Closing Bell

What's Affecting Markets Today

Employment Rises in Australia, Jobless Rate at 3.7%

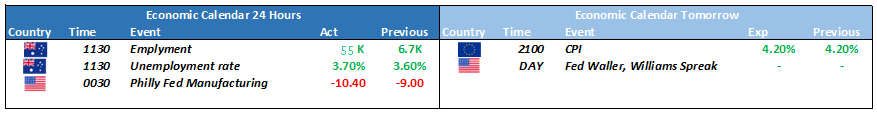

Australia saw the creation of 55,000 new jobs in October, leading to a slight increase in the unemployment rate to 3.7%. The Australian dollar remained steady, and the share market showed little change following the labour force report. This data is significant for the Reserve Bank of Australia (RBA), which aims to relax the job market to control inflation within its 2-3% target. The RBA, having recently raised the cash rate to 4.35%, has adjusted its unemployment forecast to 3.8% by December. The upcoming ABS consumer inflation report will be a key indicator for future economic assessments.

GrainCorp Announces Share Buyback and Special Dividend

GrainCorp, amidst challenges posed by El Niño weather conditions, has announced a $50 million share buyback and a special dividend, signaling confidence in its resilience. The company is exploring acquisitions and expanding into Western Australia to increase its oilseed crushing capacity, aiming to strengthen its position in agri-energy. GrainCorp’s shares rose by 5.3% after the announcement. The company is also planning a significant expansion in oilseed crushing capacity, targeting Western Australia as a strategic location for growth.

Oil Prices Decline Amid Surging US Crude Inventories

Oil prices dropped after a US government report revealed increasing crude inventories, and comments from a Federal Reserve official suggested ongoing high interest rates. The US oil stockpiles saw a significant rise, and West Texas Intermediate crude prices fell by 2%. Despite this increase, there was a notable drawdown in US product inventories, indicating rising demand for gasoline and other fuels. This mixed market sentiment follows contrasting assessments from the International Energy Agency, which predicted a less tight global oil market, and OPEC’s more optimistic outlook on production growth and market fundamentals.

ASX Stocks

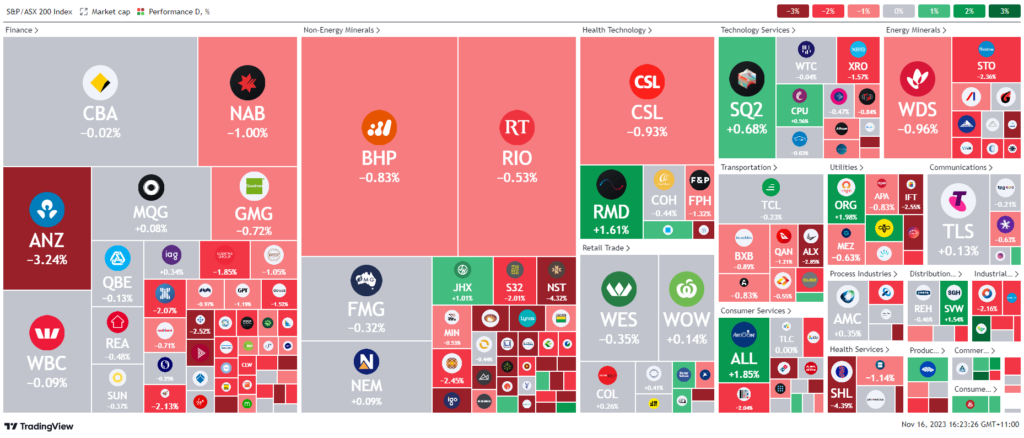

ASX 200 - 7,055.8 (-0.71%)

Key Highlights:

The ASX edged lower despite Wall Street’s rally, closing down 0.6% at 7060.3, affected by the unexpected Australian labor force report and losses in energy and financial sectors. Energy stocks particularly suffered, with Santos, Woodside, and Beach Energy seeing significant declines, mirroring the drop in oil prices due to rising US crude inventories.

The labor force report indicated the creation of 55,000 new jobs in October, slightly raising the unemployment rate to 3.7%. The Australian dollar remained stable post-report release.

On Wall Street, the S&P 500’s rise reflected investor speculation about the end of the Federal Reserve’s tightening cycle. US retail sales data showed resilience entering the holiday season, while producer prices saw an unexpected decline.

In the bond market, the 10-year Treasury yield increased, and traders reconsidered their positions following a recent bond rally.

Key stock movements included AMP plunging 15.6% after downgrading margin expectations, making it the worst performer on the ASX 200. A2 Milk rose 1.2% despite challenges in China’s infant formula market. GrainCorp gained 3.4% after announcing special and final dividends, while Sonic Healthcare fell 4.1% upon acquiring Pathology Watch. AACo increased 2.7% despite reporting a first-half net loss.

Leader

CMW-Cromwell Property Group (+4.94%)

TUA-Tuas Ltd (+4.57%)

CUV-Clinuvel Pharmaceuticals Ltd (+4.22%)

A4N-Alpha Hpa Ltd (+3.51%)

AAC-Australian Agricultural Co. Ltd (+3.42%)

Laggards

AMP-AMP Ltd (-15.03%)

DYL-Deep Yellow Ltd (-8.02%)

360-LIFE360 Inc (-5.97%)

AWC-Alumina Ltd (-5.84%)

PRN-Perenti Ltd (-5.74%)