What's Affecting Markets Today

Stocks Keep Rising Despite Bond Warnings

The S&P 500 and Dow Jones Industrial Index hit record highs, with the Dow rising 1.85% in its best day in a year. The S&P 500 has surged 19.5% since January and 37% since November, driven by the AI boom and optimism about US rate cuts and a potential Trump victory in the upcoming election. Encouragingly, the rally is expanding beyond the top tech firms like Nvidia, Apple, and Microsoft to the broader market, indicating a more robust and widespread market growth.

BHP Achieves Record Iron Ore Exports and Eyes Copper Growth

BHP sold a record 287.7 million tonnes of Australian iron ore in 2023-24, a 3% increase from the previous year. The company’s copper production rose 9% due to the OZ Minerals acquisition, with expectations for a further 10% increase as Chile’s Escondida mine produces higher grade material. BHP aims to expand its copper assets, as demonstrated by its recent bid for Anglo American. Despite iron ore being its top earner, BHP’s bullish outlook on copper aligns with the anticipated surge in copper demand driven by global electrification efforts.

New Zealand Inflation Slows, Suggesting Potential Rate Cuts

New Zealand’s annual inflation rate dropped to 3.3% in the second quarter, the weakest in three years, down from 4% in the first quarter. The Reserve Bank of New Zealand (RBNZ) held the official cash rate at 5.5% but indicated that tight monetary policy might be curbing demand more than expected. This has increased confidence that inflation will fall within the 1-3% target range, suggesting rate cuts could begin soon. The New Zealand dollar strengthened following the report, reflecting positive market sentiment towards the slowing inflation and potential rate adjustments.

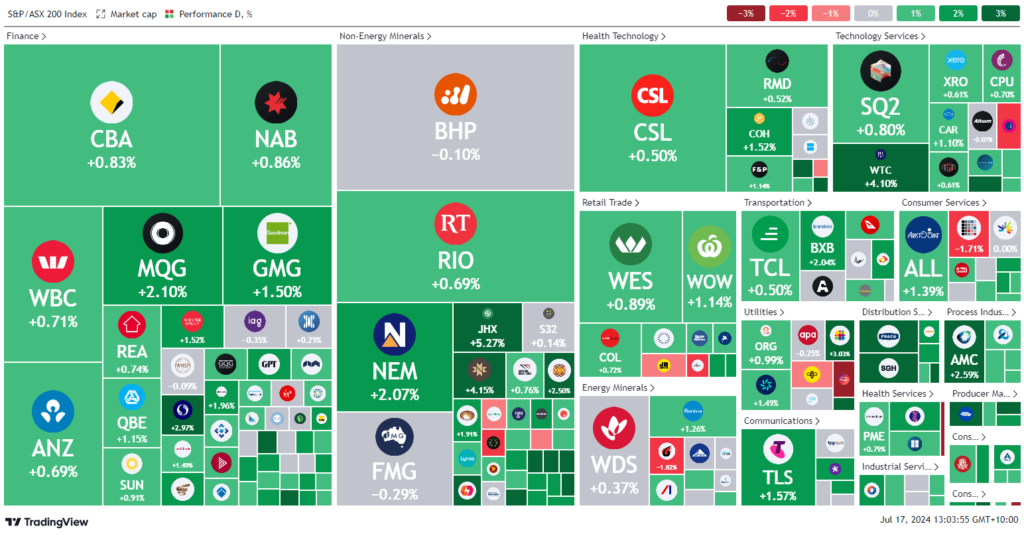

ASX Stocks

ASX 200 - 8,069.0 (0.90%)

Key Highlights:

A surge in interest rate-sensitive technology and real estate stocks propelled the Australian sharemarket to a new intraday record on Wednesday. The S&P/ASX 200 Index rose 1% to 8081 by midday, with all 11 sectors posting gains. Property stocks led the way, with Goodman up 1.2%, Scentre rising 1.1%, and Charter Hall increasing 1.2%. In New York, the Dow Jones Industrial Average rose 1.9% to a record 40,954.48, while the S&P 500 climbed 0.6% to 5667.20. The Russell 2000 enjoyed its longest winning streak since April 2000, gaining 3.5%.

Gold prices surged to a new peak of $US2469.66 per ounce, lifting ASX gold miners. West African Resources jumped 5%, and Bellevue Gold rose 3.5%. Economist Mohamed El-Erian noted the broadening US stock market rally as a positive development. Meanwhile, US 10-year Treasury yields fell 7 basis points to 4.16%, and the probability of a Federal Reserve rate cut in September reached 100%, according to CME futures.

New Zealand’s consumer price index (CPI) slowed to 0.4% in the second quarter from 0.6% previously, with an annual rate of 3.3%, below the expected 3.5%. In specific stocks, Star Entertainment rose 1.4% after resolving gaming system issues, BHP dipped 0.3% despite meeting production guidance, and online luxury retailer Cettire climbed 2.3% on strong revenue projections.

Leaders

STP – Step One Clothing Ltd (+18.84%)

KSC – K & S Corporation Ltd (+8.13%)

ADT – Adriatic Metals Plc (+7.90%)

PNV – Polynovo Ltd (+7.17%)

EOS – Electro Optic Systems (+6.98%)

Laggards

DRO – Droneshield Ltd (-20.05%)

A1M – Aic Mines Ltd (-9.89%)

PPS – Praemium Ltd (-9.62%)

MGX – Mount Gibson Iron Ltd (-9.30%)

MLX – Metals X Ltd (-7.00%)