What's Affecting Markets Today

Whitehaven Meets Guidance

Whitehaven Coal announced that it has met its production guidance for its New South Wales mine for the financial year 2024. Additionally, the company’s newly acquired mines in Queensland performed as expected. During the June quarter, the Queensland coal operations achieved an average price of $US271 per tonne, while the thermal coal produced in New South Wales fetched $US207 per tonne. This performance indicates strong operational management and market alignment for Whitehaven Coal across its key assets.

APRA to Reduce Westpac’s Risk Capital by $500 Million

The Australian Prudential Regulation Authority (APRA) has agreed to reduce Westpac’s required capital reserves by $500 million. This decision comes as a response to the bank’s improved risk management practices. Originally, APRA imposed a $500 million capital add-on in July 2019 due to identified higher operational risks. Banks must maintain capital reserves typically amounting to 12% or more of risk-weighted assets, primarily loans, to cover potential bad debts or operational issues. The reduction in capital reserves is expected to enhance Westpac’s return on equity by freeing up more capital for profitable activities.

Lifestyle Communities Pulls All Forward Guidance

Lifestyle Communities has withdrawn all forward guidance, citing media influence and uncertainties in its home-building business. The company pointed to high inflation, high interest rates, and ongoing insolvencies in the construction sector as contributing factors to this decision. Despite these challenges, Lifestyle Communities expects its operating profit for the financial year 2024 to be between $52.4 million and $53.4 million. The company’s cautious approach reflects the current volatile economic environment and its impact on the housing market and construction industry.

ASX Stocks

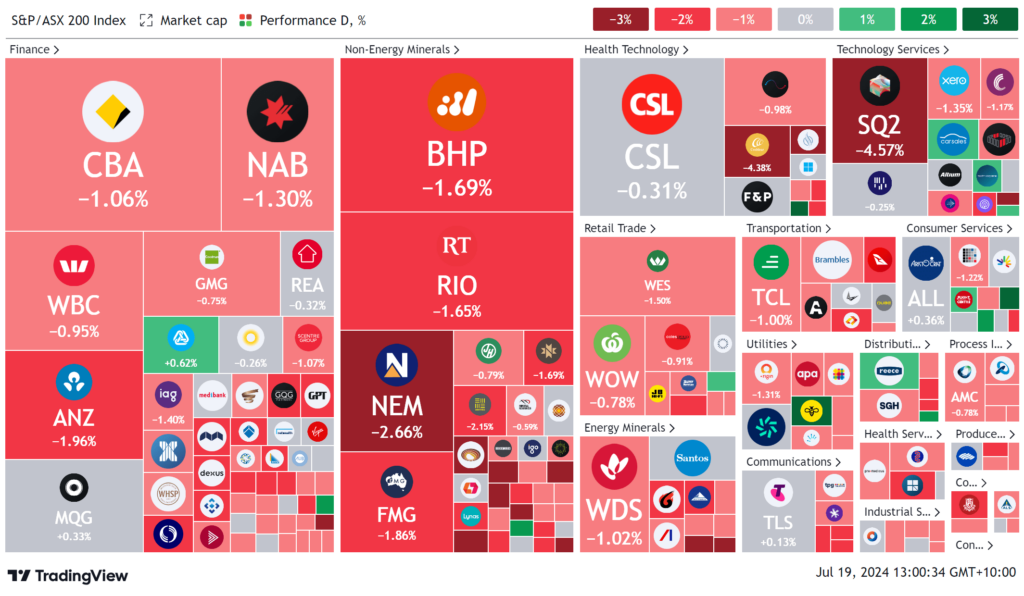

ASX 200 - 7937.2 (-0.88%)

Key Highlights:

Australian shares fell by 1.2% to dip below 8000 points at lunchtime, driven down by declines in the banking, mining, and technology sectors. Only 10 stocks in the ASX 200 showed gains, with merely three rising by more than 1%. On Wall Street, the Dow and Nasdaq also experienced losses, while Netflix shares remained flat in after-hours trading despite a 44% increase in June quarter profits to $US2.15 billion and the addition of over 8 million new subscribers.

Overnight, prices for iron ore, gold, and copper all dropped, significantly impacting local markets. Major mining companies, Newmont and Evolution Mining, saw declines of over 3%, contributing to a 2% fall in the broader materials sector. ANZ Bank highlighted weakening economic data from China, noting that GDP growth slowed to 4.7% in the second quarter, alongside reduced home sales and property investments. Additionally, the steel industry is entering a quieter summer period, traditionally marked by weaker demand.

In stock-specific news, Westpac benefited from a regulatory decision by APRA to reduce its capital adequacy requirements by $500 million. Meanwhile, Lifestyle Communities withdrew all forward guidance due to media influence and uncertainties in its home-building business, leading to a sharp 16% drop in its shares to $9.24.

Leaders

DRO – Droneshield Ltd (+7.51%)

DXB – Dimerix Ltd (+6.19%)

CAJ – Capitol Health Ltd (+5.93%)

3PL – 3P Learning Ltd (+5.80%)

UNI – Universal Store Hlds Ltd (+5.77%)

Laggards

QGL – Quantum Graphite Ltd (-18.92%)

LIC – Lifestyle Communities Ltd (-12.85%)

CVN – Carnarvon Energy Ltd (-5.41%)

SFR – Sandfire Resources Ltd (-4.93%)

MAC – Metals Acquisition Ltd (-4.84%)