Closing Bell

3 Things Affecting Markets

- Changing of the guard at the RBA

- PBoC vows to support economy

- US Bank earnings tonight

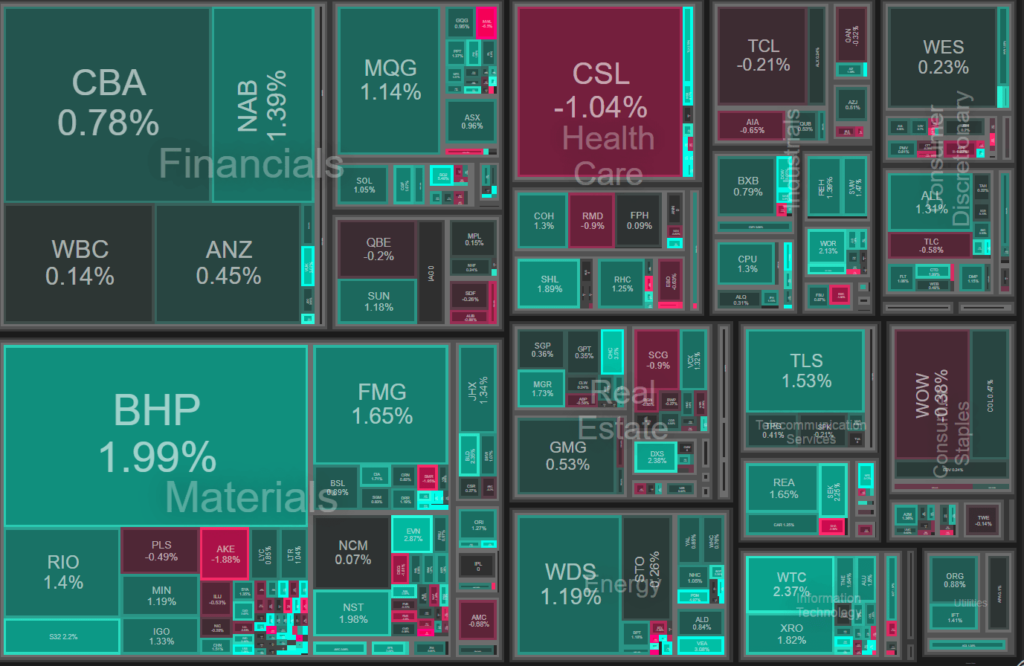

ASX Today

The ASX continued its positive back half of the week with a positive global lead, China optimism and a change in the guard helping fuel investor positivity.

There will be a change in the guard at the RBA with Michelle Bullock taking over from Philip Lowe in September along with a raft of sweeping changes like a reduction in meetings and clearer communication. Bullock is considered on the “Dovish” side, meaning the RBA will possibly be less likely to hike much further which buoyed the equity market broadly. Analysts cited Bullocks view that “just because our inflation objective has been in focus recently, it does not mean that the other part of our mandate – maintaining full employment – has become any less important. Full employment is, and has always been, one of our two main objectives”.

The People’s Bank of China has urged patience and confidence in the economy’s recovery as it pledged to use its policy tools to support growth. Zou Lan, head of the monetary policy department, specified the PBOC would use its policy tools, including the reserve requirement ratio and other instruments like the medium-term lending facility, to ensure ample liquidity in the economy.

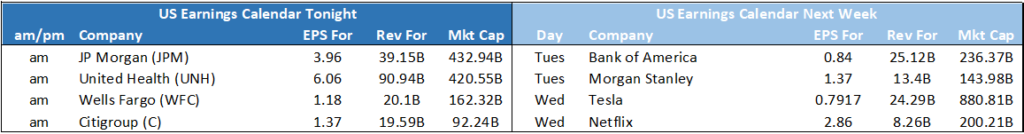

US Bank earnings kick off tonight with JP Morgan, Citi and Wells Fargo sue to deliver results. It will be interesting to see investor reaction at these elevated levels

Leader

Neuren Pharmaceuticals shares rose almost 20 per cent in early trade on Friday after the company said it had struck a new licensing agreement with a major distributor to sell its treatment for Rett syndrome overseas. Under the agreement, the Melbourne-headquartered biotech will receive a $US100 million ($150 million) upfront payment and milestone payments of up to $US427 million to expand Acadia’s exclusive distribution rights.

No Significant News.

No Significant News.

No Significant News.

No Significant News.

Laggards

No Significant News.

No Significant News.

No Significant News.

No Significant News.

No Significant News.