Closing Bell

What's Affecting Markets Today

Fed Chairman Signals Possible Rate Hikes

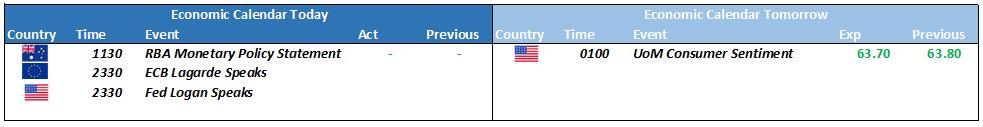

Jerome Powell, U.S. Federal Reserve Chairman, has indicated that the Fed may consider further rate hikes if necessary, countering market expectations of interest rate cuts next year. During a conference in Washington, Powell emphasized readiness to tighten policy if it becomes “appropriate,” a stance that unsettled Wall Street and spiked bond yields. This marks a shift from earlier sentiments that suggested the Fed might not raise rates further, highlighting the central bank’s commitment to carefully navigate economic data risks and manage inflation towards their 2% target. National Australia Bank’s Tapas Strickland noted Powell’s stern, arguably hawkish tone, contrasting with other Fed speakers from the past week.

RBA’s Inflation Outlook Leads to Rate Decision

The Reserve Bank of Australia has slightly raised its long-term inflation forecasts, following a period of rate-setting deliberation. Despite considering another halt in rate increases due to consistent inflation expectations with targets, the bank decided to increase the cash rate from 4.1% to 4.35%. This decision came after acknowledging the risk of sustained high inflation and a series of economic challenges including moderated wage growth, a cooling economy, and softer labor market conditions. The central bank’s quarterly statement postulated less progress on inflation reduction than previously anticipated.

Oil Prices on the Decline Amid Demand Worries

Oil prices are set for a third consecutive weekly fall, influenced by demand concerns and diminishing war-risk premium, with Saudi Arabia attributing the drop to speculative trading. West Texas Intermediate (WTI) crude remained around $76 a barrel, experiencing a 6% decrease over the week. Saudi Energy Minister’s comments echoed previous criticisms of speculators, preceding output cuts. WTI has seen about a 15% drop over three weeks due to negative demand indicators from major economies and the contained Israel-Hamas conflict not disrupting Middle Eastern oil flows. Hedge fund manager Pierre Andurand also highlighted unexpected supply surges from the U.S. and Iran as contributing factors to the decline.

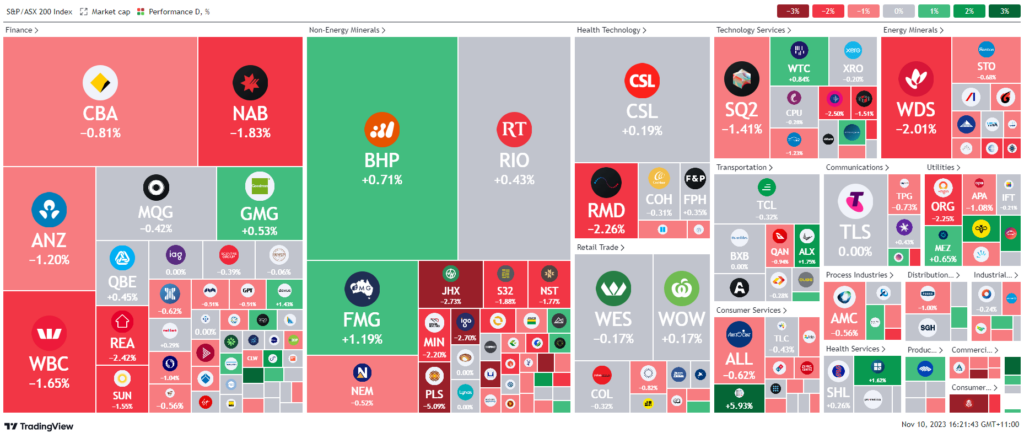

ASX Stocks

ASX 200 - 6,978.9 (-0.51%)

Key Highlights:

The Australian Securities Exchange (ASX 200) experienced a downturn near 2 pm, erasing its weekly gains due to comments from US Federal Reserve Chairman Jerome Powell that hinted at a potential policy tightening. The index fell by 0.5%, with most sectors declining and banks notably affected. The Reserve Bank of Australia (RBA) also revised its inflation expectations upwards following a recent cash rate increase to 4.35%.

Powell’s remarks at the International Monetary Conference in Washington caused a sell-off in US equity markets, with the S&P 500, Dow Jones, and Nasdaq all closing lower. This was perceived as a “tone-correction” rather than a policy change by Evercore ISI’s Krishna Guha, who believes the Fed doesn’t aim to hike rates again unless necessary.

The markets were also impacted by a weak bond sale, with the US 10-year note yield spiking. In corporate news, News Corp’s shares fell after reporting a drop in net income and earnings per share. REA Group also declined despite a revenue increase. Southern Cross Media shares dropped after a merger approach, while Imugene saw a significant rise following the commencement of a drug trial. Additionally, Magnis Energy Technologies’ shares plummeted after a default notice from a lender to its US operation. Several companies, including KMD Brands and Lithium Power International, are scheduled for annual meetings, and Janus Henderson is trading ex-dividend.

Leader

NEU-Neuren Pharmaceuticals Ltd (+10.50%)

LNW-Light & Wonder Inc (+5.93%)

RED-RED 5 Ltd (+3.91%)

BRG-Breville Group Ltd (+3.58%)

HCW-Healthco REIT (+2.92%)

Laggards

APM-APM Human Services (-20.05%)

CHN-Chalice Mining Ltd (-7.65%)

SYA-Sayona Mining Ltd (-6.90%)

CXO-Core Lithium Ltd (-5.77%)

WC8-Wildcat Resources Ltd (-5.26%)