Closing Bell

What's Affecting Markets Today

Gold Price Soars to Record High in AUD

Australian gold miners are thriving as the gold price in Australian dollars hits a record of $3138 an ounce. The surge benefits local gold miners like Northern Star and Resolute, who incur costs in AUD but sell gold in USD. The gold price has temporarily diverged from its traditional inverse correlation with real rates, showing signs of dislocation from traditional market expectations due to rising geopolitical risks and inflation outlook uncertainties.

US Bond Yields Surge

US bond yields have soared, with the 10-year yield reaching 4.99%, reflecting a tumultuous bond market. The sudden demand for higher compensation for holding US government debt is attributed to prolonged inflation expectations, questionable US fiscal positions, and geopolitical influences, including China’s ongoing sale of US treasuries.

Bank of Japan Intervenes in Bond Market

The Bank of Japan (BOJ) has intervened in the market as the 10-year Japanese Government Bond (JGB) yield hit a decade high, driven by surging US Treasury rates. The BOJ aims to stabilize market expectations and moderate the pace of yield gains, ensuring that market movements remain gradual and not abrupt.

ASX Stocks

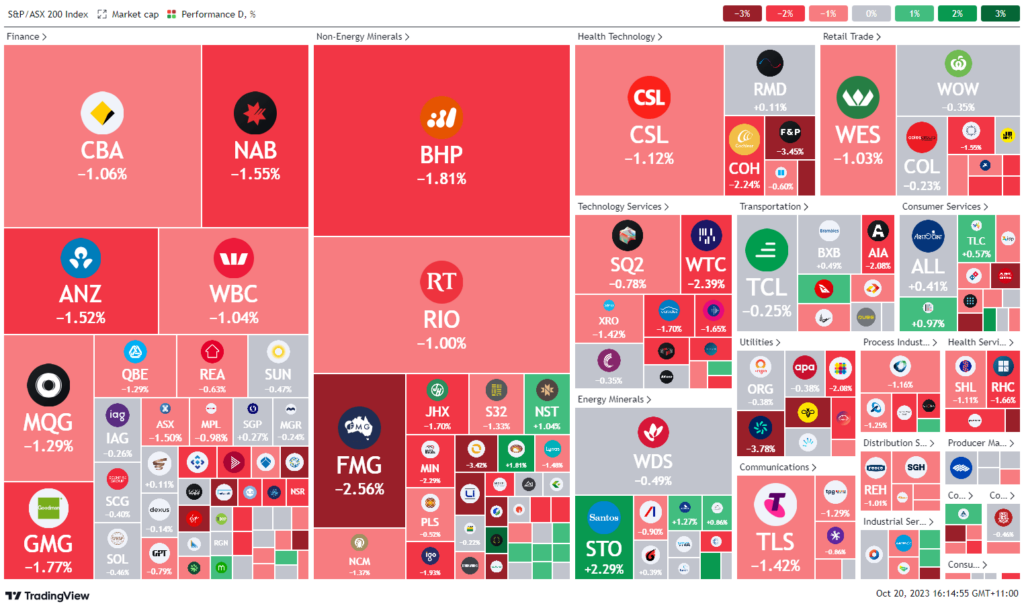

ASX 200 - 6902.7 (-1.13%)

Key Highlights:

The ASX faced a 1.1% decline, influenced by rising global tensions and uncertainties. Investors, wary of the escalating conflicts in the Middle East and Ukraine, and the surging US 10-year government bond yields, exhibited a cautious approach, leading to a broad market pullback. The energy sector saw modest gains due to a rise in Brent crude futures, amidst fears of a prolonged Israeli-Hamas conflict potentially drawing in Iran, escalating geopolitical risks. Gold miners flourished as gold prices soared, setting a record in AUD terms. Conversely, the materials sector suffered, influenced by significant capital raises and strategic moves within the industry, reflecting the market’s reactive nature to internal and geopolitical factors. The market also responded to executive movements within companies and anticipates key economic indicators and fiscal strategies from the US and Australia in the coming days.

Leader

IMD-IMDEX Ltd (+5.56%)

CCP-Credit Corp Group Ltd (+4.82%)

NCK-Nick Scali Ltd (+4.14%)

QAL-Qualitas Ltd (+3.98%)

PDN-Paladin Energy Ltd (+2.91%)

Laggards

LTR-Liontown Resources Ltd (-31.54%)

IFL-Insignia Financial Ltd (-12.61%)

A4N-Alpha Hpa Ltd (-11.22%)

AWC-Alumina Ltd (-8.15%)

TLX-TELIX Pharmaceuticals Ltd (-7.72%)