Closing Bell

What's Affecting Markets Today

Hot US Inflation Impacts Australian Dollar

The Australian dollar experienced a significant drop after US inflation data surpassed expectations, leading to speculation that both the Federal Reserve and the Reserve Bank might continue to raise interest rates. The local currency saw its most significant daily decline since early August, nearing an 11-month low. Concurrently, bond yields surged, with US 10-year rates nearing a 16-year peak.

China’s Consumer Prices Remain Steady

In September, China’s consumer inflation rate remained unchanged, while producer prices continued their decline. This has raised concerns about the need for additional support to maintain economic growth. The stagnation in consumer prices is attributed to a high comparison base from the previous year and an abundant food supply. China’s economy faces challenges from a property crisis and reduced consumer confidence, affecting various sectors.

Australia Introduces New 31-year Bond

The Australian Office of Financial Management announced the sale of a new 31-year bond, extending its debt maturity profile. This bond, set to mature in June 2054, will be the AOFM’s longest-dated security. The AOFM’s current longest-dated bond is the 2051, trading at 4.9%.

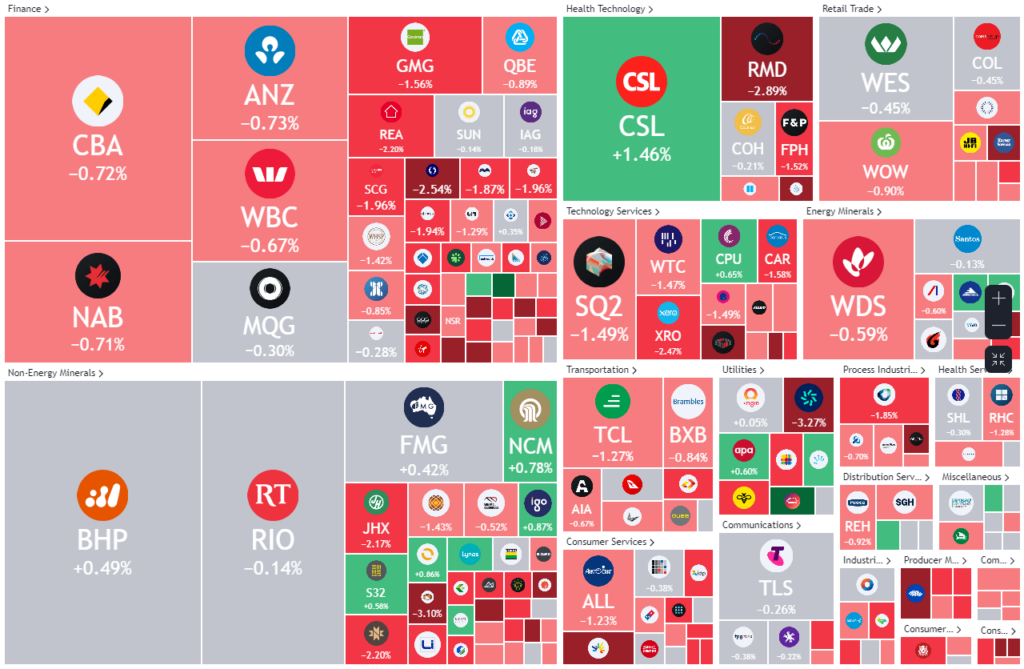

ASX Stocks

ASX 200 - 7051 -40 (-0.56%)

Key Highlights:

Australian shares followed Wall Street’s downward trend after US inflation data indicated that the Federal Reserve might not be done raising interest rates. The S&P/ASX 200 saw a decline, with rate-sensitive sectors like real estate and tech experiencing the most significant drops. In contrast, healthcare stocks, led by CSL, showed positive movement. The US sharemarket also reacted to the inflation data, with the S&P 500 declining. China’s consumer inflation remained unchanged, while producer prices continued their descent. Notable stock movements included Pact Group, ResMed, Sky Network Television, Bega Cheese, Perpetual, and Harvey Norman.

Leader

MGH-Maas Group Holdings Ltd (+3.98%)

BGA-Bega Cheese Ltd (+3.93%)

IMD-IMDEX Ltd (+3.56%)

PPT-Perpetual Ltd (+3.01%)

SIG-Sigma Healthcare Ltd (+2.99%)

Laggards

CHN-Chalice Mining Ltd (-6.52%)

CXO-Core Lithium Ltd (-6.25%)

INA-Ingenia Communities Group (-5.01%)

SYA-Sayona Mining Ltd (-4.69%)

PNV-Polynovo Ltd (-4.53%)