What's Affecting Markets Today

Asian markets mixed as market digest China data

Asia-Pacific markets presented a mixed performance on Monday as the region digested key economic data from China. The world’s second-largest economy reported May figures for retail sales, industrial output, and urban unemployment.

China’s retail sales exceeded expectations, rising 3.7% year-on-year, surpassing the forecasted 3% increase from a Reuters poll. However, industrial output and fixed asset investment fell short of expectations. Industrial output grew 5.6%, below the anticipated 6%, and fixed asset investment increased by 4%, slightly under the predicted 4.2%.

The urban unemployment rate remained steady at 5% in May, consistent with April and 0.2 percentage points lower than a year ago. The People’s Bank of China maintained its one-year medium-term lending facility rate at 2.5% and injected 4 billion yuan through seven-day reverse repurchase operations, keeping the interest rate at 1.8%.

Following the announcements, Hong Kong’s Hang Seng index rose 0.71%, while China’s CSI 300 dipped 0.1%. Japan’s Nikkei 225 dropped 1.82%, and South Korea’s Kospi fell 0.31%.

ASX Stocks

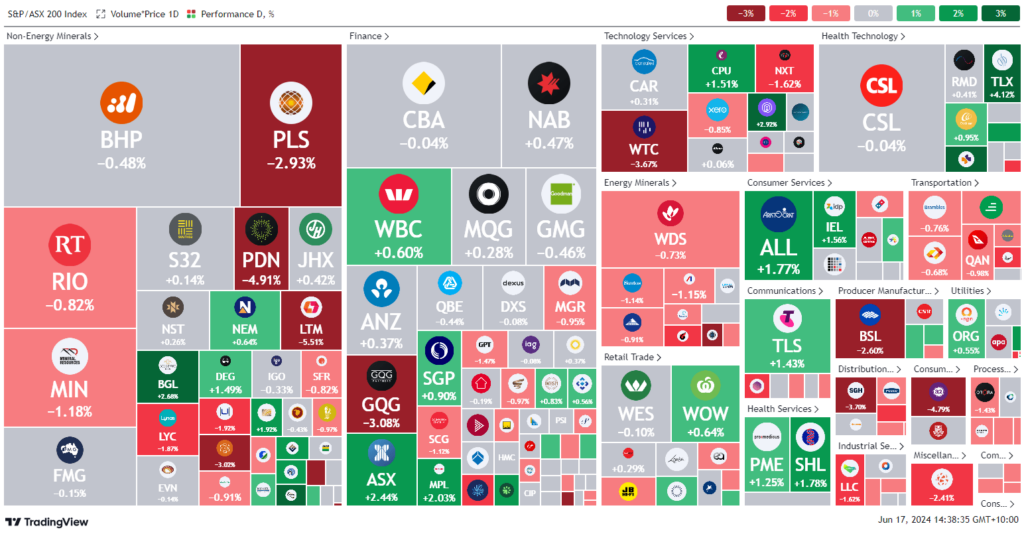

ASX 200 - 7,718.9 (-0.10%)

Key Highlights:

Australian shares experienced a subdued tone on Monday, with energy and tech sectors leading losses. Investors remained cautious ahead of the Reserve Bank’s rate decision and France’s upcoming elections. The S&P/ASX 200 eased 0.1% or 3.7 points to 7720.30, extending last week’s 1.7% drop, the biggest in two months. The All Ordinaries also drifted 0.1% lower.

Energy stocks were pressured by weaker oil prices, with Brent and light crude both falling 0.3%. Santos dropped 1.1%, Beach Energy and Woodside fell 0.6%, and Ampol declined 0.9%. Tech stocks retreated, with Wisetech down 2.9%, Zip 2.4% lower, and EML Payments down 1.7%. However, Life360 rose 3% after a 9.2% gain last week.

Miners were under pressure, with Rio Tinto and BHP both down 0.7%. Iron ore prices fell further due to disappointing economic data from China and concerns over near-term demand. Gold miners bucked the trend, supported by rising gold prices. Bellevue Gold jumped 2.7%, while De Grey and Gold Road each climbed 1.7%. The big four banks saw gains, led by Westpac’s 0.7% rise. The Australian dollar traded at US66¢, gaining 0.5% last week.

Leaders

CMM Capricorn Metals Ltd 4.26%

TLX TELIX Pharmaceuticals Ltd 4.12%

SIG Sigma Healthcare Ltd 3.88%

RED RED 5 Ltd 3.37%

JIN Jumbo Interactive Ltd 3.11%

Laggards

VUL Vulcan Energy Resources Ltd -8.21%

LTM Arcadium Lithium Plc -6.34%

PDN Paladin Energy Ltd -4.84%

ERA Energy Resources of Australia Ltd -4.76%

HGH Heartland Group Holdings Ltd -4.74%