Closing Bell

3 Things Affecting Markets

- Taiwan Semiconductors – TSMC fell the most in more than five months after cutting its outlook

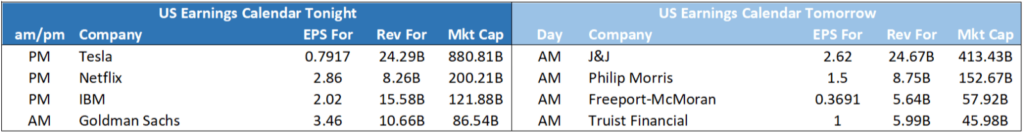

- Tech Wreck – Tech stocks have weighed down the market into next weeks slew of earnings

- Interest rates – nerves around central bank decisions as the ECB and the Fed meet next week

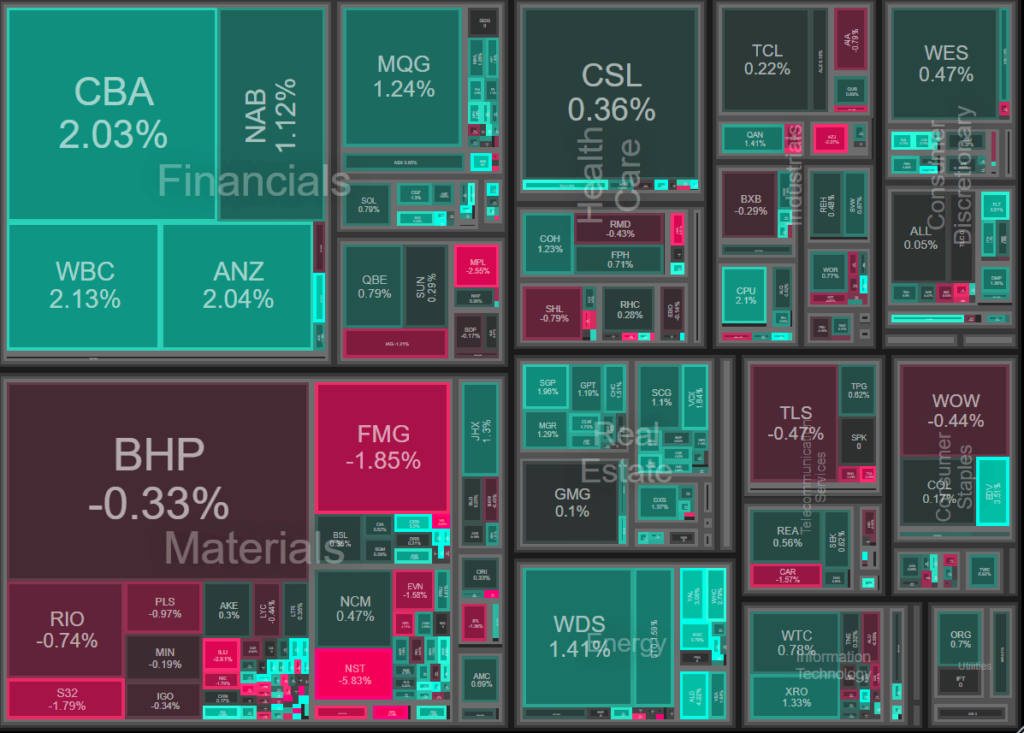

ASX Today

ASX 200 - 7313.9 (-0.15%)

The ASX remained relatively static today, demonstrating a slight downward trend as investors attempted to balance the effects of China’s additional stimulus measures against a downturn in technology stocks. This technology sector weakness followed chipmaking giant TSMC’s grim outlook for the year.

Key points:

Taiwan Semiconductors announced a postponement of production at its Arizona project until 2025. This delay highlights the difficulties of international expansion amidst an extended slump in the electronics market.

In an effort to stimulate economic activity, China’s primary economic regulator, the National Development and Reform Commission, introduced new initiatives to encourage spending in the automobile and consumer electronics sectors.

These measures gave major mining companies a slight boost. However, their growth was contained.

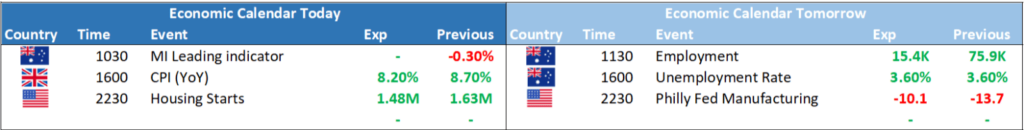

The absence of economic data at the week’s end, combined with an impending flood of economic and earnings data next week, gave investors minimal incentive to participate.

The banks saw a small rollback of this week’s gains as investors began to take profits.

Leader

No Significant News.

No Significant News.

No Significant News.

No Significant News.

No Significant News.

Laggards

No Significant News.

No Significant News.

No Significant News.

No Significant News.

No Significant News.