Closing Bell

3 Things Affecting Markets

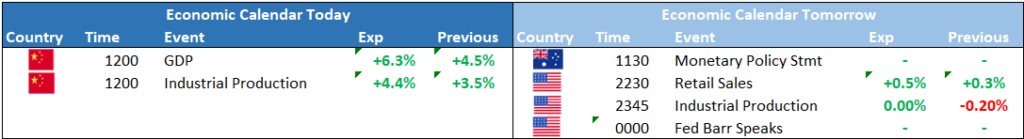

- China GDP – 6.3% versus 7.1% expected

- Bonds Yields edge higher – Investors wary that central banks may keep hiking

- US earnings – Mixed earnings results Friday give investors reason to start taking profits

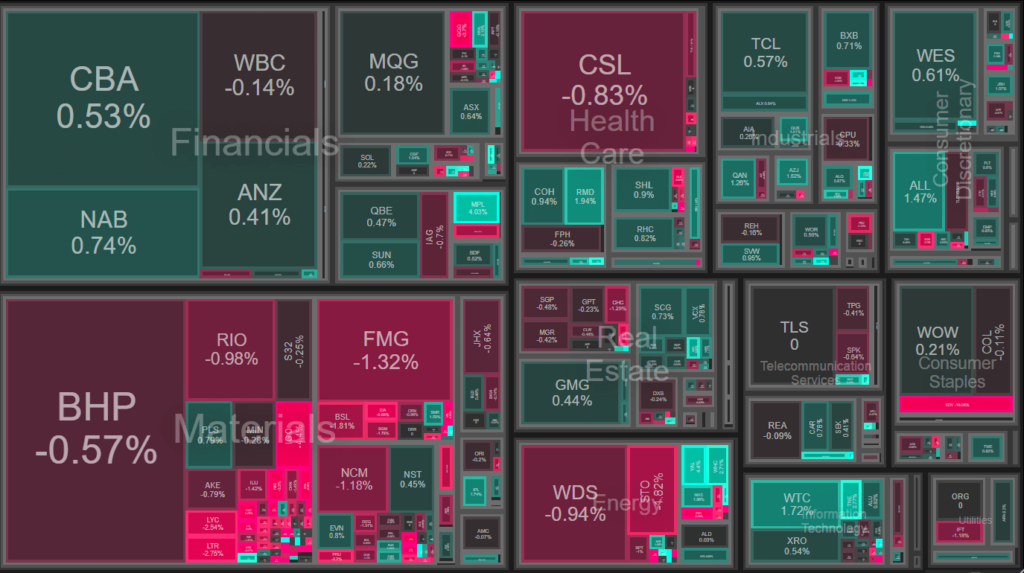

ASX Today

The ASX began the day on a mixed note, with commodities and oil acting as a drag on the market due to the slowing growth of China’s economy. Data released on Monday showed that China’s economy experienced fragile growth in the second quarter, although the annual figure appeared more robust due to base effects. The overall economic momentum is quickly faltering due to weakening domestic and foreign demand.

The National Bureau of Statistics released data showing that the Gross Domestic Product (GDP) only grew by a marginal 0.8% in the April-June period, compared to the previous quarter. This figure is significantly higher than the 0.5% increase analysts anticipated in a Reuters poll, yet considerably lower than the 2.2% expansion seen in the first quarter.

In terms of specific market movements, coal stocks received a boost from rising coal prices, with WHC and YAL stocks up by 2.7% and 4.4%, respectively.

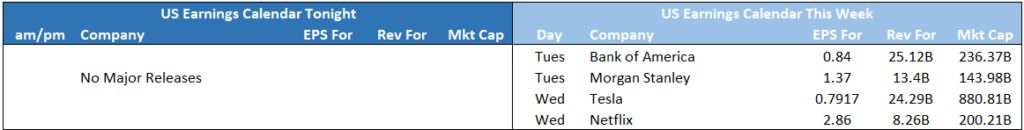

Looking forward, the market is expected to be relatively quiet tonight due to a lack of significant economic data on the agenda. However, the remainder of the banks are set to release their US earnings updates on Tuesday night, continuing the current earnings season.

Leader

No Significant News.

No Significant News.

No Significant News.

No Significant News.

No Significant News.

Laggards

Endeavour Group acknowledges the announcement made by the Victorian Government on Sunday 16th of July regarding reforms for Poker Machines in the State.

No Significant News.

No Significant News.

No Significant News.

No Significant News.