What's Affecting Markets Today

Asian markets mixed

Asia-Pacific markets were mixed on Thursday following comments from U.S. Federal Reserve Chair Jerome Powell, indicating a potential rate cut in September if inflation trends remain favorable.

Japan’s Nikkei 225 dropped 2.72%, and the Topix fell 3.45%, with real estate stocks and exporters declining due to a stronger yen. The Bank of Japan raised its benchmark interest rate to “around 0.25%,” its highest since 2008, causing the yen to strengthen to 148.61 against the dollar.

Toyota reported a 12.2% revenue increase to 11.84 trillion yen for Q1, with a 16.7% rise in operating income. However, shares dropped 8.29%.

Meanwhile, South Korea’s Kospi gained 0.26%, with exports rising 13.9% year-on-year in July. Hong Kong’s Hang Seng index edged up 0.2%, while mainland China’s CSI 300 saw a marginal decline. China’s manufacturing PMI contracted to 49.8 in July, below expectations of 51.5

ASX Stocks

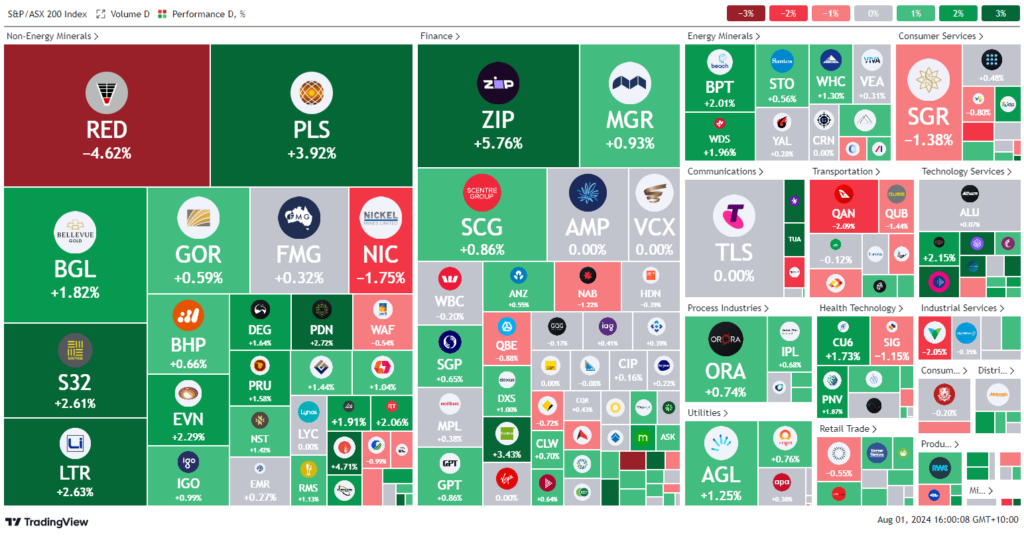

ASX 200 - 8,127.3 (+0.4%)

Key Highlights:

The Australian sharemarket has reached a record high, surpassing 8100 points, driven by rate optimism and rising oil prices. The S&P/ASX 200 increased by 34 points, or 0.4%, to 8126.7, building on gains from the previous day following lower core inflation figures that eased rate concerns.

Tech and real estate stocks surged, with Commonwealth Bank briefly surpassing $138 per share for the first time before retreating. Oil prices also climbed, with Brent crude rising 2.8% to $US80.72 per barrel and U.S. oil up 5% to $US78.49, following geopolitical tensions in Tehran.

Energy stocks advanced 1.3%, led by a 1% gain in Woodside. In contrast, Monadelphous Group shares dropped 5% to $12.33 after Albemarle terminated contracts at the Kemerton Project in Western Australia, impacting expected revenue and reducing construction work-in-hand by approximately $200 million.

Leaders

ZIP ZIP Co Ltd (+6.28%)

TPW Temple & Webster Group Ltd (+5.43%)

RDX REDOX Ltd (+4.49%)

VSL Vulcan Steel Ltd (+4.48%)

SFR Sandfire Resources Ltd (+4.37%)

Laggards

DRO Droneshield Ltd (-14.21%)

CCP Credit Corp Group Ltd (-4.99%)

MND Monadelphous Group Ltd (-4.97%)

RED RED 5 Ltd (-4.49%)

BCI BCI Minerals Ltd (-3.92%)