Closing Bell

What's Affecting Markets Today

China’s Manufacturing Sector Faces Contraction

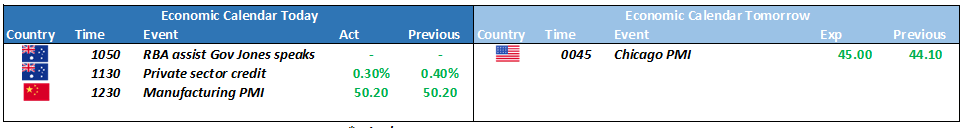

China’s manufacturing activity contracted in October, indicating a fragile economic recovery. The official manufacturing purchasing managers index dropped to 49.5 from 50.2 in September, falling below the growth indicator level of 50. Despite the influence of an eight-day public holiday, the data reveals that market demand continues to be weak, with both manufacturing and non-manufacturing new orders indices indicating a contraction in demand.

Australian 10-year Bond Futures Soar

Australian 10-year bond futures have reached a significant yield of 5%, the highest since 2011, trading at the price of $95. This surge followed a rise in Japan’s 10-year government bond yield, which reached its peak since May 2013, reflecting global anticipation and adjustments ahead of the Bank of Japan’s upcoming policy decision.

RBA Likely to Maintain Higher Rates

UBS predicts that the Reserve Bank of Australia (RBA) will maintain higher interest rates for an extended period, postponing the forecasted first-rate cut to November 2024. Following the RBA Governor’s openness to further rate increases subject to inflation outlook, UBS anticipates a quarter-percentage-point hike in the upcoming RBA meeting, elevating the official cash rate to 4.35%.

ASX Stocks

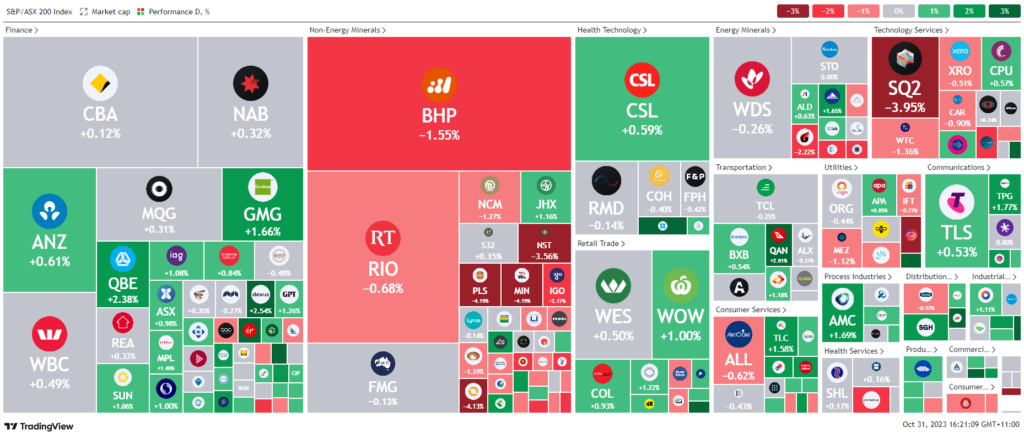

ASX 200 - 6,771.6 (-0.02%)

Key Highlights:

The Australian stock market experienced a dip due to significant losses in mining stocks, despite earlier gains. The S&P/ASX 200 index remained nearly flat, with the materials sector suffering the most, influenced by a decline in shares from major companies like BHP, Fortescue, and Rio Tinto due to weaker iron ore prices. In contrast, Wall Street saw a surge, with tech stocks like Microsoft, Amazon, and Apple making notable gains, while Tesla faced a decline. The Reserve Bank of Australia is expected to maintain higher interest rates, as per UBS, delaying its first rate cut forecast to November 2024. In the market, Inghams emerged as a top performer, expecting substantial earnings, while Treasury Wine Estates paused trading amid a significant acquisition move. Other companies like Origin Energy and Liontown Resources experienced slight shifts in their stock values due to various market influences.

Leader

ING – Inghams Group Ltd: (+7.92%)

360 – LIFE360 Inc: (+5.54%)

JLG – Johns LYNG Group Ltd: (+4.30%)

HDN – Homeco Daily Needs REIT: (+3.88%)

CTT – Cettire Ltd: (+3.63%)

Laggards

WC8 – Wildcat Resources Ltd: (-18.61%)

SYA – Sayona Mining Ltd: (-8.64%)

WBT – Weebit Nano Ltd: (-8.45%)

CEN – Contact Energy Ltd: (-5.81%)

DTL – Data#3 Ltd: (-4.69%)