What's Affecting Markets Today

Oil steadied after reaching a seven-week high, buoyed by a sustained risk-on sentiment in broader markets, which overshadowed signs of rising stockpiles. Brent crude traded above $85 a barrel, while West Texas Intermediate neared $82. Optimism driven by expectations of US interest rate cuts also lifted the S&P 500 to a new record.

The American Petroleum Institute reported a 2.3 million-barrel increase in US crude inventories, marking the third consecutive rise, with stockpiles at the Cushing, Oklahoma hub also growing. Despite initial losses earlier in the month due to OPEC+ plans to increase market supply, oil has rebounded as Asian refiners resume operations post-maintenance, boosting demand. However, Brent’s relative strength index exceeding 70 indicates oil may be nearing overbought levels.

Bank of Japan board members discussed accelerating policy normalization amid concerns that the weak yen’s impact on inflation might necessitate a response, according to minutes from their April meeting. Some members emphasized the importance of exchange rates on economic activity and prices, suggesting monetary policy adjustments if currency fluctuations affect the inflation outlook.

The minutes hint at a potential rate hike as early as July, although market speculation has cooled after the bank announced plans to reduce bond buying next month. Analysts will watch upcoming data closely, with consumer inflation expected to reach 2.6% in May, the 26th consecutive month meeting or exceeding the bank’s target. Some central bankers advocated for moderate rate hikes to preempt the need for rapid increases seen in the US and Europe. Governor Kazuo Ueda acknowledged the possibility of a rate hike at the July 30-31 meeting, contingent on incoming data.

ASX Stocks

ASX 200 - 7,760.9 (-0.2%)

Key Highlights:

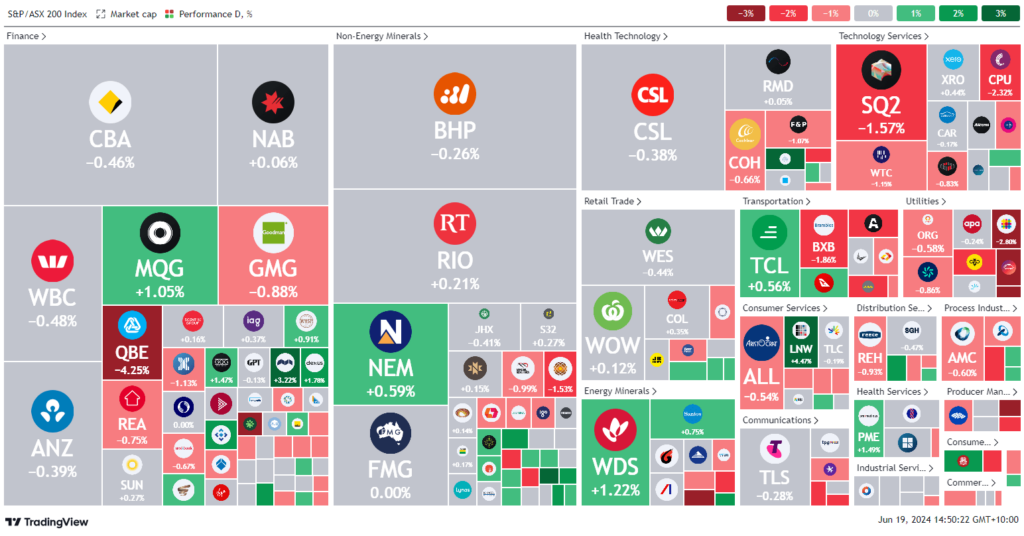

Australian shares turned lower in the final hours of trading, with the S&P/ASX 200 down 16 points, or 0.2%, at 7761.60 around 2:30 pm. Despite gains in energy stocks, which remained the best-performing sector up 0.7%, the broader index faced moderate declines. Woodside shares rose by 1.2%, driven by overnight gains in oil and LNG.

Nuclear stocks saw a boost following Opposition Leader Peter Dutton’s pledge for seven nuclear power plants by 2050. Paladin Energy rose 1% to $13.69, and Deep Yellow increased 1.9% to $1.45.

The session was relatively quiet, with no ASX sector moving more than 1% in either direction.

In the US, the S&P 500 rose 0.3% to a record 5487.03, led by Nvidia’s 3.5% gain, making it the world’s most valuable publicly traded company with a market cap of $3.4 trillion. Other major tech stocks like Microsoft and Apple fell, bringing their market caps to $3.32 trillion and $3.29 trillion, respectively.

Helia Group shares plummeted 15.2% to $3.56 after Commonwealth Bank of Australia flagged potential changes to their mortgage insurance contract. Downer EDI gained 0.6% to $4.71 after securing a new NBN contract worth over $100 million. Beach Energy’s shares dropped 3.6% to $1.48 due to broker downgrades, following a 2.2% fall the previous day. QBE Insurance fell 2.2% to $17.97 as it announced the closure of its North American middle-market business.

WA1 Resources reported high-grade niobium concentrate results, boosting shares by 24% to $20.09. Firefly Metals rose 15.1% to 80¢ after revealing promising copper and gold assay results from its Green Bay project in Canada.

Leaders

WA1 – WA1 Resources Ltd (+23.69%)

FFM – Firefly Metals Ltd (+14.39%)

SXG – Southern Cross Gold Ltd (+12.80%)

PYC – PYC Therapeutics Ltd (+9.52%)

TBN – Tamboran Res. Corp. (+7.90%)

Laggards

HLI – Helia Group Ltd (-18.60%)

PGH – Pact Group Holdings Ltd (-7.27%)

BPT – Beach Energy Ltd (-5.88%)

PMT – Patriot Battery Metals Inc (-5.34%)

BDM – Burgundy Diamond Mines Ltd (-5.26%)