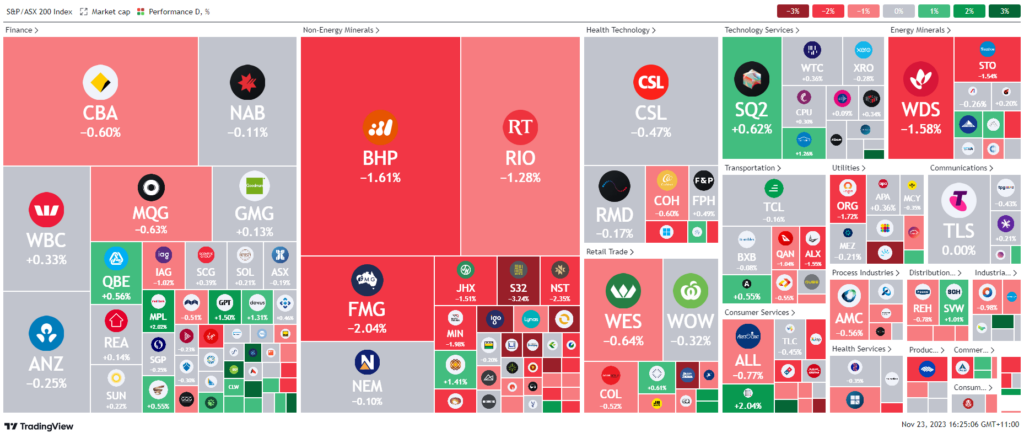

ASX 200 - 7,029.2 (-0.63%)

Key Highlights:

The Australian sharemarket experienced a decline, largely driven by losses in commodity stocks. The S&P/ASX 200 fell by 0.6%, influenced by a drop in crude oil and iron ore prices. The discord within OPEC led to a delay in their meeting, impacting oil prices, and consequently, energy stocks like Woodside and Santos saw significant declines. Additionally, the materials sector suffered due to a decrease in iron ore prices, affecting major players like BHP Group, Fortescue Metals, and Rio Tinto. Despite the downturn in commodities, the US market showed slight gains, with the S&P 500, Dow Jones, and Nasdaq all experiencing modest increases. In corporate news, Origin Energy’s shares fell after postponing their acquisition vote, while TPG Telecom modestly slipped following a spectrum band purchase. Furniture retailer Nick Scali saw a significant drop after its CEO sold a large shareholding. AMP Financial, however, emerged as the top performer on the ASX 200, rising 5.9% after announcing a lower-than-expected payout to departing financial planners.

Leader

ERA-Energy Resources of Australia Ltd (+6.25%)

AMP-AMP Ltd (+5.88%)

HLS-Healius Ltd (+5.31%)

MGH-Maas Group Holdings Ltd (+5.13%)

TUA-Tuas Ltd (+4.80%)

Laggards

NCK-Nick Scali Ltd (-6.71%)

NIC-Nickel Industries Ltd (-5.20%)

SGR-The Star Entertainment Group Ltd (-4.76%)

ADT-Adriatic Metals Plc (-4.48%)

WGX-Westgold Resources Ltd (-4.31%)