Closing Bell

What's Affecting Markets Today

Bill Ackman covers his bet against US Treasuries

Billionaire investor Bill Ackman has withdrawn his short bet on US Treasuries, citing heightened global risks and a quicker-than-anticipated economic slowdown. Ackman had previously bet against 30-year Treasuries, expecting structural changes like globalization and energy transitions to drive persistent inflation and higher yields. However, the investor has now decided that the risks of maintaining this position, given the current long-term rates and global uncertainties, are too high.

Bitcoin’s Resilient Rally Defying Critics and Turmoil

Bitcoin is experiencing a remarkable resurgence, doubling its value since January and currently standing at $US34,600. Despite the tumultuous downfall of crypto mogul Sam Bankman-Fried and the subsequent crypto winter, Bitcoin has emerged robust, reaching levels not seen since April 2022. A pivotal moment fueling this rally was a US court’s approval for the nation’s first Bitcoin exchange-traded fund (ETF), a significant advancement for crypto investors. This decision allows traditional investors exposure to digital assets without direct ownership, marking a transformative moment in cryptocurrency investment avenues. The crypto asset’s revival showcases its resilience amidst global market uncertainties and regulatory challenges.

Oil rebounds as Israel yet to invade Gaza

Oil prices have slightly recovered after a significant drop, as Israel has not yet initiated a ground invasion of Gaza, preventing further escalation in the Middle East conflict. The market has seen some reduction in the war-risk premium due to the absence of immediate disruptions in the Middle East, a crucial region for global crude supply. However, oil prices remain volatile, influenced by potential actions from the U.S. regarding Iranian oil sanctions and possible disruptions in key shipping routes.

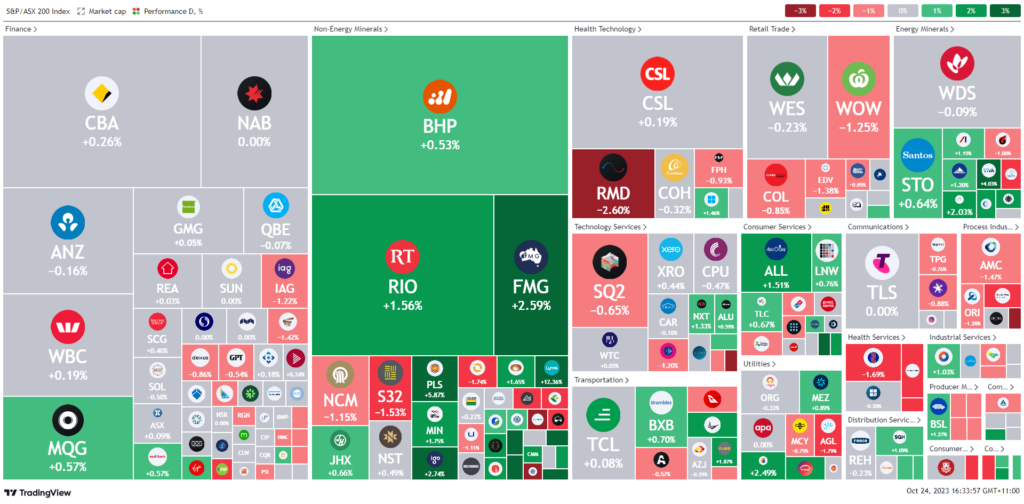

ASX Stocks

ASX 200 - 6,856.9 (0.19%)

Key Highlights:

The Australian stock market showed a flat performance, with losses in consumer and healthcare sectors neutralizing earlier gains. Despite turbulent bond market movements overnight, the S&P/ASX 200 index slightly dropped. Wall Street’s performance also mirrored a mixed outcome, influenced by rising US debt and concerns over the Middle East conflict. In the local market, consumer staples like Woolworths and Coles saw a decline, while energy stocks benefited from higher oil prices due to ongoing Middle East tensions. Zip Co experienced a surge following a positive quarterly update, and other specific stocks like Ansell and Perseus also saw notable movements due to industry developments and operational updates. Upcoming events, including speeches from Reserve Bank of Australia governor Michele Bullock and key international reports, are anticipated to influence market directions further.

Leader

LYC-Lynas Rare EARTHS Ltd (+12.36%)

MMS-Mcmillan Shakespeare Ltd (+8.96%)

SGF-SG Fleet Group Ltd (+7.86%)

SIQ-Smartgroup Corporation Ltd (+6.52%)

CXO-Core Lithium Ltd (+6.06%)

Laggards

WBT-Weebit Nano Ltd (-4.85%)

AAC-Australian Agricultural Co. (-4.53%)

EMR-Emerald Resources NL (-4.47%)

ELD-Elders Ltd (-4.33%)

ABB-Aussie Broadband Ltd (-3.94%)