What's Affecting Markets Today

Anglo Coking Coal Mine Blaze to Have Months-Long Impact

A fire at Anglo American’s Grosvenor underground mine in Australia has halted production. The fire, caused by a methane explosion, may take several months to extinguish. Grosvenor, responsible for 30% of the company’s annual coking coal output, faces significant delays, complicating Anglo’s plans to sell its coal assets following a rejected $75 billion BHP takeover. The fire impacts potential sale prices and timelines for Grosvenor and Moranbah North mines. Grosvenor, which resumed production in February 2022 after a 2020 explosion, has high methane levels, with 60% of the gas supplied to Queensland’s electricity grid.

Lendlease Sells US Military Housing Business for $480m

Lendlease has agreed to sell its US military housing business to Guggenheim Partners Investment Management for $480 million, marking a significant premium to its book value. This sale aligns with Lendlease’s strategy to exit international property development and overseas construction, focusing instead on its Australian operations. CEO Tony Lombardo emphasized the company’s priorities of strengthening its balance sheet, returning capital to security holders, and investing in Australian developments. Lendlease anticipates FY24 operating profit after tax to be between $260 million and $275 million and expects group gearing to reach the upper end of its target range.

Inflation Has No Chance of Hitting Chalmers’ Forecasts: Survey

A survey of 37 economists indicates that inflation in Australia will remain above the Reserve Bank’s target for at least 12 months, challenging Treasurer Jim Chalmers’ optimistic forecast of a 2.75% consumer price index by December. Despite Chalmers’ confidence, economists expect underlying inflation to stay above the 2%-3% range until June next year. Chalmers acknowledged the pressure of existing interest rate rises and noted that inflation does not always decrease in a straight line. Treasury estimates suggest that a $300 energy bill rebate per household could reduce headline inflation by 0.5 percentage points by late this year.

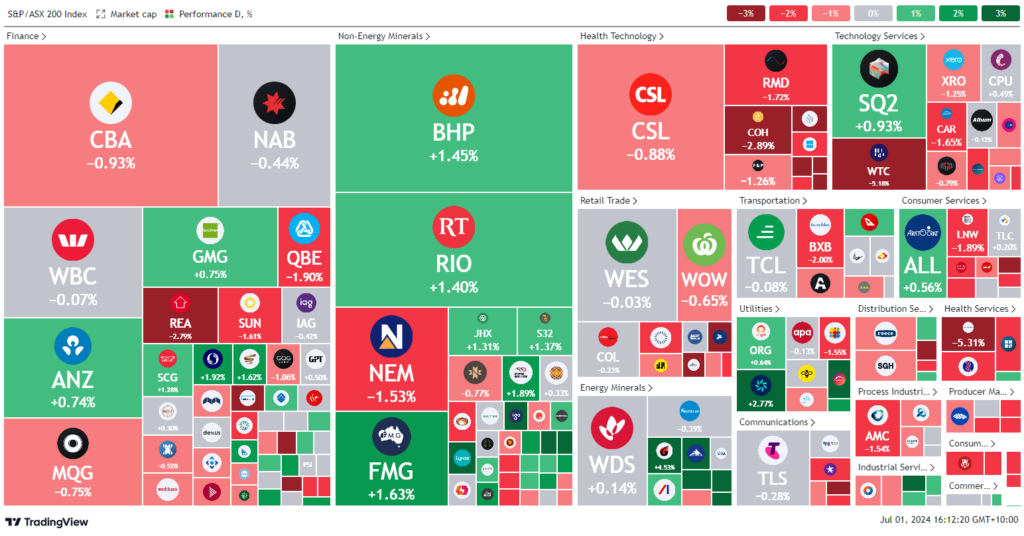

ASX Stocks

ASX 200 - 7,750.7 (-0.2%)

Key Highlights:

The Australian sharemarket fell by 0.4% as investors processed the first round of election results in France and anticipated the upcoming UK election. The S&P/ASX 200 Index dropped by 31.2 points to 7736.3, with technology stocks being the worst performers, down 1.8%, and WiseTech plummeting 5.6%. The euro rose 0.2% to $US1.0740 after Marine Le Pen’s far-right party appeared to secure a smaller-than-expected lead in France’s legislative election.

In commodities, oil prices remained stable with Brent trading around $US85 and West Texas Intermediate below $US82, as China’s economic outlook and geopolitical tensions in Europe and the Middle East influenced market sentiments. China’s manufacturing contraction in June further clouded crude demand prospects.

Lendlease surged 4.3% after announcing the sale of its US military housing business for $480 million. Coronado Global Resources soared 10% following the suspension of Anglo American’s Grosvenor coal operations in Queensland due to a fire. Brambles dropped 2% after replacing Xavier Garijo, the head of its CHEP Americas business, due to cultural differences. David Cuenca, previously head of CHEP Europe, succeeded Garijo immediately, with Brambles planning to appoint a new European head within two weeks.

Leaders

MMI – Metro Mining Ltd (+14.89%)

ERA – Energy Resources of Australia Ltd (+12.50%)

CHN – Chalice Mining Ltd (+10.92%)

SVM – Sovereign Metals Ltd (+8.94%)

CRN – Coronado Global Resources Inc (+8.65%)

Laggards

STX – Strike Energy Ltd (-16.96%)

GYG – Guzman Y Gomez Ltd (-8.83%)

PE1 – Pengana Private Equity Trust (-8.24%)

OBM – Ora Banda Mining Ltd (-8.21%)

DUG – DUG Technology Ltd (-7.97%)