Closing Bell

3 Things Affecting Markets

- China Property – Evergrande back in the news as the property giant booked a $119B loss

- RBA Minutes – showed the bank is willing to continue increasing if inflation persists

- US earnings – Banks earnings tonight

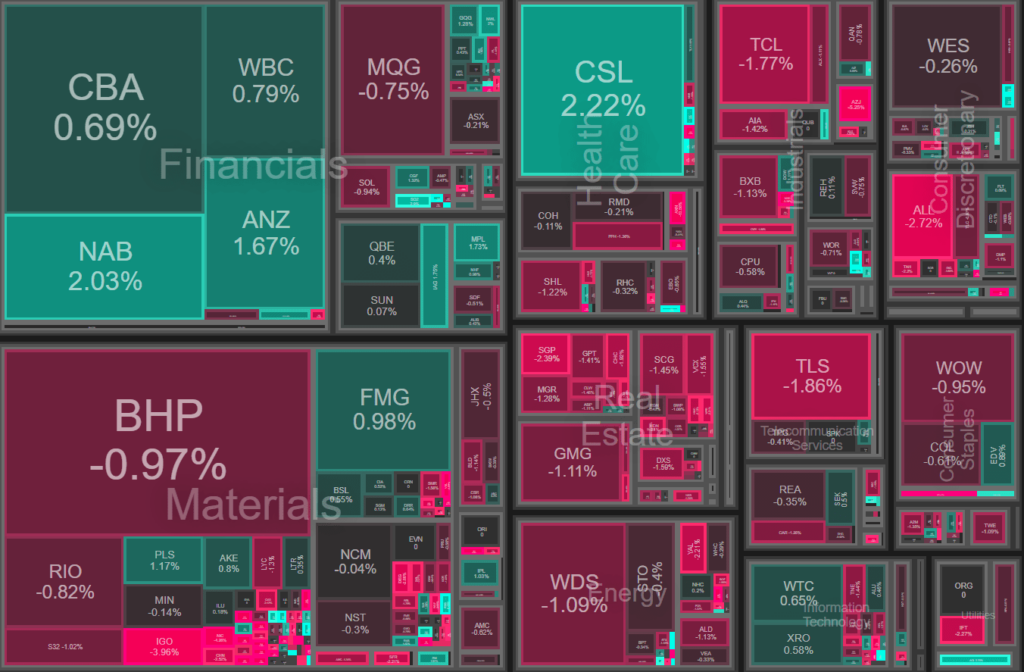

ASX Today

Today, the banks proved to be the only bright spot on the screen as the broader market faced a downturn due to ongoing concerns about the Chinese economy.

- The sentiment in the Chinese market was not aided by the property developer giant, Evergrande, which registered a staggering loss of $119 billion.

- The market has been anxiously awaiting a stimulus announcement from the People’s Bank of China (PBoC) throughout the week. However, no such announcement has yet been made, leading to a sense of nervousness among investors who had speculated based on this expectation.

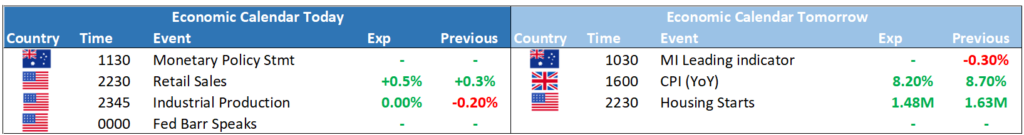

In economic news, the RBA’s latest minutes offered key insights:

Despite recent declines, inflation remains high, driven by costs like electricity and rent. This and a tight labor market might fuel price and wage increases.

Housing prices are climbing, with mortgage payments reaching a historical high in May.

Amid economic uncertainties, the Reserve Bank Board opted to leave the cash rate at 4.1%.

Future policy might need tightening to control inflation, pending a reassessment in August.

Given these factors, the RBA remains committed to interest rate hikes if inflation continues, which impacted the consumer discretionary sector.

On the corporate front:

- Ansell reported a disappointing quarterly update. The global healthcare hygiene giant continues to grapple with inventory management challenges.

- In contrast, Lithium stocks swam against the current in the materials sector. Producers such as AKE and PLS managed to achieve a small positive day.

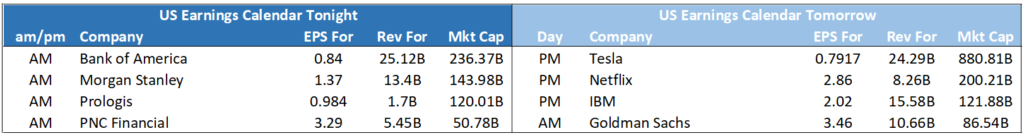

The focus now shifts to the US bank earnings to be released tonight, and the impending Tesla and Netflix results due tomorrow night.

Leader

No Significant News.

No Significant News.

No Significant News.

No Significant News.

No Significant News.

Laggards

The Syrah Resources share price has come under pressure today after the company released its quarterly update which revealed that trading conditions remain tough. According to the release, the Chinese anode market continues to be impacted by high cell and anode inventories. This has kept graphite prices low and only a fraction above it costs of production.

Gloves maker Ansell has warned a glut of unsold products following the coronavirus pandemic has now spread to surgical items, causing distributors to cut back on their orders. The oversupply is also being felt in Ansell’s division making protective gear for pharmaceutical and laboratory workers, and triggered Ansell to deliberately slow production and warn of another earnings hit.

No Significant News.

No Significant News.

No Significant News.