Closing Bell

3 Things Affecting Markets

- USD at 2-Month lows.

- US inflation cools, Bond yields retreat.

- China exports fall dramatically.

ASX Today

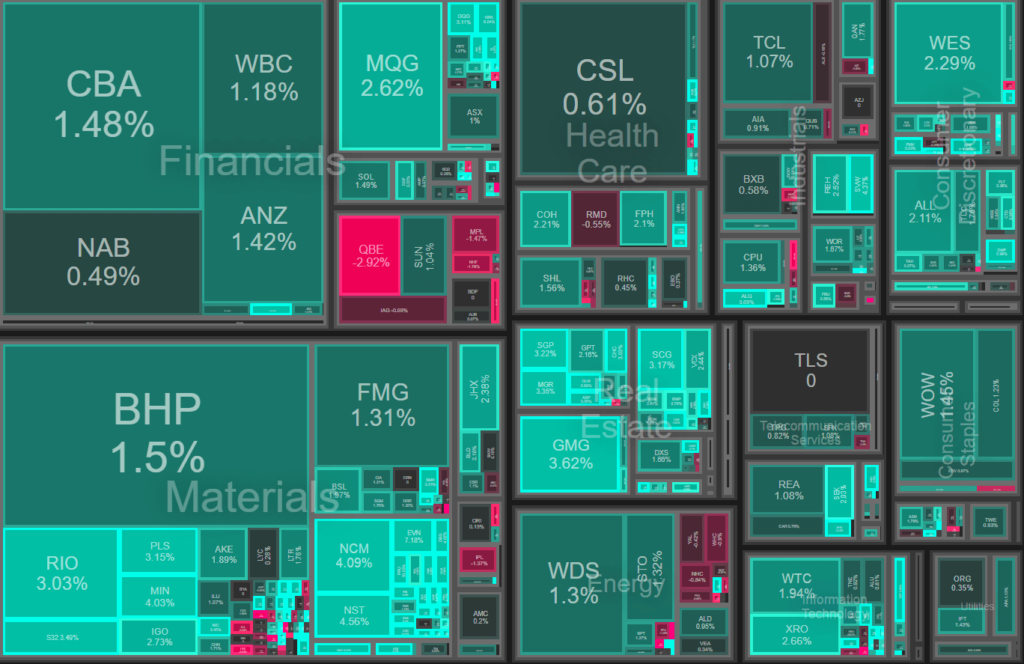

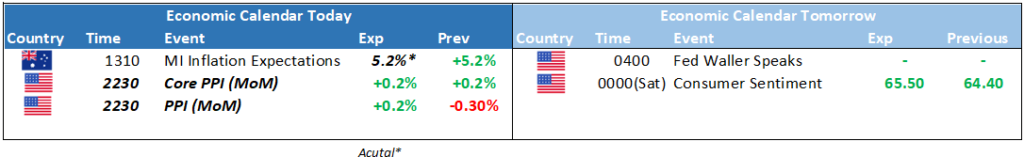

The ASX had one of its best days this year rallying over 1.6% after a positive lead from US markets as investors speculation we have reached peak rates which led to a heavy USD and strong commodity prices. Investors piled into rate sensitive gold stocks today as the US dollar hits a two-month low against a basket of other major currencies. Gold tends to rise as the US dollar and treasury yields decline, with the gold price climbing to $US1961 an ounce this afternoon. Real estate stocks are also catching a bid as investors scale back rate increase expectations. Goodman Group is up 4 per cent, with Westfield owner Scentre Group climbing 2.8 per cent. More evidence of a slowdown in China was released today as exports fell 12.4 per cent in June in US dollar terms versus the year ago period. Expectations were for exports to fall 4.1 per cent, Imports fell 6.8 per cent, versus expectations for a fall of 4.1 per cent, sparking further calls for stimulus. Tonight sees US quarterly earnings kick off with PepsiCo and Delta Airlines due to report before the US open.

Leader

No Significant News.

No Significant News.

No Significant News.

No Significant News.

No Significant News.

Laggards

No Significant News.

No Significant News.

No Significant News.

No Significant News.

No Significant News.