Closing Bell

What's Affecting Markets Today

Oil’s Uncertain Path Amid Economic Concerns

Oil is on track for its largest weekly decline since March, with West Texas Intermediate nearing $US83 a barrel. This drop is attributed to concerns over global economic health affecting demand. Despite a surge in Q3 due to supply restrictions by OPEC+ leaders, the rally has reversed recently due to macroeconomic worries. However, both Russia and Saudi Arabia remain committed to output cuts for the year’s remainder.

US Bond Yields and Federal Reserve’s Stance

The US 10-year yield has slightly decreased after reaching a 16-year peak this week. Mary Daly, President of the Federal Reserve Bank of San Francisco, suggests that even if rates remain unchanged, the policy will become more restrictive as inflation drops. She also hinted that the recent spike in bond yields could be a reason for the Fed to maintain its current rate.

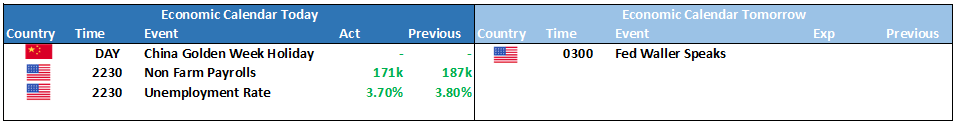

Anticipation Surrounding US Non-Farm Payrolls

The upcoming US non-farm payrolls data is in focus, with predictions indicating the addition of 170,000 jobs in September. Despite some market stability, there’s significant concern about the prolonged impact of sustained high interest rates. Barclays analysts believe that unless there’s a significant downturn in equities, global bonds will continue to decline.

ASX Stocks

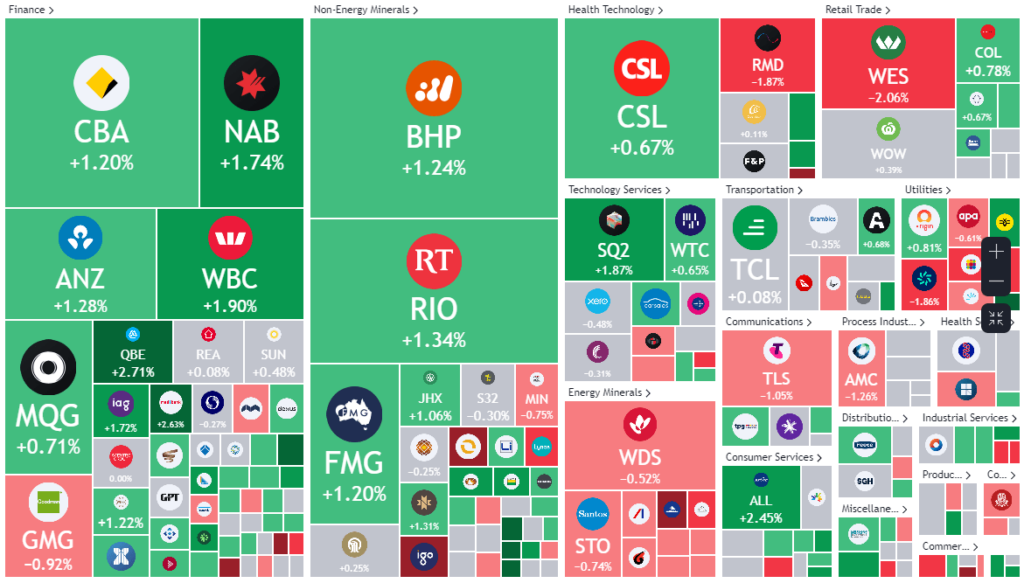

ASX 200 - 6958.8 +33.3 (0.48%)

Key Highlights:

The S&P/ASX 200 index saw a 0.6% rise, driven by significant rallies in financial and mining stocks. Major banks, including Commonwealth Bank and Westpac, saw gains, with BHP Group also rallying by 1.2%. The recent surge in long-term bond yields has impacted the local share market, influencing equity valuations throughout the year. The Australian dollar also experienced a slight increase. However, the energy sector struggled as crude oil prices continued to drop. Notably, Magellan Financial Group shares plummeted by 18.4% after reporting a significant decrease in funds under management for September.

Leader

RED-RED 5 Ltd (+11.32%)

RMS-Ramelius Resources Ltd (+5.35%)

DEG-De Grey Mining Ltd (+3.70%)

GNE-Genesis Energy Ltd (+3.49%)

LFG-Liberty Financial Group (+3.21%)

Laggards

MFG-Magellan Financial Group Ltd (-18.39%)

AZS-AZURE Minerals Ltd (-7.61%)

PXA-Pexa Group Ltd (-7.43%)

ERA-Energy Resources of Australia Ltd (-5.88%)

CXO-Core Lithium Ltd (-5.41%)