Closing Bell

What's Affecting Markets Today

Oil Market Stabilizes Ahead of OPEC+ Meeting

Oil prices have stabilized after recent fluctuations, with Brent crude hovering below $US81 a barrel and West Texas Intermediate near $US76. The market’s focus is now on the upcoming OPEC+ meeting, where decisions on supply that could affect the market into 2024 will be made. Despite recent declines in oil prices due to fading war-risk premiums from the Israel-Hamas conflict and concerns over robust supplies, speculation suggests that OPEC+ might extend supply curbs. US inventories have been increasing, leading to hedge funds reducing their bullish bets on oil.

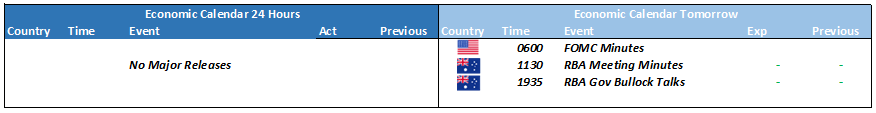

RBA’s Busy Week with Speeches and Monetary Policy Minutes

The Reserve Bank of Australia (RBA) has a packed schedule this week, featuring several key events. Michele Bullock will participate in a panel at the ASIC Annual Forum and speak at the ABE Annual Dinner. Carl Schwartz is also set to speak at the Australian Securitisation Forum’s Conference. Furthermore, the RBA will release the minutes of its November 2023 Monetary Policy Meeting. The market will closely watch these events for insights into the RBA’s future policy direction, especially considering the recent softening in its tightening bias.

China Holds Benchmark Lending Rates Steady

China has kept its benchmark lending rates unchanged, with the one-year and five-year loan prime rates remaining at 3.45% and 4.2%, respectively. This decision aligned with market expectations and did not significantly impact regional indexes. The stability in China’s lending rates comes as the country continues to navigate its economic challenges, maintaining a steady approach in its monetary policy.

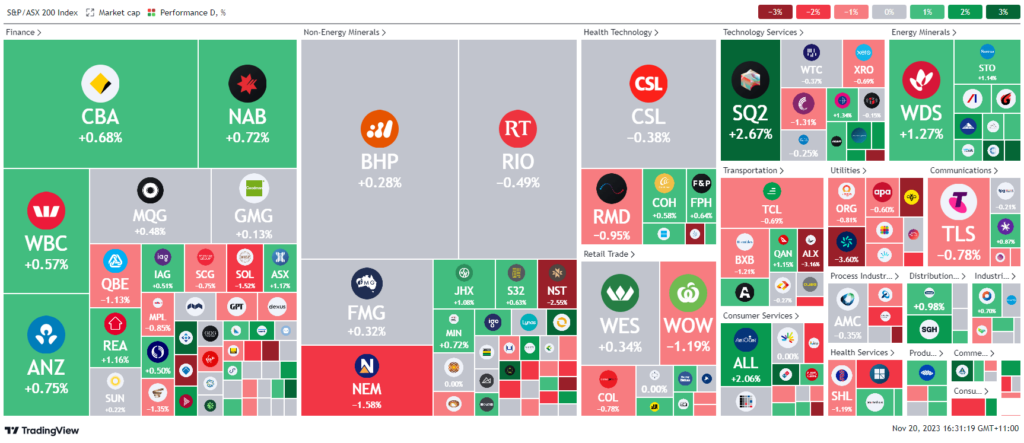

ASX Stocks

ASX 200 - 7,061.9 (0.18%)

Key Highlights:

The ASX was modestly uplifted in its final trading hours, primarily driven by gains in the energy sector, following a late-week surge in oil prices. The S&P/ASX 200 increased by 0.2% to 7063, paralleled by a similar rise in the All Ordinaries. The energy sector outperformed other sectors, echoing the uptrend in US energy giants like ExxonMobil, Chevron, and ConocoPhillips. Australian oil and gas majors Woodside and Santos contributed to this surge, with increases of 1% and 1.2%, respectively. Brent crude remained steady after a significant Friday jump, trading around $US80.66 a barrel.

This market movement aligns with JPMorgan’s expectations of OPEC extending output cuts in their upcoming meeting. The US stock market also closed higher, indicative of an ‘epic risk rally’ as described by Bank of America strategist Michael Hartnett, noting a massive $US23.5 billion inflow into equities.

Key stock movements included Karoon Energy’s rebound by 5.1% after a capital raise, Accent Group’s 5.6% drop amidst retail performance concerns, a 1.8% rise in the Australian Securities Exchange, and continued investor interest in Paladin Energy. Brambles saw a 1.8% decline even as it appointed Xavier Garijo to head its Americas’ pallet business.

Leader

CRN-Coronado Global Resources Inc (+3.86%)

AKE-Allkem Ltd (+3.22%)

SMR-Stanmore Resources Ltd (+3.16%)

PDN-Paladin Energy Ltd (+3.09%)

HMC-HMC Capital Ltd (+3.04%)

Laggards

MCY-Mercury NZ Ltd (-5.71%)

SGR-The Star Entertainment Group Ltd (-3.13%)

RMS-Ramelius Resources Ltd (-2.86%)

BFL-BSP Financial Group Ltd (-2.83%)

360-LIFE360 Inc (-2.82%)