Closing Bell

What's Affecting Markets Today

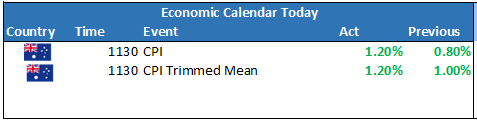

Australia’s CPI Surges Beyond Expectations

Australia’s Consumer Price Index (CPI) has risen by 1.2% in the September quarter, surpassing economists’ predictions of a 1.1% increase. Annually, the CPI grew by 5.4%, with core inflation rising by 5.2%. Surging oil prices have been identified as a significant contributor to this inflationary pressure. The Reserve Bank of Australia (RBA), in response, may consider further interest rate hikes to manage inflation and ensure economic stability.

Australian Dollar and Bond Yields Ascend Post-Inflation Report

Following a stronger-than-anticipated CPI report, the Australian dollar and government bond yields have seen a rise. The likelihood of the RBA increasing the cash rate has also surged, with bond futures indicating a 58% probability of a rate hike in November, marking a significant shift from the previous 35% estimation.

Rising Geopolitical Tensions Threaten Oil Stability

BCA Research highlights increasing geopolitical risks, particularly in the Middle East, as a potential threat to oil stability. With escalating conflicts and strategic power plays involving countries like Russia, China, and Iran, there’s a looming risk of an oil shock. The uncertainty in these regions poses a substantial risk to global oil supplies, potentially impacting the global economic outlook for 2024.

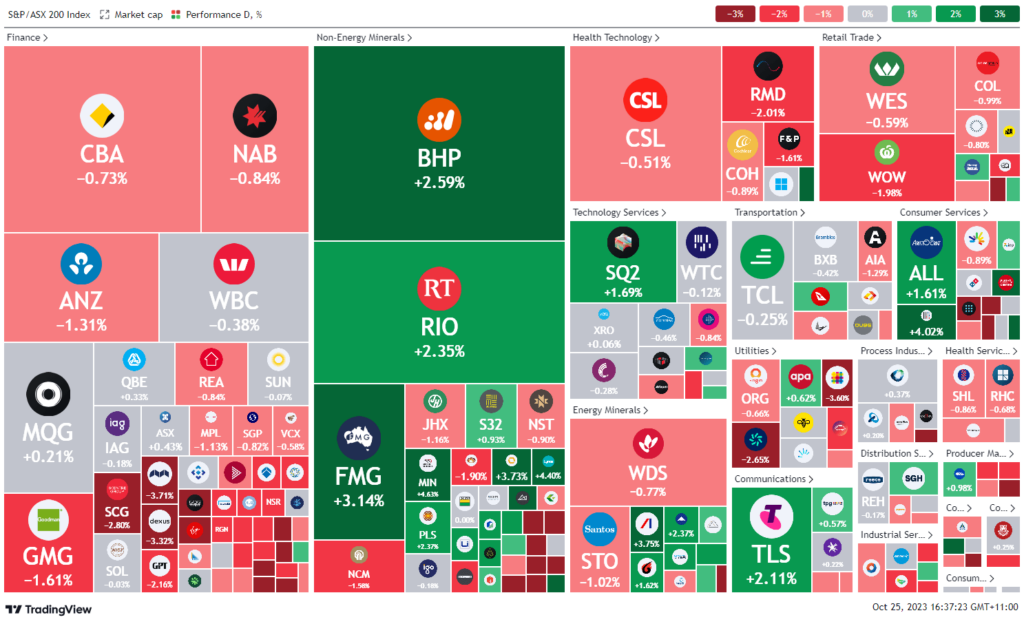

ASX Stocks

ASX 200 - 6,854.3 (-0.04%)

Key Highlights:

The ASX experienced a tumultuous trading day, influenced by a higher-than-expected September quarter CPI report, eventually regaining stability to trade flat. The S&P/ASX 200 slightly rose, despite initial dips influenced by unexpected inflation figures. Materials stocks, particularly iron ore miners like BHP, Fortescue Metals Group, and Rio Tinto, witnessed significant gains, contrasting the losses in the real estate and consumer sectors. The CPI rose by 1.2% in the September quarter, surpassing the anticipated 1.1%, reflecting an annualized increase of 5.4%. This unexpected inflation trajectory has left the Reserve Bank of Australia (RBA) in a precarious position regarding interest rate adjustments in their upcoming November 7 meeting. Following the CPI report, the Australian dollar and government bond yields experienced a slight increase. In corporate highlights, companies like Kogan and Corporate Travel Management saw stock rises due to positive quarterly reports, while others like Magellan and Dexus faced declines due to executive reshuffles and other internal adjustments.

Leader

LRS-Latin Resources Ltd (+8.00%)

TLX-TELIX Pharmaceuticals Ltd (+6.14%)

IMD-IMDEX Ltd (+5.88%)

MIN-Mineral Resources Ltd (+4.96%)

MMS-Mcmillan Shakespeare Ltd (+4.93%)

Laggards

HLS-Healius Ltd (-6.02%)

BGL-Bellevue Gold Ltd (-5.85%)

WBT-Weebit Nano Ltd (-5.83%)

RMS-Ramelius Resources Ltd (-5.49%)

CMM-Capricorn Metals Ltd (-4.79%)