What's Affecting Markets Today

Labour Market Still Relatively Tight

Australian bond yields and the dollar saw slight increases following data release from the Australian Bureau of Statistics indicating that the job market remains relatively tight. ABS head of labour statistics, Bjorn Jarvis, noted an increase in employment by 50,000 people and a rise in the number of unemployed by 10,000, leading to a slight unemployment rate increase to 4.1%. The participation rate rose to 66.9%, just shy of the historical high of 67% from November 2023. With high job vacancies and near-peak employment ratios, the labour market’s tightness persists despite the unemployment rate being above 4% since April.

Reserve Bank’s Perspective on Labour Market

The Reserve Bank of Australia monitors labour market strength closely as it influences interest rate decisions. A robust job market reduces the likelihood of interest rate cuts. Currently, the unemployment rate is expected to reach 4.2% by the end of 2024, compared to the 4.1% rate in June. The employment-to-population ratio increased slightly to 64.2%, near its November 2023 high of 64.4%. These figures, combined with the high participation rate, suggest a continued tight labour market, crucial for the Reserve Bank’s monetary policy considerations.

Goldman Sachs Neutral on Domino’s

Goldman Sachs has maintained a neutral rating on Domino’s Pizza stock, with a price target of $36.30 per share, following the company’s decision to close stores in France and Japan. The broker views these closures as proactive steps towards a quality franchise network for sustainable growth. Despite the closures, Domino’s reported strong performance in Australia, Germany, and Singapore. Goldman forecasts earnings of $1.34 per share for financial 2024 and $1.64 for financial 2025. Currently, the stock is down 8.5%, trading at $33.02.

ASX Stocks

ASX 200 - 8,034.4 (-0.3%)

Key Highlights:

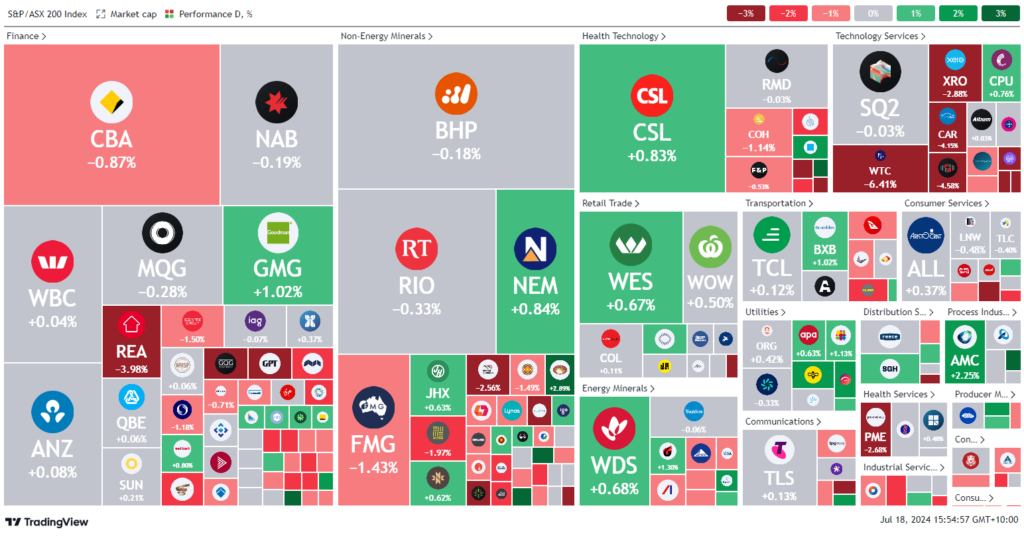

Australian shares fell by 0.2% at lunchtime, primarily driven by a 2.9% tumble in the tech sector, which mirrored declines in overseas markets. This heavy selling in tech stocks accelerated following the release of data showing the Australian economy added 50,200 jobs in June, with the jobless rate rising to 4.1%. The Reserve Bank’s next interest rate move remains uncertain, with inflation at 4% showing no signs of slowing. VanEck’s head of investments, Russel Chesler, indicated that an interest rate increase might be necessary to control inflation.

Globally, semiconductor stocks dropped sharply due to profit-taking and concerns over US-China economic relations. The Nasdaq saw a significant drop of 2.8%, its worst day since December 2022, and Japan’s Nikkei 225 Index opened nearly 2% lower. Locally, Domino’s Pizza shares fell 9% to $32.88, while Guzman y Gomez declined 1.9% to $26. The iron ore price slipped by 2.2%, with BHP and Rio Tinto trading slightly lower.

In other notable movements, Accent Group announced the closure of 18 Glue stores, boosting its stock by 9.2% to $2.14. Telix Pharmaceuticals increased its sales guidance, lifting its shares by 0.2%. Fortescue announced a restructure, resulting in 700 job cuts primarily in its green hydrogen business.

Leaders

HTA – Hutchison Teleco. (+19.64%)

ZIP – ZIP Co Ltd (+10.28%)

AX1 – Accent Group Ltd (+10.20%)

THL – Tourism Holdings Rentals Ltd (+6.25%)

SKT – Sky Network Television Ltd (+5.75%)

Laggards

DMP – Domino’s Pizza Enterprises Ltd (-8.42%)

PMT – Patriot Battery Metals Inc (-7.27%)

C79 – Chrysos Corporation Ltd (-6.67%)

BSE – Base Resources Ltd (-6.25%)

NEU – Neuren Pharmaceuticals Ltd (-6.19%)