Closing Bell

What's Affecting Markets Today

Global Bond Yields and US Jobs Data

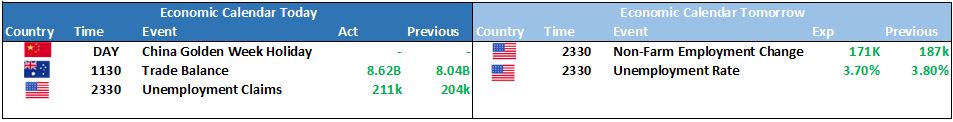

Bond yields worldwide pulled back from their multi-year peaks after US jobs data came in softer than anticipated, alleviating concerns about persistent high interest rates to curb inflation. The upcoming US labour report is keenly awaited, predicting 170,000 new jobs for September. Concurrently, the Australian dollar rebounded from its 11-month low, and Australian bond yields also saw a decline.

Yen’s Speculated Intervention

The Japanese yen surged to 148.43 per $US, sparking speculations of Japanese authorities intervening to bolster the currency. Earlier this week, the yen had dipped to 147.37 per $US but rebounded past the 150 per $US mark, a significant threshold for potential intervention. Masato Kanda, Japan’s top currency official, remained tight-lipped about any intervention.

Australia’s Trade Surplus Growth

Australia’s trade balance surplus for August soared to $9.64 billion, surpassing July’s $7.32 billion and outdoing economists’ predictions. The surge was attributed to a 4% increase in exports, particularly gold, while imports dipped by 0.4%.

ASX Stocks

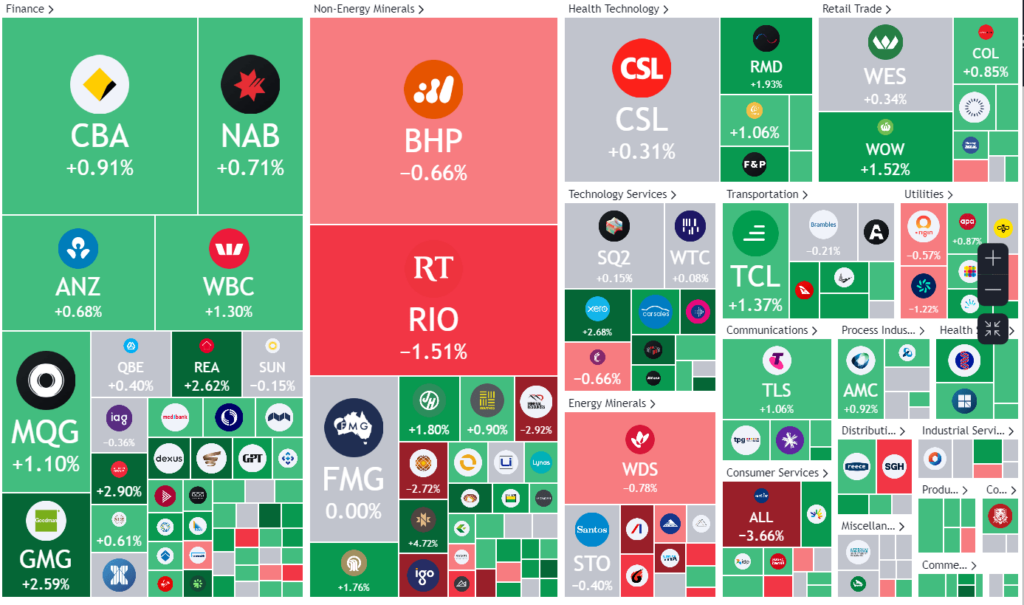

ASX 200 - 6925.5 +35.3 (0.51%)

Key Highlights:

The S&P/ASX 200 experienced a 0.5% rise, recovering from its lowest point in nearly a year. Despite a brutal oil price drop, energy stocks managed to reduce their losses. Wall Street’s Nasdaq also saw a 1.4% hike after ADP data indicated a rise in US private payrolls. The market’s volatility stems from the realization that central banks might delay rate adjustments. On the ASX 200, energy stocks faced a decline, but real estate and major banks saw gains. Gold miners benefited from rising gold prices, while lithium stocks showed mixed results. Qantas shares also rose, rebounding from a one-year low.

Leader

STX-Strike Energy Ltd (+11.54%)

APM-APM Human Services International Ltd (+4.95%)

NST-Northern Star Resources Ltd (+4.72%)

CUV-Clinuvel Pharmaceuticals Ltd (+4.53%)

GMD-Genesis Minerals Ltd (+3.76%)

Laggards

CXO-Core Lithium Ltd (-6.33%)

MAD-Mader Group Ltd (-6.09%)

IGO-IGO Ltd (-3.98%)

LRS-Latin Resources Ltd (-3.77%)

ALL-Aristocrat Leisure Ltd (-3.66%)