Closing Bell

What's Affecting Markets Today

Australian Unemployment Dips, RBA Under Pressure

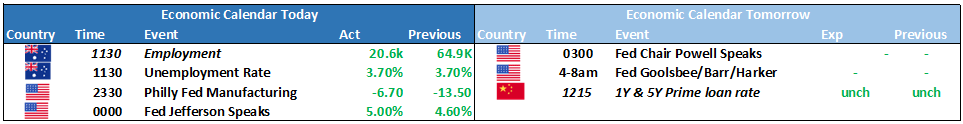

Australia’s job market showed unexpected resilience in September, with the unemployment rate falling to 3.6%. This development, coupled with a modest increase of 6,660 in new jobs, puts additional pressure on the Reserve Bank of Australia (RBA) to reconsider its monetary policy stance. The current cash rate of 4.1%, maintained since June, might be revisited by the RBA in response to the tightening labor market and evolving economic conditions.

Oil Prices Fluctuate Amid Global Uncertainties

Oil prices receded from recent highs as global markets grapple with evolving geopolitical tensions in the Middle East and policy adjustments in the United States concerning Venezuela. The U.S. decision to ease some sanctions on Venezuelan commodities could lead to a significant increase in the country’s oil output, influencing global supply dynamics. Meanwhile, the persistent uncertainties in the Middle East continue to cast shadows over global oil supply stability, contributing to market volatility.

U.S. and Australian Bond Yields Surge

Bond yields in the United States have witnessed a notable surge, with two-year yields climbing to a remarkable 17-year high. This trend is mirrored in Australia, where bond yields have ascended, reflecting market anticipations of potential adjustments in monetary policy by the Reserve Bank of Australia (RBA). The evolving bond market dynamics underscore a broader market sentiment leaning towards the expectation of tighter monetary policy in the foreseeable future.

ASX Stocks

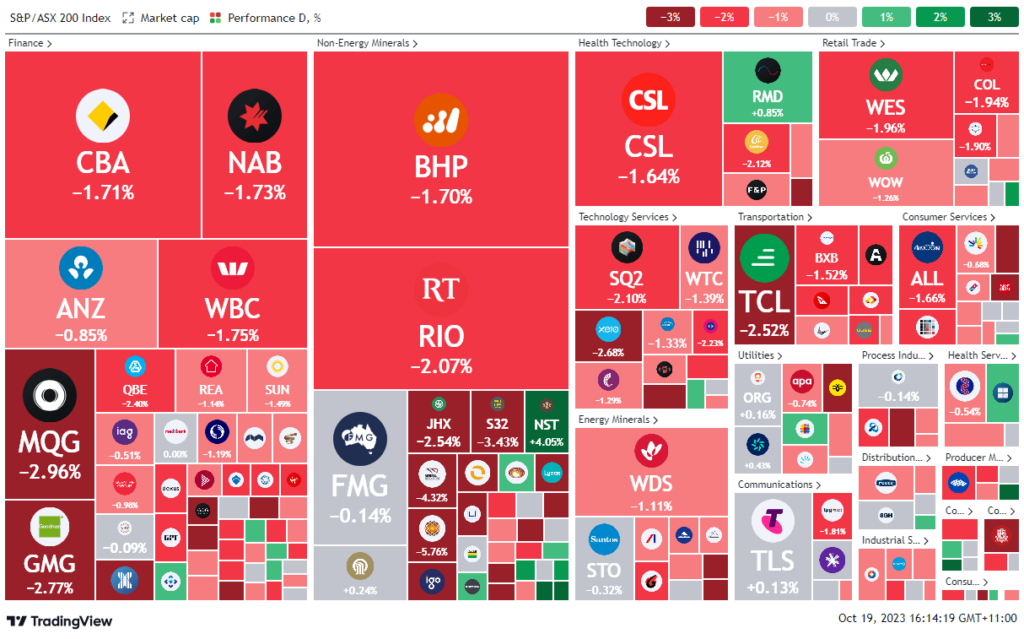

ASX 200 - 6972.7 -104.9 (-1.48%)

Key Highlights:

The ASX faced a significant downturn, dropping over 100 points, influenced by escalating Middle East tensions and unexpected domestic unemployment figures. The S&P/ASX 200 plummeted by 1.5%, with all sectors, notably materials, financials, and tech, experiencing losses. Major banks such as Commonwealth Bank, ANZ, National Australia Bank, and Westpac saw declines exceeding 1%. Despite a fall in the jobless rate to 3.6% in September, concerns linger due to a withdrawal of around 13,000 people from the labour force, rather than increased employment. Global market sentiments were also affected by geopolitical uncertainties, with the Dow Jones, S&P, and Nasdaq all experiencing losses. Specific stocks like Qantas and Telix Pharmaceuticals faced notable declines, while Weebit Nano saw a surge due to a new commercial agreement. The market’s direction seems to be influenced by a combination of international geopolitical events and domestic economic indicators, awaiting crucial CPI figures amidst global uncertainties.

Leader

DYL-Deep Yellow Ltd (+9.45%)

ARB-ARB Corporation Ltd (+4.09%)

NST-Northern Star Resources Ltd (+4.05%)

EMR-Emerald Resources NL (+3.49%)

OCL-Objective Corporation Ltd (+3.39%)

Laggards

TLX-TELIX Pharmaceuticals Ltd (-9.97%)

NWL-Netwealth Group Ltd (-7.24%)

CHN-Chalice Mining Ltd (-7.02%)

AWC-Alumina Ltd (-6.51%)

PLS-Pilbara Minerals Ltd (-5.76%)