Closing Bell

3 Things Affecting Markets

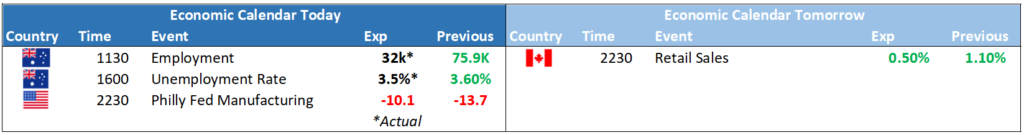

- AU Employment – Still super strong and putting increased pressure for the RBA to continue hiking

- No China Simulus – China has kept its prime one-year and five-year lending rates unchanged to dash hopes of cuts that would support economic activity.

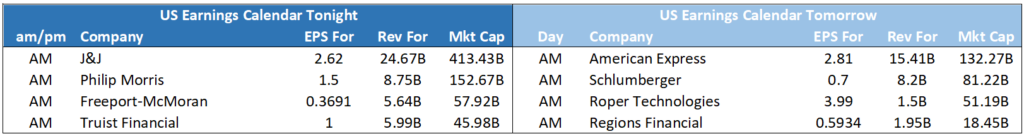

- US earnings disappointment – Tesla and Netflix fell 4% and 8% respectively in after hours trading

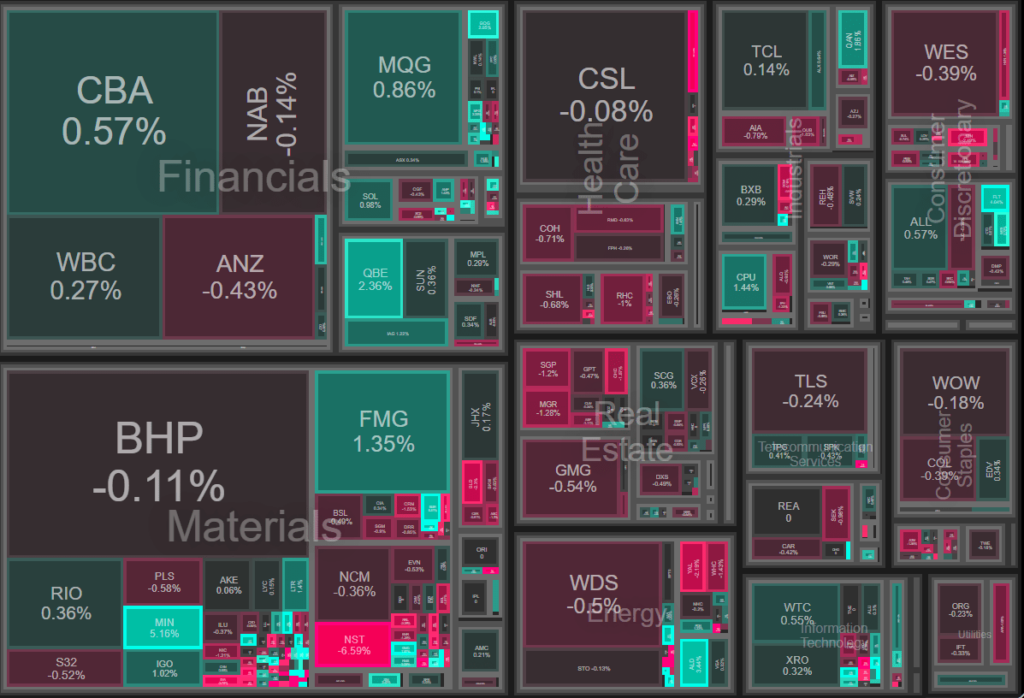

ASX Today

ASX 200 - 7325.0 (+0.02%)

Strong employment figures in Australia have overshadowed the previous optimism that rate hikes might have concluded. Employment change notably outperformed expectations, with 32.6K jobs added versus the forecasted 15.4K. Concurrently, unemployment rates fell to 3.5%, outdoing the anticipated 3.6%, and reaching the lowest in decades.

- Particularly in New South Wales, the unemployment rate is now below 3%. However, this trend does not favour wage inflation, which typically emerges as the second wave of inflation, triggered by an inevitable drop in productivity.

Investors who were anticipating a stimulus from China were left disappointed, as the window for the People’s Bank of China (PBoC) to add stimulus passed without any changes.

- This disappointment reverberated in the US market as well, where Nasdaq futures remained under pressure. Notable tech companies, Netflix and Tesla, saw a continued decline in the aftermarket session.

Given these developments, the Reserve Bank of Australia (RBA) might be considering additional rate hikes in the near future.

Leader

No Significant News.

No Significant News.

No Significant News.

No Significant News.

No Significant News.

Laggards

No Significant News.

No Significant News.

No Significant News.

No Significant News.

No Significant News.