Closing Bell

3 Things Affecting Markets

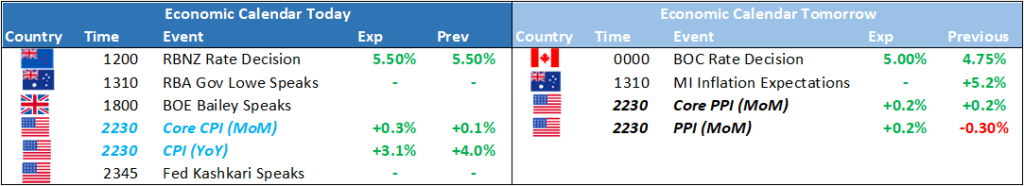

- US CPI Data tonight

- RBA Gov Lowe Spoke

- China stimulus hopes

ASX Today

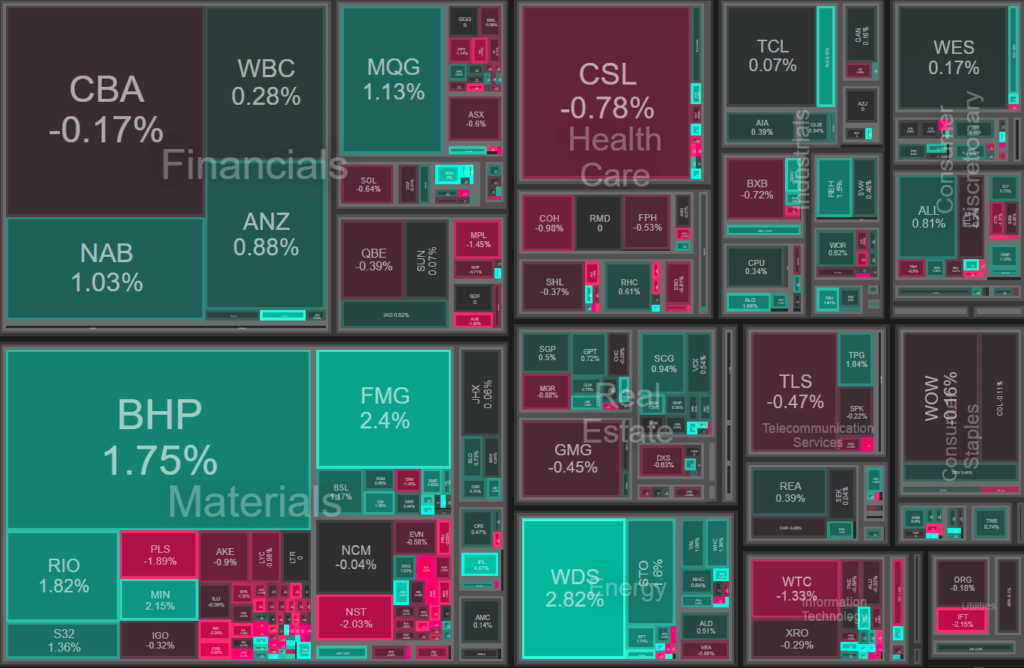

After an initial rally in the first half hour the ASX drifted off over the day as investor nerves over inflation data weighed down the market. Cyclicals in mining and energy were the main driver of the rally as Chinese stimulus hopes ran high. Reserve Bank governor Philip Lowe says the central bank is “deadly serious” about getting inflation back to target and will become more aggressive if it looks like it is not achieving its goal. This statement didn’t help the market, although it is widely speculated that Gov Lowe will not be renewed in his role later this year. Hong Kong-listed Chinese stocks also advanced, as Chinese state media reported that Beijing is likely to roll out more stimulus measures to support a slowing economic recovery. Still, gains in Asian markets were limited ahead of key U.S. consumer price index (CPI) inflation data due later in the day. While overall inflation is expected to have retreated, core CPI inflation is expected to remain sticky, which in turn is expected to invite more rate hikes by the Fed in the near-term.

Leader

Incitec Pivot surged around 6% after it confirmed The Australian Financial Review’s Street Talk column that the company received acquisition offers for its fertilisers business. Incitec did not name where the offers were from.

Broker upgrades after yesterdays stellar results helped continue the rally

No Significant News.

No Significant News.

No Significant News.

Laggards

KMD Brands shares declined 11.3 per cent after the company acknowledged a “softening” consumer sentiment in a trading update. It’s expecting sales to hit $NZ1.1 billion ($1 billion) for financial year 2023. Underlying EBITDA is projected to be in the range of $NZ105 million to $NZ110 million.

No Significant News.

No Significant News.

Extension of a supplier contract and pullback from yesterdays rally as gold sold off in Asia

No Significant News.