Closing Bell

What's Affecting Markets Today

Australian Dollar Rises Post-Fed Decision

The Australian dollar surged to a three-week high of US64.10¢, influenced by the Federal Reserve’s decision to maintain existing interest rates. The market interpreted Fed Chairman Jerome Powell’s remarks as an indication of peaked interest rates, enhancing the appeal of risk assets. Despite Powell not discussing rate cuts, investors perceived a balanced policy view, casting doubts on further rate hikes.

Bitcoin Soars to a 17-Month Peak

Bitcoin has escalated to a 17-month high, reaching $US35,000, spurred by intense activity in the derivatives market. The cryptocurrency experienced a 28% rally last month, fueled by anticipations of the US Securities and Exchange Commission possibly approving cryptocurrency-focused exchange-traded funds, marking the most significant monthly increase since January.

Optimistic Forecast for Iron Ore Prices

Citi predicts a potential rise in iron ore prices, reaching $US130 a tonne by year’s end, contingent on China amplifying its policy stimulus. This week, iron ore prices soared to a five-week high due to expectations of increased demand from China, coupled with significant producers like Vale SA expressing optimism regarding price uptrends due to China’s supportive stance on infrastructure activities.

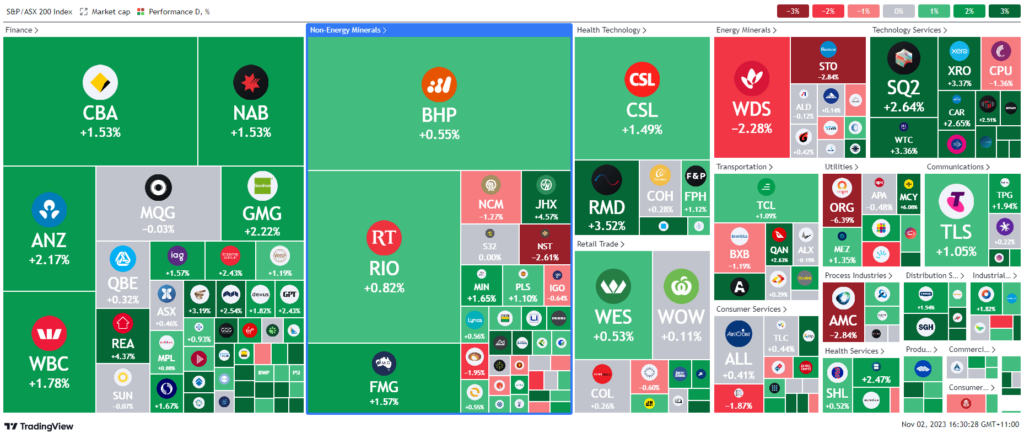

ASX Stocks

ASX 200 - 6,896.4 (0.85%)

Key Highlights:

The ASX experienced a rally, with sectors sensitive to interest rates showing significant gains following the Federal Reserve’s decision to maintain existing rates, causing traders to speculate that US interest rates may have peaked. Tech stocks led the surge, followed by real estate and financial sectors, with the S&P/ASX 200 climbing 1.1%, crossing the 6900 points threshold. However, utilities struggled, pulled down by Origin Energy’s 6.4% drop after a rejected takeover offer. Despite the Fed Chairman, Jerome Powell, not ruling out future rate hikes, the market remains skeptical of further tightening in this cycle. Notable movements included Pacific Current and Alpha HPA shares soaring, while CSR faced a decline due to increased cost pressures in its aluminum business. Janus Henderson also saw a rise in shares ahead of its planned ASX de-listing in December.