What's Affecting Markets Today

Fed Official Cools Rate Hype, Australian Dollar Falls, Yields Surge

The Australian dollar experienced a decline following comments from Fed governor Christopher Waller, which dampened hopes for aggressive rate cuts. Waller indicated that while the US is close to achieving a 2% inflation goal, the Federal Reserve should not hastily cut rates. His cautionary stance, coupled with the statement from Atlanta Fed president Raphael Bostic about potential inflation “see-sawing” with premature rate cuts, led to a surge in US Treasury yields and a recalibration of expectations for a March rate cut, now seen as less likely.

China Hits GDP Growth Goal, Focus Turns to Support in 2024

China achieved its economic target for 2023, with a 5.2% GDP growth, aligning with Beijing’s official target and forecasts. The year-end saw increases in industrial production and investment, but mixed indicators in December with rising industrial output and retail sales growth, but a higher urban jobless rate. The year’s economic challenges, including deflationary pressures and a property slump, prompted stimulus measures. Looking ahead, China’s focus shifts to sustaining economic momentum, with potential fiscal policy playing a significant role. The property sector slump remains a key concern, affecting investment, employment, and consumer spending.

Oil Falls as Risk-Off Sentiment Outweighs Offline US Crude Field

Oil prices saw a decline despite production cuts in North Dakota’s shale basin and increased attacks in the Red Sea. West Texas Intermediate futures dropped due to a stronger dollar and broader risk-off market sentiment. Brent futures settled slightly higher. The Israel-Hamas conflict initially added a war-risk premium to crude prices, but this has since subsided. The recent US-UK airstrikes on Houthi targets in Yemen escalated tensions, raising concerns about Iran’s involvement, but the oil market currently seems to discount the likelihood of this significantly impacting production. Citigroup notes that while there has been no direct loss of production, diversions are indirectly affecting the market. However, there is no strong expectation of a significant increase in oil prices due to these regional tensions and events.

ASX Stocks

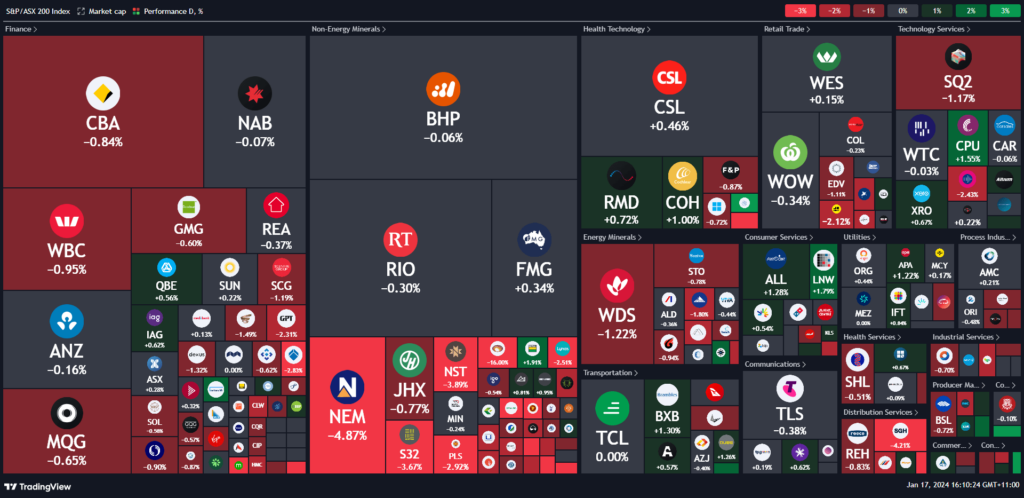

ASX 200 - 7,378 (-0.5%)

Key Highlights:

Australian shares experienced a midday fall, mirroring Wall Street’s losses following comments by US Federal Reserve Governor Christopher Waller, who expressed caution about near-term rate cuts. The S&P/ASX 200 index declined by 0.2%, influenced by losses in real estate stocks like Scentre Group, Charter Hall, and Goodman. In the US, the S&P 500, Nasdaq, and Dow Jones all closed lower.

The Australian dollar fell sharply, dropping below US66¢, in response to a strengthening US dollar and a surge in the yield of the US 10-year note. Waller’s remarks, focusing on steady economic and labor market conditions and gradual inflation reduction, were less dovish than expected, leading to adjustments in market expectations.

National Australia Bank now predicts that the Reserve Bank of Australia (RBA) will maintain the current cash rate of 4.35% until November before initiating rate cuts. This revision is based on the RBA’s reluctance to increase rates further and recent CPI data providing some leeway.

In the commodities market, oil prices fell due to the impact of a stronger US dollar, despite ongoing Middle East tensions. Energy stocks like Woodside, Santos, and Karoon declined in response.

At the World Economic Forum in Davos, Chinese Premier Li Qiang announced a 5.2% economic expansion for China in 2023, with the fourth-quarter GDP report pending release.

Notably, Evolution Mining’s stock plummeted by 17.9% after the company reported lower gold production and revised production guidance for its Red Lake mine. Lottery Corporation’s shares saw a marginal increase, with the appointment of Doug McTaggart as its new chairman starting March 1.

Leaders

BDM – Burgundy Diamond. Ltd (+8.33%)

IPX – Iperionx Ltd (+6.80%)

A2M – The a2 Milk Company Ltd (+5.65%)

MHJ – Michael Hill Int.Ltd (+4.34%)

DTL – Data#3 Ltd (+4.04%)

Laggards

HTA – Hutchison Telecom (-19.51%)

EVN – Evolution Mining Ltd (-16.27%)

3PL – 3P Learning Ltd (-9.96%)

DVP – Develop Global Ltd (-8.62%)

SPR – Spartan Resources Ltd (-6.52%)