What's Affecting Markets Today

Uranium Outlook Slashed by UBS

UBS has reduced its uranium price forecast by 9% to $US78 per pound for 2025-26, citing weak buyer interest and slow demand recovery. Paladin Energy and Boss Energy saw price targets cut and their stocks plummet during Monday’s trading, contributing to their status as some of the most shorted stocks on the ASX. Despite the bearish outlook, UBS retains a “buy” rating for these stocks, pointing to medium- to long-term optimism driven by reactor growth in China and India and increased supply. Contrasting views include Bank of America forecasting a surge in uranium prices to $US140 per pound by 2027.

China Retail Sales Miss Expectations

China’s retail sales grew by 3% in November, missing market expectations of 5%, raising concerns about the country’s economic recovery. While industrial production met forecasts with a 5.4% increase and unemployment held steady at 5%, iron ore futures dropped 0.5% following the sales data. Market sentiment was further dampened by the lack of new stimulus measures from the Central Economic Work Conference, casting doubt on the strength of China’s economic revival.

ASX Stocks

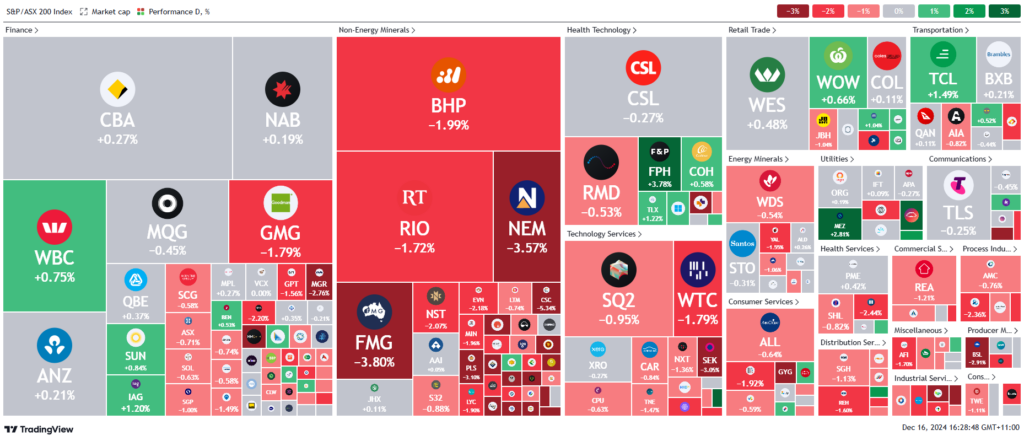

ASX 200 - 8,274 (-0.70%)

Key Highlights:

ASX Extends Losses Amid Gloomy China Outlook

The ASX closed 0.6% lower on Monday, down 46.5 points to 8249.5, marking its fifth consecutive day of declines. Weighed down by weak economic data from China, including disappointing November retail sales growth of 3% (below the expected 5%), the market struggled to recover. ING’s chief China economist, Lynn Song, noted household confidence remains fragile, delaying the impact of promised consumption support policies.

Miners were the biggest drag on the index, down 2%, with BHP slipping 2% to $40.21 and Fortescue falling 4.2% to $18.66. Iron ore futures also dipped over the weekend. Energy stocks dropped, with Boss Energy plummeting 8.1% to $2.40.

Among movers, DigiCo fell 5.5% in its second ASX session, now 15% below its $5 offer price. HMC Capital, a major stakeholder, sank 13.7%. Pilbara Minerals and South32 saw mixed analyst ratings but fell 2.9% and 3.8%, respectively. Consumer staples offered a bright spot, with Woolworths rising 0.7% to $30.62.

Star Entertainment gained 5.1% after leadership changes, while broader sentiment re

Leaders

CEN – Contact Energy Ltd (+7.02%)

SGR – The Star Entertainment Group Ltd (+5.13%)

ASB – Austal Ltd (+5.00%)

SXG – Southern Cross Gold Ltd (+4.38%)

SDR – Siteminder Ltd (+4.30%)

Laggards

ERA – Energy Resources of Australia Ltd (-20.00%)

HMC – HMC Capital Ltd (-13.49%)

APX – Appen Ltd (-13.23%)

BC8 – Black Cat Syndicate Ltd (-11.28%)

LOT – Lotus Resources Ltd (-9.52%)