Closing Bell

What's Affecting Markets Today

Surprise Jump in September Retail Sales Puts Pressure on RBA

Australian retail sales in September exceeded expectations, rising by 0.9%, a result that could bolster the Reserve Bank of Australia’s (RBA) confidence in the economy’s resilience against further interest rate hikes. The unexpected retail boost, driven by department stores and household goods, contrasts with the prevailing downbeat consumer sentiment, making a stronger case for the RBA to consider raising interest rates to 4.35% in its upcoming November 7 meeting.

ASX Gold Miners Rally as Safe Havens Sought

ASX gold miners experienced a rally as the conflict in Gaza intensified, driving investors towards the safety of gold holdings. Gold prices hovered near $US2000 an ounce, marking gold as one of the significant beneficiaries since the onset of the Hamas-Israel conflict, with a rise of over 9%. The ongoing conflict and upcoming central bank decisions globally will likely continue to influence gold’s performance in the market.

Oil Dips as Israeli Offensive Starts Cautiously

Oil prices have declined despite the escalation in Gaza, as a more cautious approach by Israel eased market concerns of a broader conflict that could disrupt the global oil supply. The cautious approach has led to a decrease in Brent and West Texas Intermediate prices, reflecting the market’s response to the unfolding geopolitical events and their potential impact on oil supplies from a region that accounts for a significant portion of global oil production.

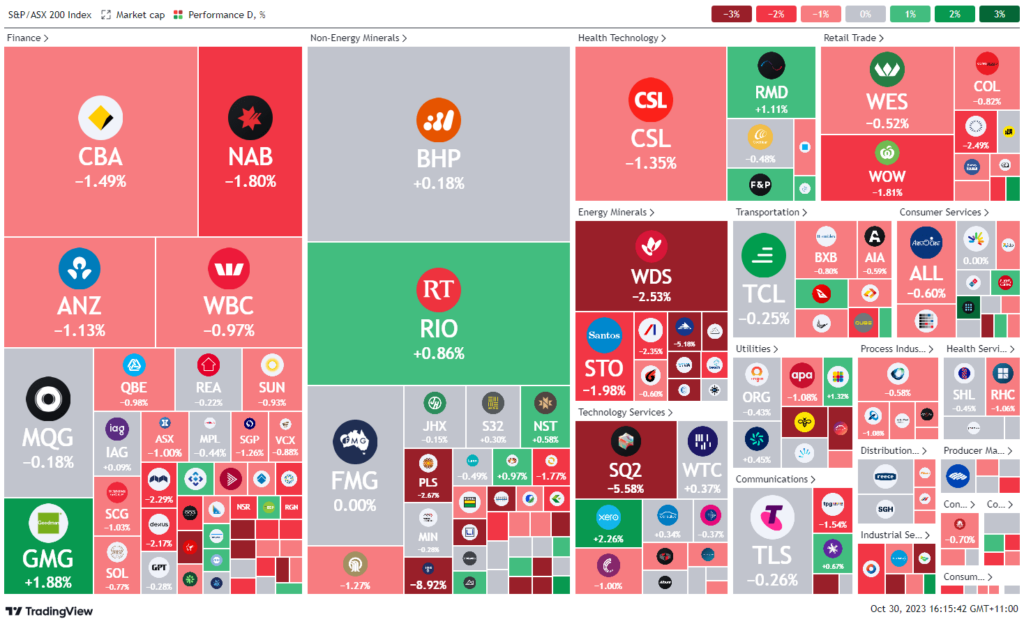

ASX Stocks

ASX 200 - 6,772.9 (-0.79%)

Key Highlights:

The ASX has dropped to a 12-month low, influenced by escalating conflicts between Israel and Hamas, causing investors to shy away from equities. Major banks and energy stocks have seen a decline, while gold miners and tech stocks experienced a rally due to investors seeking safe havens and following gains on the Nasdaq 100. The ongoing conflict in Gaza has spooked markets globally, causing fluctuations in oil prices and affecting Wall Street, with significant indices like the Dow and the S&P 500 experiencing losses. Despite these uncertainties, US markets have seen a majority of companies in the S&P 500 beating earnings expectations, indicating a potential annual earnings growth of 4.3%. In company-specific movements, various stocks such as IGO and Star Entertainment Group have experienced declines due to individual business challenges and market conditions.

Leader

WC8-Wildcat Resources Ltd (+11.61%)

WGX-Westgold Resources Ltd (+7.07%)

NEM-Newmont Corporation (+3.19%)

TPW-Temple & Webster Group Ltd (+2.83%)

RSG-Resolute Mining Ltd (+2.82%)

Laggards

IGO-IGO Ltd (-8.92%)

SGR-The Star Entertainment Group Ltd (-8.82%)

CEN-Contact Energy Ltd (-6.88%)

SQ2-Block Inc (-5.55%)

WHC-Whitehaven Coal Ltd (-5.25%)