Closing Bell

What's Affecting Markets Today

ANZ Warns of Potential RBNZ Rate Hikes

ANZ has revised its forecast for the Reserve Bank of New Zealand (RBNZ), pushing the expected start of rate cuts to 2025 and cautioning that interest rate hikes could resume. The RBNZ is anticipated to maintain the cash rate at 5.5% at its next meeting. ANZ New Zealand’s chief economist, Sharon Zollner, highlights that while hiking is not in their central forecast, it remains a significant risk, especially with inflation still high. Financial markets, however, expect a rate decrease as the next move. ANZ predicts subsequent rate cuts after 2025, bringing the cash rate to 4.75%, contrasting with bond traders who see a 60% chance of a cut as early as May 2024.

Oil Prices Hit Four-Month Low Amid Economic Worries

Oil prices plummeted to a four-month low, dropping around 5%, due to concerns over global demand following weak economic reports from the US and Asia. Brent futures fell by 4.6% and WTI by 4.9%, reaching their lowest levels since early July. The decline was influenced by rising unemployment claims in the US and predictions of reduced oil refinery activity in China. Despite OPEC and IEA forecasting supply tightness, recent US data showed abundant inventories. However, Chinese economic activity showed signs of recovery in October.

Gold Prices Surge on Fed Rate Pause Expectations

Gold prices increased by 1% to $US1980.49 per ounce, driven by expectations that the Federal Reserve may halt its rate-hiking cycle, positioning gold for a 2.3% weekly gain. The precious metal, sensitive to interest rates, benefited from signs of slowing inflation and growing bets that the Fed will keep rates unchanged in December, with potential easing in early 2024. Gold’s rise towards $US2000 per ounce reflects investors’ reassessment of the US economic strength.

ASX Stocks

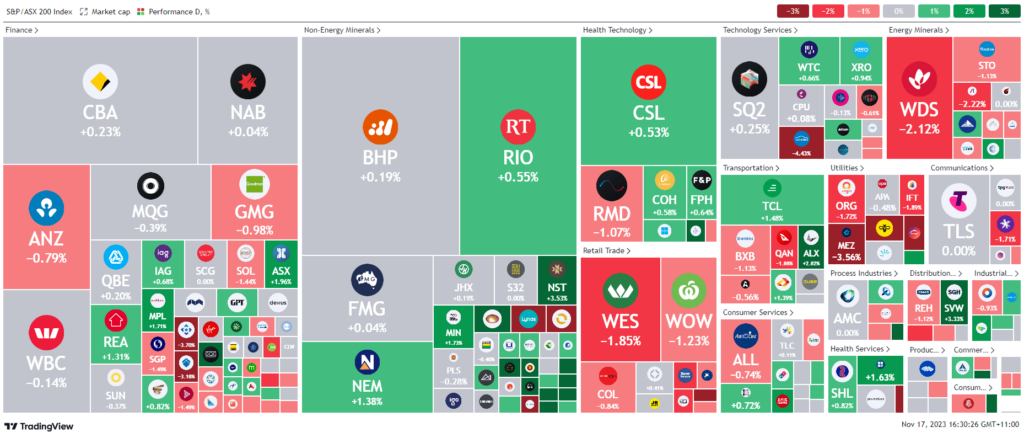

ASX 200 - 7,049.4 (-0.13%)

Key Highlights:

The ASX had a flat session today, paralleling a quiet Wall Street, with energy stocks suffering notably after a more than 4% drop in oil prices. Both the S&P/ASX 200 and the All Ordinaries remained unchanged mid-day, yet the index is poised to end the week positively, potentially marking the best month since January with a 4% gain.

Energy was the hardest hit sector, declining 1.4%, while real estate also saw a downturn. Conversely, the mining sector led the gains, buoyed by rising gold prices, with significant gains for Rio Tinto, BHP, and Fortescue.

Banking stocks showed mixed results, with CBA slightly up, but Westpac, NAB, and ANZ experiencing declines. Qantas fell by 1.5%, whereas GrainCorp saw a nearly 6% increase, making it one of the top performers.

Woodside, New Hope, and Santos were among the notable decliners in the energy sector.

In stock movements, Nuix slumped 2.5% ahead of its federal court hearing on disclosure rule breaches. Steadfast Group dropped 1.9% following a large institutional placement. Telix shares saw a 3.4% leap after bullish comments from IMF Investors, and NexGen surged 6.2% following positive remarks at the Sohn Conference. AVZ is currently in a trading halt due to a dispute over a Congo lithium mine.

Leader

GQG-GQG Partners Inc (+7.25%)

DYL-Deep Yellow Ltd (+5.51%)

A2M-The a2 Milk Company Ltd (+4.58%)

TLX-TELIX Pharmaceuticals Ltd (+4.55%)

WAF-West African Resources Ltd (+4.38%)

Laggards

AX1-Accent Group Ltd (-8.77%)

IMU-Imugene Ltd (-8.25%)

MCY-Mercury NZ Ltd (-4.84%)

CEN-Contact Energy Ltd (-4.50%)

CAR-CAR Group Ltd (-4.46%)